Global| Dec 22 2017

Global| Dec 22 2017U.S. Durable Goods Orders Recover as Aircraft Rebounds

Summary

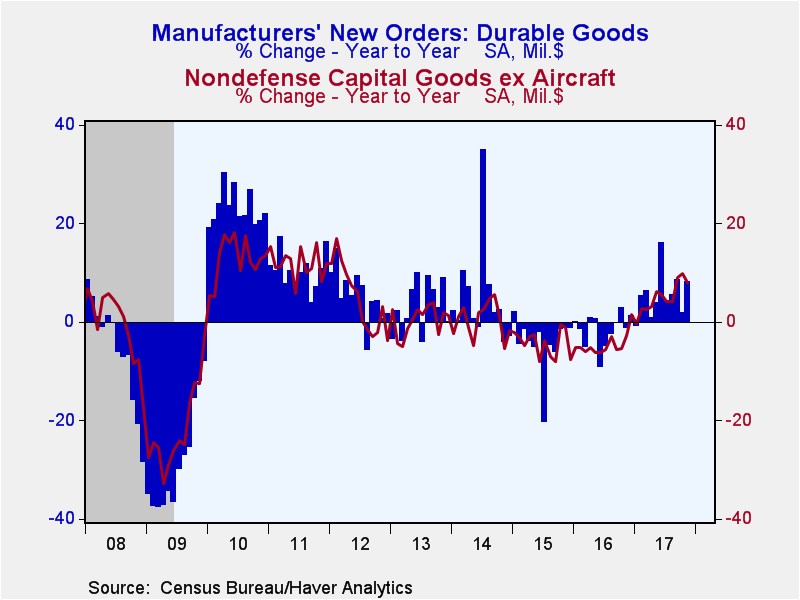

New orders for durable goods rebounded somewhat in November, 1.3% (8.2% y/y), after October's 0.4% decline; that was revised from -1.2% reported initially. Market expectations, evidenced in the Action Economics Forecast Survey, had [...]

New orders for durable goods rebounded somewhat in November, 1.3% (8.2% y/y), after October's 0.4% decline; that was revised from -1.2% reported initially. Market expectations, evidenced in the Action Economics Forecast Survey, had looked for a 2.0% jump from the initial reading..

The transportation sector was, as often happens, the prime mover, with those new orders jumping 4.2% (10.7% y/y) after a 3.9% fall in October. Nondefense aircraft & parts orders gained 14.5% in November to $12.5 billion, more than 3x their November 2016 amount, after their 15.8% fall the month before. Motor vehicle & parts orders rose 1.4% (5.6% y/y). Excluding the transportation sector, durable goods new orders edged down 0.1% (7.0% y/y), after 1.3% gains in each October and September.

Nondefense capital goods orders also reflected the November rebound in aircraft, as they rose 2.6% (22.6% y/y) following a drop of 3.0% in October. Excluding aircraft, that sector's orders slipped 0.1% (+8.1% y/y) after an upwardly revised 0.8% rise in October.

Electrical equipment orders rose 0.7% (0.5% y/y) last month after October's 1.0% gain. Machinery orders reversed some of their October strength, as they fell 1.1% (8.8% y/y) following +2.6% in that earlier month. Orders for computers & electronic products also eased, 0.3% (also 8.8% y/y), but that followed a sizable 1.8% advance in October. Primary metals orders rose 0.8% (10.0% y/y) after a 2.1% gain the month before, and orders for fabricated metals decreased 0.3% (+6.3% y/y) following -0.5% in October.

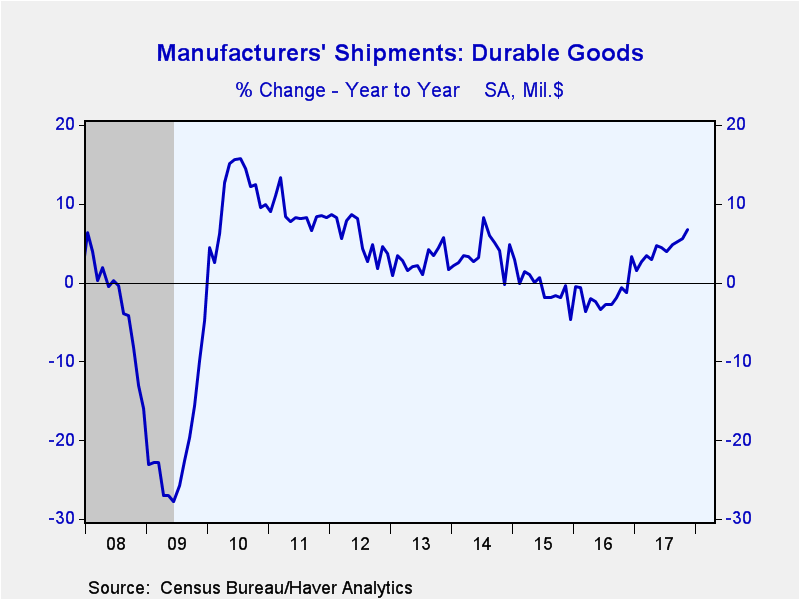

Shipments of durable goods gained 1.0% (6.7% y/y) last month after a 0.5% rise. Shipments outside of the transportation sector edged higher 0.2% (6.7% y/y) after two months of strong increase.

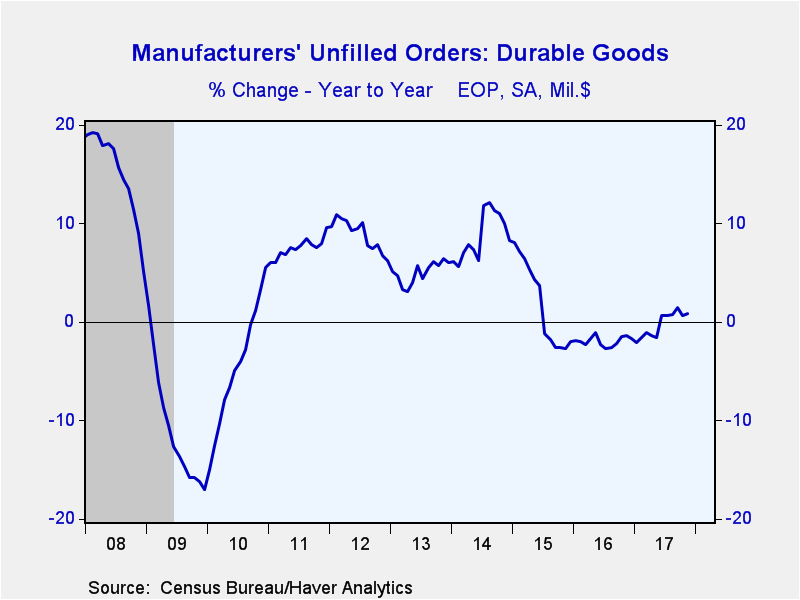

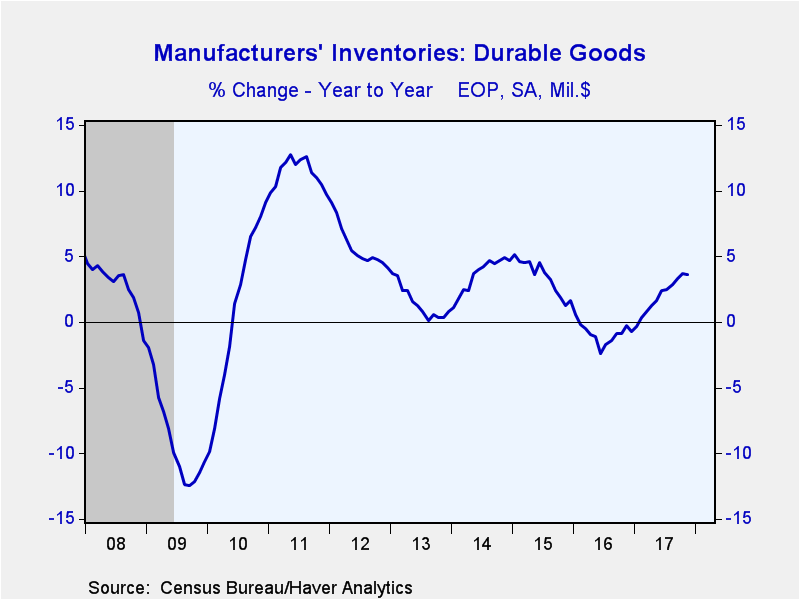

Unfilled orders for durable goods again hardly moved, edging up 0.1% (0.9% y/y) in November after October's 0.05% rise. Outside the transportation sector, order backlogs rose 0.4% (4.5% y/y) following a slightly revised 0.6% in October. Durable goods inventories rose 0.2% (3.6% y/y), the same size move as in October. Excluding transportation, inventories were up 0.4% (5.5% y/y) after a 0.3% rise.

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | Nov | Oct | Sep | Nov Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, %) | 1.3 | -0.4 | 2.4 | 8.2 | -1.7 | -4.6 | 4.7 |

| Transportation | 4.2 | -3.9 | 4.7 | 10.7 | -3.4 | -6.2 | 8.2 |

| Total Excluding Transportation | -0.1 | 1.3 | 1.3 | 7.0 | -0.7 | -3.6 | 2.9 |

| Nondefense Capital Goods | 2.6 | -3.0 | 7.3 | 22.6 | -7.1 | -11.0 | 0.9 |

| Excluding Aircraft | -0.1 | 0.8 | 2.3 | 8.1 | -4.6 | -4.3 | 0.3 |

| Shipments | 1.0 | 0.5 | 1.2 | 6.7 | -1.6 | -0.6 | 3.8 |

| Unfilled Orders | 0.1 | 0.0 | 0.3 | 0.9 | -1.7 | -2.0 | 8.3 |

| Inventories | 0.2 | 0.1 | 0.6 | 3.6 | -0.7 | 1.6 | 4.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.