Global| Feb 26 2009

Global| Feb 26 2009U.S. Durable Goods Orders Lowest in Six Years; Latest Six-Month Decline a Record

by:Tom Moeller

|in:Economy in Brief

Summary

The recession in the U.S. factory sector entered an even more dire phase during the last several months. New orders for durable goods fell 5.2% last month after downwardly revised declines of between 4.0% and 8.0% during four of the [...]

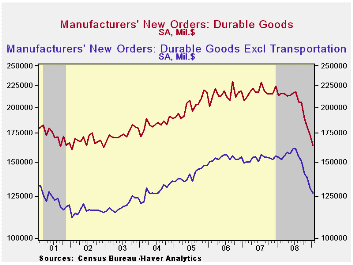

The

recession in the U.S. factory sector entered an even more dire phase

during the last several months. New orders for durable goods

fell 5.2% last month after downwardly revised declines of between 4.0%

and 8.0% during four of the prior five months. Since July new

orders have plummeted 24.9%, a record six-month drop. The

latest decline doubled Consensus expectations for a 2.4% drop.

The

recession in the U.S. factory sector entered an even more dire phase

during the last several months. New orders for durable goods

fell 5.2% last month after downwardly revised declines of between 4.0%

and 8.0% during four of the prior five months. Since July new

orders have plummeted 24.9%, a record six-month drop. The

latest decline doubled Consensus expectations for a 2.4% drop.

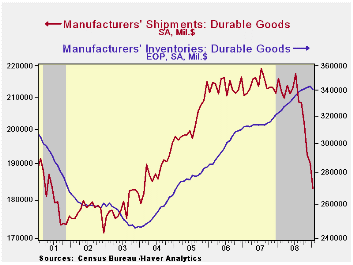

That shortfall in new orders has been aptly followed by lower shipments of durable goods. Off 3.7% in January, the decline followed shortfalls of between 3.0% and 4.0% during four of the prior five months. Year-to-year shipments fell 15.2% and they are down 15.9% during just the last six months. This extreme weakness has brought with it a 17.5% twelve-month decline in industrial production of durable goods. During the last ten years there has been an 83% correlation between the twelve-month change in shipments of durable goods and the change in durables industrial production.

Last month, the production cuts may finally have

succeeded in curbing inventory accumulation. Inventories of

manufactured durables fell 0.8%, the first monthly decline since

2003. But more efforts to curb the inventory buildup are to

come. Six-month growth still amounted to 1.3%. And

while that's down from the peak, it compares to outright inventory

decumulation at an 8.0% rate during the last recession. Orders for

transportation equipment led last month's decline in orders for durable

goods with a 13.5% drop which left them off 38.7%

year-to-year. The aircraft sector led that shortfall with a

nearly three-quarters drop in nondefense bookings. Orders for

motor vehicles & parts fell by a lesser one-third during the

last year. Lower new orders for computers & electronic

products followed closely for the top weakest spot in last month's

decline with a 5.0% drop (-13.6% y/y) which followed the 7.1% December

shortfall. Orders for just computers & related

products were the weakest and posted a 16.0% drop and they're off by

more than one quarter during the last twelve months. Working

the other way were new orders for communications equipment which rose

1.2%. That recovered a piece of the 5.2% decline during

December and limited the year-to-year shortfall to just

2.6%.

Last month, the production cuts may finally have

succeeded in curbing inventory accumulation. Inventories of

manufactured durables fell 0.8%, the first monthly decline since

2003. But more efforts to curb the inventory buildup are to

come. Six-month growth still amounted to 1.3%. And

while that's down from the peak, it compares to outright inventory

decumulation at an 8.0% rate during the last recession. Orders for

transportation equipment led last month's decline in orders for durable

goods with a 13.5% drop which left them off 38.7%

year-to-year. The aircraft sector led that shortfall with a

nearly three-quarters drop in nondefense bookings. Orders for

motor vehicles & parts fell by a lesser one-third during the

last year. Lower new orders for computers & electronic

products followed closely for the top weakest spot in last month's

decline with a 5.0% drop (-13.6% y/y) which followed the 7.1% December

shortfall. Orders for just computers & related

products were the weakest and posted a 16.0% drop and they're off by

more than one quarter during the last twelve months. Working

the other way were new orders for communications equipment which rose

1.2%. That recovered a piece of the 5.2% decline during

December and limited the year-to-year shortfall to just

2.6%.

Most other industries have been notably hard hit by weakening demand. Orders for primary metals fell 4.6% last month and they're down by more than one-third during the last twelve. Machinery orders fell 2.0% last month and they're off 23.0% during the last year. Electrical equipment bookings reversed all of a downwardly revised December gain with a 6.1% flop. They're down by 22.1% during the last twelve months.

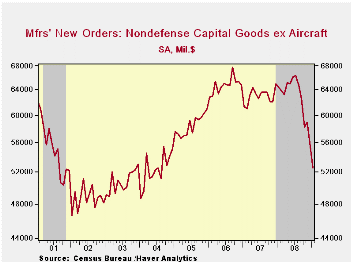

Capital

equipment orders are very much

suffering from all this weakness in the front-end of the

economy. They fell 8.8% last month and are down 26.2% during

the last twelve. Orders for nondefense capital goods have been

particularly hard hit and they posted a 28.3% fall just in

January. Alone, aircraft orders have fallen by three-quarters

year-to-year. And without aircraft, nondefense capital goods

orders fell 5.4% during January and by 18.5% during the last twelve

months to their lowest level since 2004. During the last ten

years there has been an 80% correlation between the y/y change in

nondefense capital goods orders and the change in equipment &

software spending in the GDP accounts. The correlation of the

GDP figure with capital goods shipments is, as one would expect, a

larger 92%. The durable goods figures are available in

Haver's USECON database. The U.S. Auto

Industry from the Federal Reserve Bank of Cleveland can be

found here.

Capital

equipment orders are very much

suffering from all this weakness in the front-end of the

economy. They fell 8.8% last month and are down 26.2% during

the last twelve. Orders for nondefense capital goods have been

particularly hard hit and they posted a 28.3% fall just in

January. Alone, aircraft orders have fallen by three-quarters

year-to-year. And without aircraft, nondefense capital goods

orders fell 5.4% during January and by 18.5% during the last twelve

months to their lowest level since 2004. During the last ten

years there has been an 80% correlation between the y/y change in

nondefense capital goods orders and the change in equipment &

software spending in the GDP accounts. The correlation of the

GDP figure with capital goods shipments is, as one would expect, a

larger 92%. The durable goods figures are available in

Haver's USECON database. The U.S. Auto

Industry from the Federal Reserve Bank of Cleveland can be

found here.

| NAICS Classification (%) | January | December | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Durable Goods Orders | -5.2 | -4.6 | -23.3 | -5.8 | 1.4 | 6.2 |

| Excluding Transportation | -2.5 | -5.5 | -17.4 | -1.3 | -0.3 | 9.1 |

| Nondefense Capital Goods | -2.7 | -10.2 | -28.3 | -6.7 | 3.5 | 9.4 |

| Excluding Aircraft | -5.4 | -5.8 | -18.5 | -0.3 | -2.7 | 10.7 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates