Global| Aug 21 2020

Global| Aug 21 2020U.S. Existing Home Sales Surge As Prices Strengthen

by:Tom Moeller

|in:Economy in Brief

Summary

• Existing home sales rose last month to highest level since December 2006. • Sales strength was broad-based across the nation. • Pricing power picked up. The National Association of Realtors (NAR) reported that sales of existing [...]

• Existing home sales rose last month to highest level since December 2006.

• Sales strength was broad-based across the nation.

• Pricing power picked up.

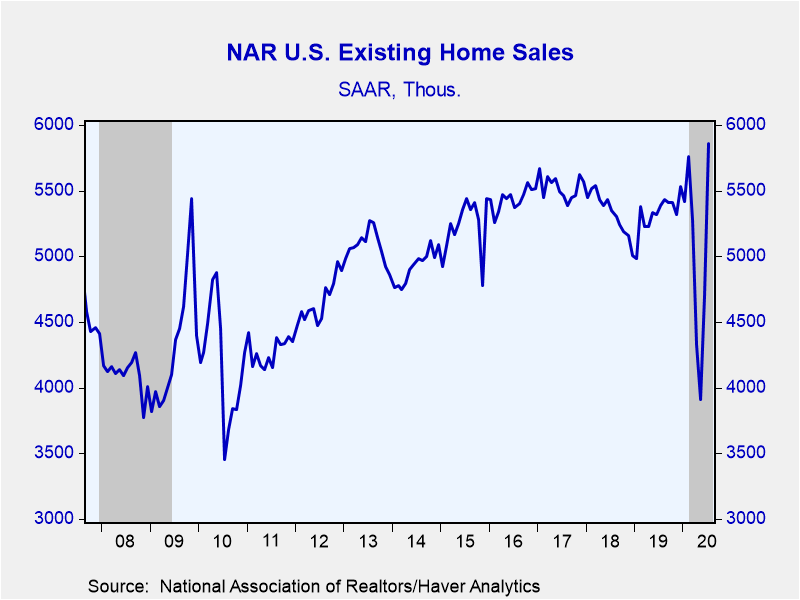

The National Association of Realtors (NAR) reported that sales of existing homes jumped 24.7% (8.7% y/y) during July to 5.860 million units (AR) after rising 20.2% to 4.700 million in June, revised from 4.720 million. It was the highest level of sales since December 2006. The Action Economics Forecast Survey expected July sales of 5.40 million. Existing home sales data are compiled when sales close. The total includes single-family houses plus condos and co-ops.

Sales of existing single-family homes jumped 23.9% (9.8% y/y) to 5.280 million units following a 19.3% June gain. The series dates back to January 1968. Sales of condos and co-ops strengthened 31.8% (0.0% y/y) to 580,000 units, rebounding 70.6% during the last two months to the highest level since February.

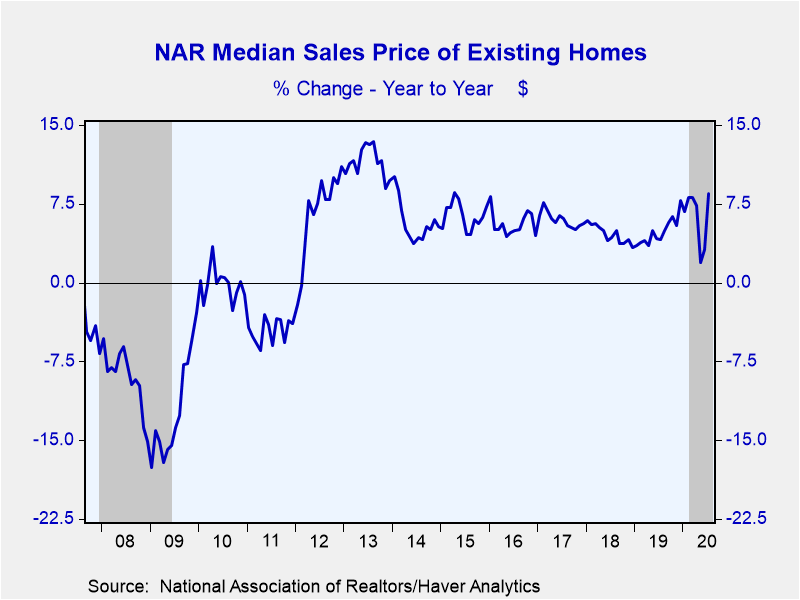

The median price of an existing home increased 3.3% (8.5% y/y) to a record $304,100 after a 3.8% June rise. The mean sales price improved 2.6% last month (6.5% y/y) to $337,500. The median home price in the Northeast eased 5.0% (+4.0% y/y) to $317,800. In the Midwest, prices rose 4.0% (8.0% y/y) to $244,500. The median home price in the South strengthened 4.6% (9.9% y/y) to $268,500 while prices in the West improved 5.2% (11.3% y/y) to $453,800. The price data are not seasonally adjusted.

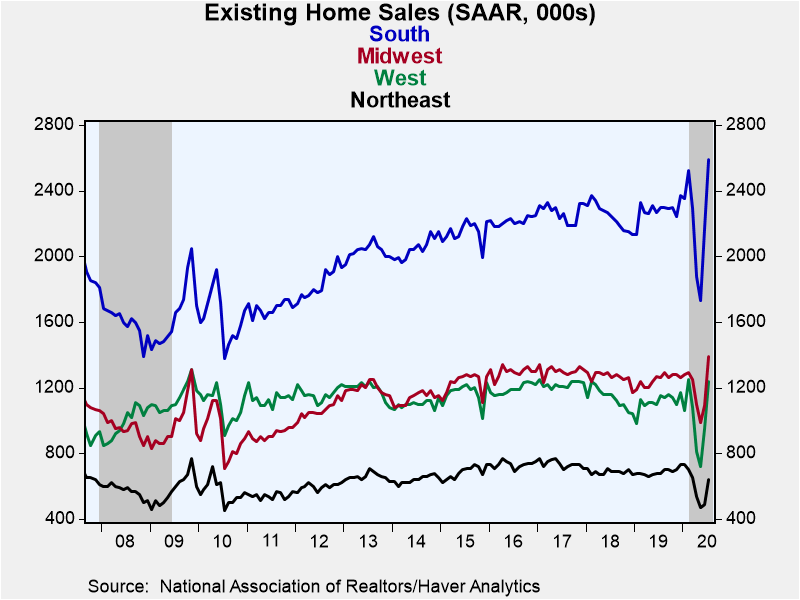

Sales in all four regions of the country strengthened last month. In the West, sales increased 30.5% (7.8% y/y) to 1.240 million, about as they did in June. Sales in the South improved 19.4% during July (12.6% y/y) to 2.590 million units after a 25.4% June rebound which followed three straight months of decline. In the Northeast, sales surged 30.6% (-5.9% y/y) to 640,000 after a modest 4.3% June rise. Sales surged 27.5% (10.3% y/y) in the Midwest to 1.390 million units, the highest level since December 2006.

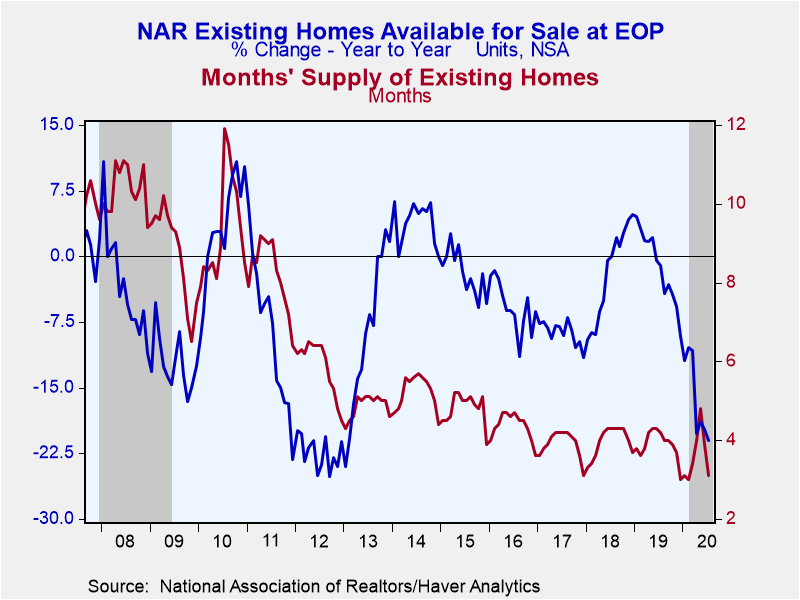

The number of homes on the market declined 21.1% y/y. The months' supply of homes on the market fell sharply to 3.1, roughly matching the record low of 3.0 months in February.

The data on existing home sales, prices and affordability are compiled by the National Association of Realtors. The data trace back to February 1968. Total sales and price data and regional sales can be found in Haver's USECON database. Regional price and affordability data and national inventory data are available in the REALTOR database. The expectations figure is from the Action Economics Forecast Survey, reported in the AS1REPNA database.

| Existing Home Sales (SAAR, 000s) | Jul | Jun | May | Jul Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total Sales | 5,860 | 4,700 | 3,910 | 8.7 | 5,330 | 5,334 | 5,527 |

| Northeast | 640 | 490 | 470 | -5.9 | 687 | 687 | 736 |

| Midwest | 1,390 | 1,090 | 990 | 10.3 | 1,248 | 1,264 | 1,302 |

| South | 2,590 | 2,170 | 1,730 | 12.6 | 2,281 | 2,245 | 2,268 |

| West | 1,240 | 950 | 720 | 7.8 | 1,115 | 1,138 | 1,222 |

| Single-Family Sales | 5,280 | 4,260 | 3,570 | 9.8 | 4,754 | 4,737 | 4,904 |

| Median Price Total ($, NSA) | 304,100 | 294,500 | 283,600 | 8.5 | 269,783 | 257,267 | 245,950 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates