Global| Jun 27 2012

Global| Jun 27 2012U.S. Durable Goods Orders Recover M/M But Momentum Fades

by:Tom Moeller

|in:Economy in Brief

Summary

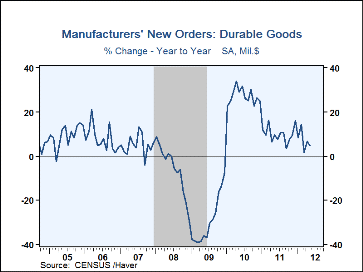

New orders for durable goods rebounded 1.1% in May following a 0.2% dip in April (last month reported as unchanged). The Consensus forecast was for a 0.5% rise. Despite May's gain, the y/y increase continued to decelerate to 4.6% [...]

New orders for durable goods rebounded 1.1% in May following a 0.2% dip in April (last month reported as unchanged). The Consensus forecast was for a 0.5% rise. Despite May's gain, the y/y increase continued to decelerate to 4.6% versus a 9.8% rise last year. Much of the slowing has been due to a 4.5% y/y decline in nondefense aircraft & parts orders. Orders for motor vehicles were a still strong 17.1%. Less the transportation sector, durable goods orders ticked up 0.4% last month. The y/y gain slowed to 3.8% from its 8.6% rise last year and an 18.0% 2010 increase.

In other industry categories, machinery orders rose 4.1% (-3.6% y/y) but primary metals bookings fell 1.5% (+12.9% y/y). Orders for computers & electronic products slipped 0.9% (+4.5% y/y) while electrical equipment, appliance & components orders rose 1.1% (1.9% y/y). Except for computers, these y/y gains are well off from last year.

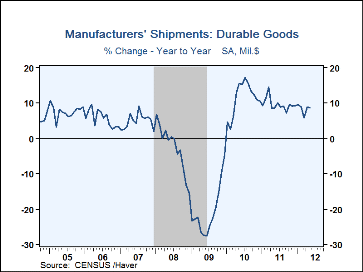

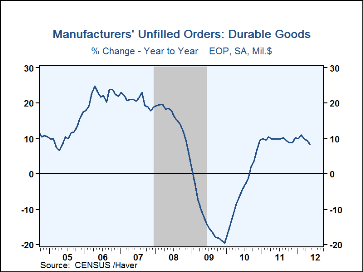

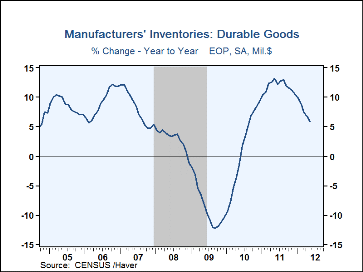

Shipments of durable goods rose 0.7% (8.7% y/y) for the second straight month. Unfilled orders for durable goods were roughly unchanged (8.3% y/y) for the third straight month. Inventories rose 0.5% (5.8% y/y).

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification (%) | May | Apr | Mar | Y/Y | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|

| New Orders | 1.1 | -0.2 | -3.7 | 4.6 | 9.8 | 27.1 | -30.0 |

| Nondefense Capital Goods | 1.3 | -0.8 | -12.2 | 5.1 | 13.2 | 36.3 | -36.9 |

| Excluding Aircraft | 1.6 | -1.4 | -2.3 | 1.5 | 10.3 | 17.1 | -24.5 |

| Shipments | 0.7 | 0.7 | 0.9 | 8.7 | 9.6 | 11.4 | -21.0 |

| Inventories | 0.5 | 0.3 | 0.4 | 5.8 | 10.3 | 9.5 | -10.2 |

| Unfilled Orders | -0.0 | -0.1 | 0.0 | 8.3 | 10.3 | 9.6 | -19.5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.