Global| Jan 31 2019

Global| Jan 31 2019U.S. Employment Costs Continue to Firm

by:Tom Moeller

|in:Economy in Brief

Summary

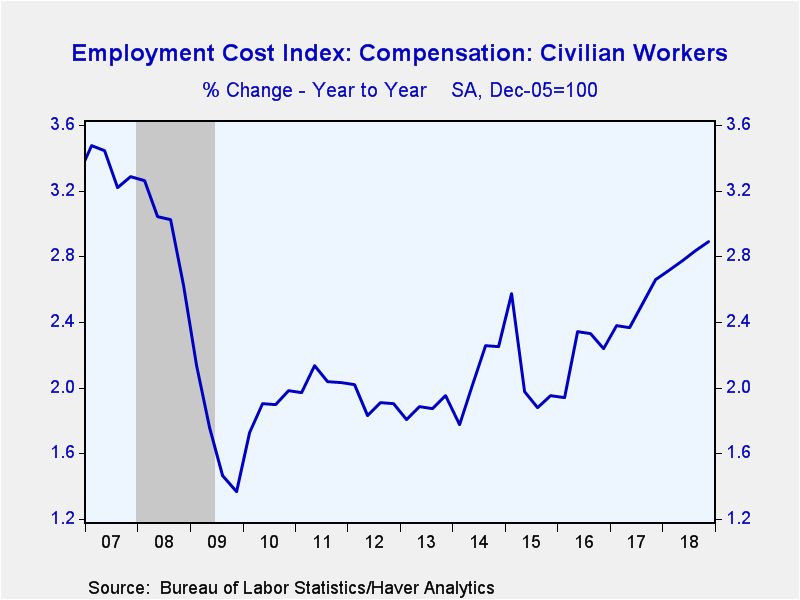

The employment cost index (ECI) for civilian workers rose 0.7% in Q4 2018 following a 0.8% Q3 gain. A 0.8% rise had been expected in the Action Economics Forecast Survey. The gains combined to lift y/y compensation growth to 2.9%, the [...]

The employment cost index (ECI) for civilian workers rose 0.7% in Q4 2018 following a 0.8% Q3 gain. A 0.8% rise had been expected in the Action Economics Forecast Survey. The gains combined to lift y/y compensation growth to 2.9%, the strongest increase since Q3 2008. Civilian workers include those in private industry and state & local government, but not federal government employees.

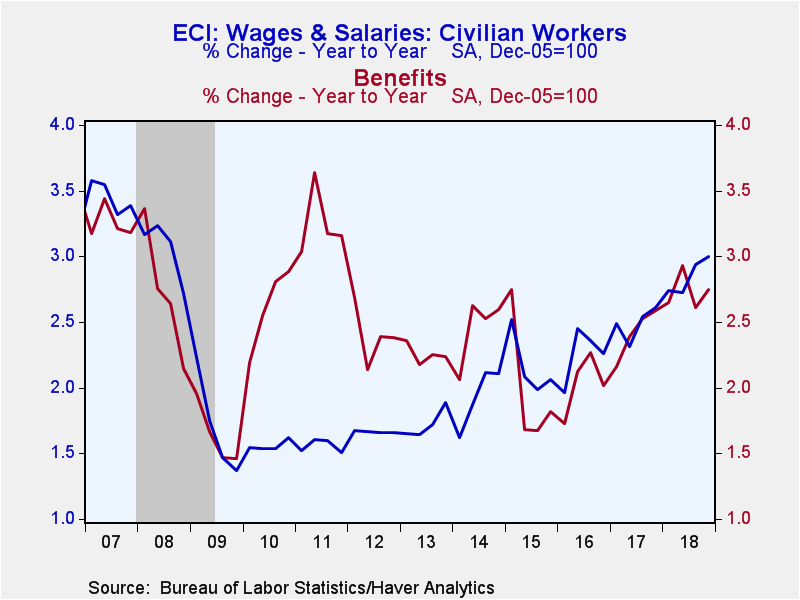

Wage and salaries rose 0.6% (3.0% y/y) following a 0.9% jump while benefits for civilian workers improved 0.7% (2.7% y/y) after a 0.4% gain (2.7% y/y).

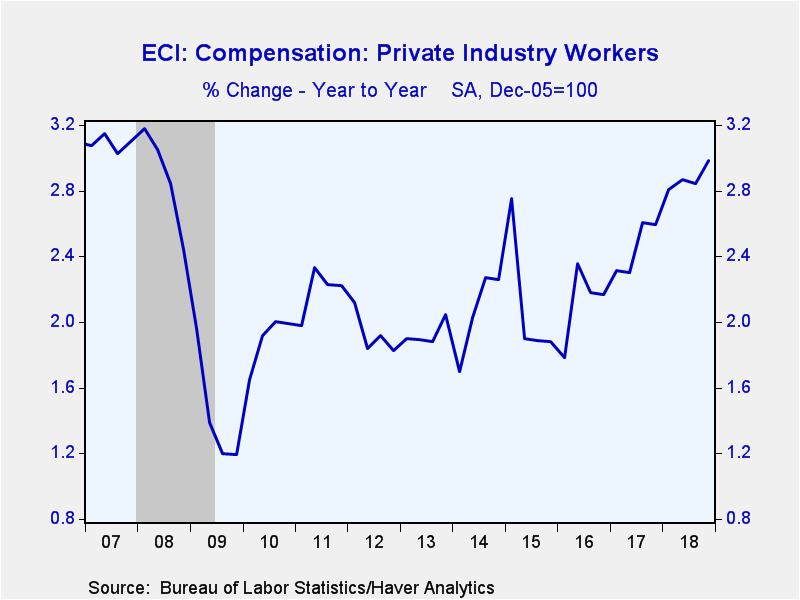

Employment cost gains in private industry moderated to 0.6% last quarter after a 0.8% Q3 rise. Here again, however, the y/y rise accelerated to 3.0%, the strongest growth in ten years. Compensation in goods producing industries rose 0.6% (2.3% y/y) following a 0.2% rise. Factory sector compensation improved 0.6% (2.1% y/y) and earnings in the construction sector rose 0.5% (2.8% y/y). Compensation within the service sector strengthened 0.6% (3.1% y/y) as earnings in the leisure & hospitality sector jumped 1.4%. The 4.1% y/y gain was increased from a low of 0.8% in early 2013. Education & health care compensation firmed 0.7% and the 2.8% y/y increase also was a ten-year high. Professional & business services compensation improved 0.5% (2.6% y/y) after a 0.9% rise. Trade, transportation & utilities compensation rose a lessened 0.5%, but the 3.4% y/y rise remained nearly the strongest in 15 years. Financial services compensation increased 0.5% (3.3% y/y) after a 0.1% uptick. Information sector earnings rose 0.3% and accelerated to 4.8% y/y. State & local government workers realized their second straight 0.8% gain in compensation and the 2.7% y/y rise was the quickest in ten years.

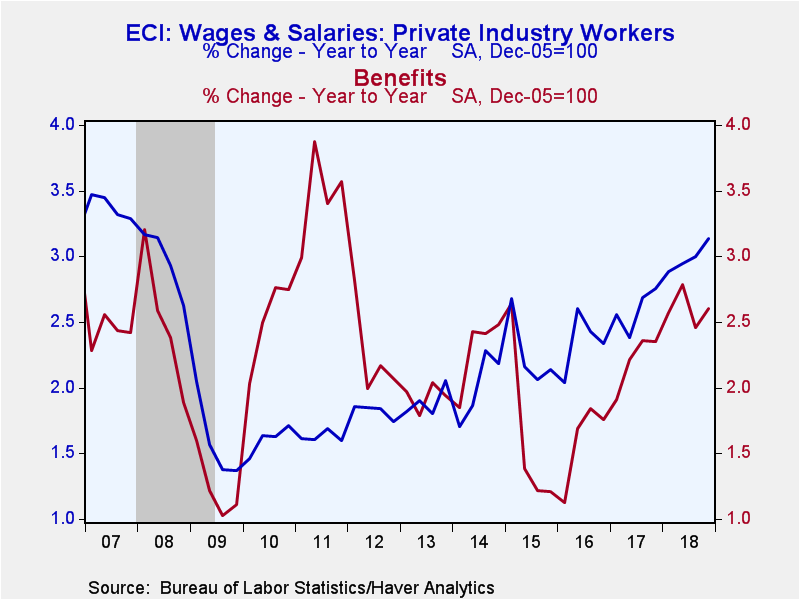

Wage gains within private industry eased q/q to 0.7%, but the 3.1% y/y increase was improved from 1.6% averaged from 2009 to 2012. Goods-producing industry wages rose 0.7% (3.1% y/y). Factory sector wages surged 0.8% (2.8% y/y), the quickest quarterly increase since 2006, and construction wages rose a steady 0.5% (3.1% y/y). Service-producing industry wages increased 0.6% and a strengthened 3.2% y/y. Annual wage growth in leisure & hospitality rose to 4.6% from a low of 0.7% in 2011. In education & health services, wages rose 0.7% (3.2% y/y) after a 1.0% jump. Professional & business services wages added 0.5% (2.8% y/y) to a 1.2% Q3 rise, and trade, transportation & utilities wages rose a lessened 0.4% (3.4% y/y). State & local government workers wages rose 0.6% and an accelerated 2.4% y/y.

Private industry benefits rose an improved 0.5% (2.6% y/y) as service-producing benefits strengthened 0.6% and 3.0% y/y, triple the growth early in 2016. Sales & office worker benefits improved a steady 0.7% q/q, but the 3.4% y/y gain doubled the 2015 rise. Goods-producing benefits nudged 0.2% higher (1.2% y/) after a 0.4% decline in Q3. Factory sector benefits rose 0.3% q/q after a 0.7% shortfall, leaving the y/y rise depressed at 0.9%. State & local government worker benefits strengthened 1.0% q/q. The y/y increase was steady at 3.1%.

The employment cost index figures are available in Haver's USECON database. Consensus estimates come from the Action Economics survey in Haver's AS1REPNA database. This quarter's release included annual seasonal adjustment revisions affecting the last five years.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates