Global| Jun 04 2021

Global| Jun 04 2021U.S. Factory Orders Retreated in April; Shipments Continued to Rise

by:Sandy Batten

|in:Economy in Brief

Summary

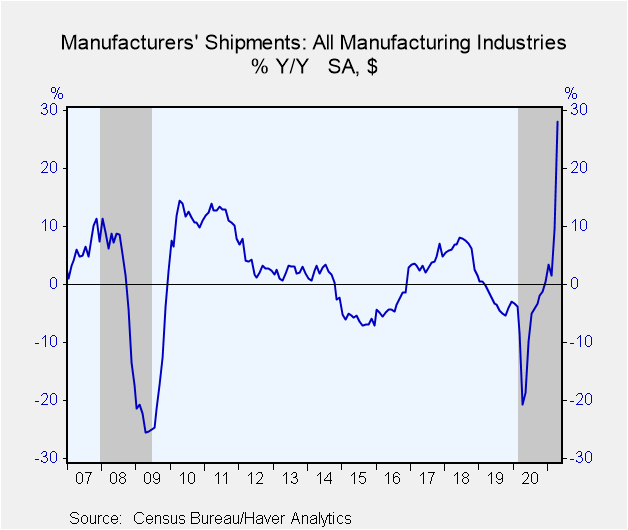

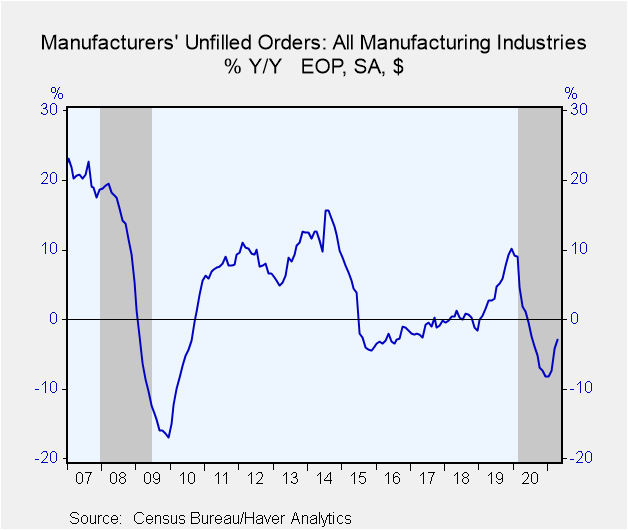

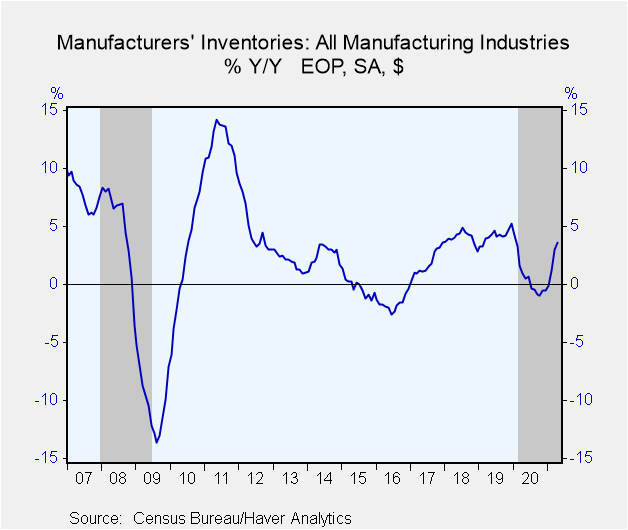

• April retreat less than half March gains. • April shipments added to March surge. • Order backlogs and inventories continued to rise. New orders for manufactured goods fell 0.6% m/m (+34.1% y/y) in April following an upwardly [...]

• April retreat less than half March gains.

• April shipments added to March surge.

• Order backlogs and inventories continued to rise.

New orders for manufactured goods fell 0.6% m/m (+34.1% y/y) in April following an upwardly revised 1.4% m/m gain in March (initially 1.1%). The Action Economics Forecast Survey expected a 0.3% decline. This was the first monthly decline since April 2020.

Orders in durable goods industries fell 1.3% m/m (+52.2% y/y) in April from an upwardly revised 1.3% m/m increase in March (initially 0.8%). Transportation sector orders slumped 6.6% m/m (+187.9% y/y) in April on top of a downwardly revised 3.1% monthly decline in March. Electrical equipment orders slipped 0.7% m/m in April. Apart from these two declines, orders rose in the other major categories in April.

Nondurable goods orders, which equal shipments, edged up 0.1% m/m (+19.4% y/y) in April on top of a slightly upwardly revised 1.6% monthly gain in March. Shipments from petroleum refineries fell 1.2% m/m in April following a downwardly revised 3.4% m/m increase in March. The weakest performance in April was posted by textile mills, which slumped 2.0% m/m after having risen 3.6% m/m in March. Beverage and tobacco products shipments fell 1.7% m/m. By contrast, leather product shipments jumped up 7.0% m/m.

Shipments of durable goods rose 0.6% m/m (37.8% y/y) in April versus a 2.7% m/m gain in March. Transportation shipments slipped 0.4% m/m in April following a downwardly revised 3.5% m/m rise in March. Shipments of nonmetallic mineral products and shipments of furniture each fell 0.3% m/m. Primary metals shipments rose 2.7% m/m on top of a 4.8% jump in March. Shipments of wood products increased 1.3%, adding to their 4.9% gain in March.

Inventories of manufactured products rose 0.3% m/m (3.6% y/y) in April following a slightly upwardly revised 0.8% m/m gain in March. Durable goods inventories increased 0.5% m/m (2.3% y/y) following a 1.1% rise in March. Transportation equipment inventories rose 0.6% m/m, while excluding transportation, inventories gained 0.3% m/m. Auto inventories strengthened 1.6% m/m. Nondurable goods inventories were unchanged in April (+5.7% y/y). A 1.3% m/m decline in petroleum inventories offset small increases in most other major categories.

The value of unfilled orders rose 0.2% m/m (-2.9% y/y) in April after a 0.5% m/m gain in March. Unfilled orders in the transportation sector fell 0.5% m/m and excluding transportation, backlogs jumped 1.5%. Apart from the decline in transportation backlogs, all other major categories experienced increased unfilled orders in April.

The factory sector data are available in USECON database.

| Factory Sector (% chg) - NAICS Classification | Apr | Mar | Feb | Apr Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| New Orders | -0.6 | 1.4 | 0.4 | 34.1 | -10.4 | -0.2 | 5.7 |

| Shipments | 0.4 | 2.1 | -1.8 | 28.2 | -6.7 | -2.6 | 6.0 |

| Unfilled Orders | 0.2 | 0.5 | 0.8 | -2.9 | -8.2 | 10.2 | -1.6 |

| Inventories | 0.3 | 0.8 | 0.8 | 3.6 | -0.5 | 5.3 | 2.8 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.