Global| Dec 17 2010

Global| Dec 17 2010U.S. Current Account Deficit Widens in Q3

by:Tom Moeller

|in:Economy in Brief

Summary

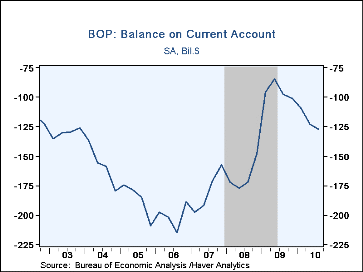

Figures released yesterday indicated that the U.S. current account deficit widened in Q3 to $127.2B from a revised $123.2B in Q2. The figure was slightly deeper than Consensus expectations for $126.0B. The Q2 ratio to GDP was 3.5%, [...]

Figures released yesterday indicated that the U.S. current account deficit widened in

Q3 to $127.2B from a

revised $123.2B in Q2. The figure was slightly deeper than Consensus

expectations for $126.0B. The Q2 ratio to GDP was 3.5%, its deepest since

Q4 2008. A deeper deficit in the goods trade offset slight improvement in

services versus Q2.

Figures released yesterday indicated that the U.S. current account deficit widened in

Q3 to $127.2B from a

revised $123.2B in Q2. The figure was slightly deeper than Consensus

expectations for $126.0B. The Q2 ratio to GDP was 3.5%, its deepest since

Q4 2008. A deeper deficit in the goods trade offset slight improvement in

services versus Q2.

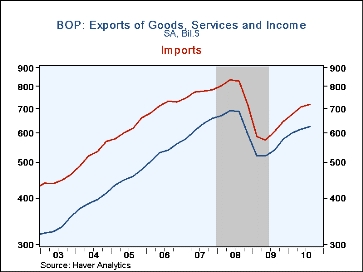

The deficit on goods deteriorated to $171.2B in Q2. While 2.2% quarterly growth in exports exceeded the 1.7% growth in imports, the deficit grew due to imports' larger dollar value. Nevertheless, versus last year growth in exports of 20.2% was short of the 23.3% growth in imports due to the earlier and firmer economic U.S. economic recovery versus the rest of the world.

The surplus on services grew slightly to $36.8B last quarter from a lessened $36.5B in Q2. This modest q/q improvement was in contrast to the marked improvement since the Q3 2009 balance of $32.8B. Versus last year, services exports grew 9.2% versus 8.1% growth in imports. Much of that divergence was due to a 12.7% rise in travel exports versus a 3.8% rise in imports. Passenger fare exports rose 26.5% y/y versus a 12.0% y/y import rise.

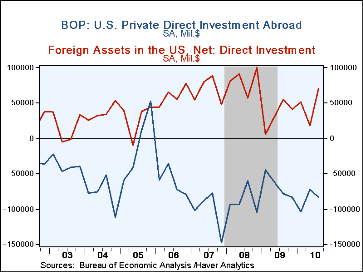

The balance on income deteriorated to $41.1 billion in Q3 from an upwardly revised $43.0B the quarter before. Income receipts totaled $165.5B billion, up just $1.7B from Q2 (12.9% y/y). Income from U.S. private direct investment abroad, i.e., interest and dividends, gained $1.5B to $106.6B (18.9% y/y) but Q3 income payments on foreign owned assets rose $4.1B to $121.6B from $118.0B in Q2. Income paid on foreign direct investment rose to $37.6B, up nearly two-thirds y/y. Finally, unilateral transfers held roughly stable q/q with a net outflow of $33.9 billion in Q3.

From the U.S. capital account, U.S. direct investment abroad fell $10.6B q/q to $83.1B while payments to foreigners on investment here rose $52.4B to $70.5B.

Balance of Payments data are in Haver's USINT database, with summaries available in USECON.

| US Balance of Payments SA | Q3'10 | Q2'10 | Q1'10 | Year Ago | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Current Account Balance($ Bil.) | -127.2 | -123.2 | -109.2 | -97.5 | -378.4 | -668.9 | -718.1 |

| Deficit % of GDP | 3.5% | 3.4% | 3.0% | 2.4% | 2.7% | 4.6% | 5.1% |

| Balance on Goods ($ Bil.) | -171.2 | -169.6 | -151.3 | -132.1 | -506.9 | -834.7 | -823.2 |

| Exports | 2.2% | 3.4% | 5.2% | 20.2% | -18.1% | 12.5% | 12.0% |

| Imports | 1.7% | 6.3% | 6.1% | 23.3% | -26.4% | 7.9% | 5.8% |

| Balance on Services ($ Bil.) | 36.8 | 36.5 | 36.9 | 32.8 | 132.0 | 135.8 | 121.1 |

| Exports | 2.3% | 0.3% | 2.6% | 9.2% | -6.0% | 9.4% | 17.1% |

| Imports | 2.9% | 0.8% | 2.1% | 8.1% | -7.0% | 8.5% | 9.1% |

| Balance on Income($ Bil.) | 41.1 | 43.0 | 40.2 | 35.5 | 121.4 | 152.0 | 99.6 |

| Unilateral Transfers ($ Bil.) | -33.9 | -33.2 | -34.9 | -33.6 | -124.9 | -122.0 | -115.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates