Global| Feb 23 2021

Global| Feb 23 2021U.S. FHFA House Price Index Continues to Rise Markedly

by:Sandy Batten

|in:Economy in Brief

Summary

• House prices rose 1.1% m/m, the seventh consecutive monthly increase of 1.0% or more. • Prices were up 11.4% y/y, a series record annual increase dating back to 1991. • For all of 2020, prices rose 7.7% despite the pandemic. The [...]

• House prices rose 1.1% m/m, the seventh consecutive monthly increase of 1.0% or more.

• Prices were up 11.4% y/y, a series record annual increase dating back to 1991.

• For all of 2020, prices rose 7.7% despite the pandemic.

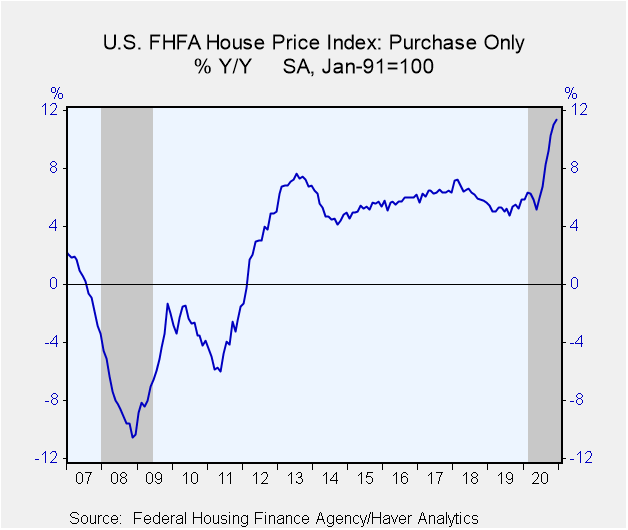

The Federal Housing Finance Agency (FHFA) House Price Index increased 1.1% m/m in December following an unrevised 1.0% m/m gain in November. This was the seventh consecutive month in which house prices had risen by 1.0% or more. Prior to this seven-month run, this index had risen 1% or more in only five months in the series history dating back to January 1991. Compared to a year ago, house prices were up 11.4%, the highest annual rate of increase in the series history. Over the past seven months, house prices rose 16.6% annualized, also their highest seven-month advance ever. For Q4, house prices were up 3.8% from Q3 and 10.8% from Q4 2019, both series records. This was the 38th consecutive quarter in which house prices have risen. House prices rose in all 50 states in Q4 from a year earlier. For all of 2020, prices rose 7.7%. The all-transactions quarterly index increased 2.1% q/q in Q4, its largest rise since Q2 2017.

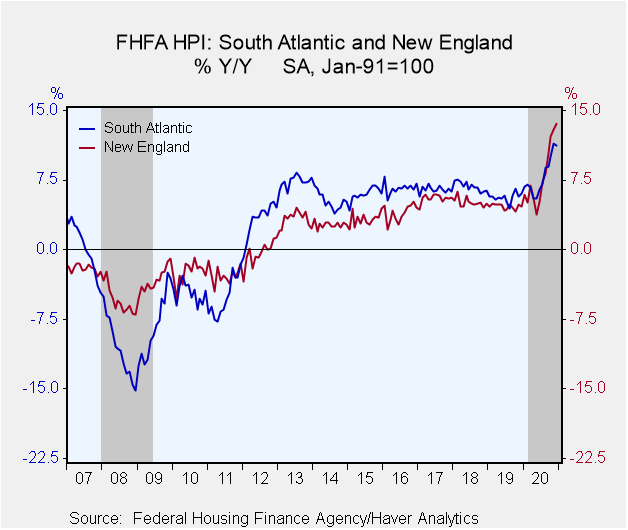

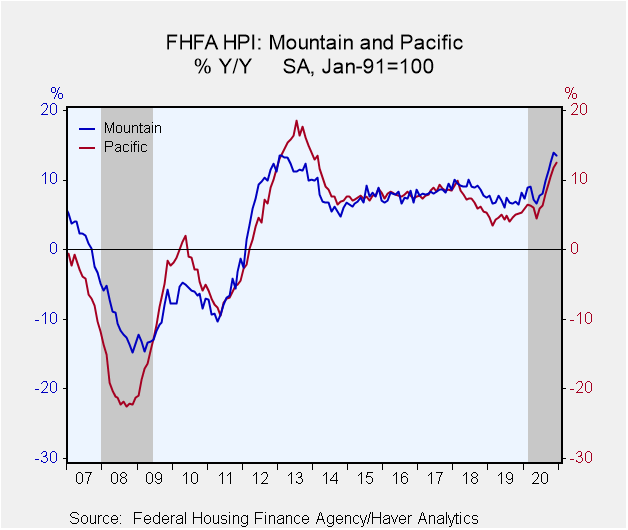

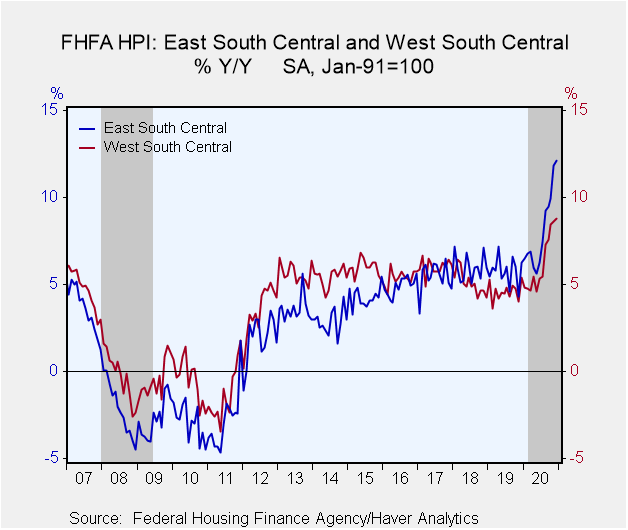

House prices rose in each census division in December from November and also from a year ago. Seasonally adjusted monthly house price changes in December from November ranged from +0.8% in the West North Central and South Atlantic regions to +1.7% in the East South Central region. The 12-month changes ranged from +8.8% in the West South Central division to +13.7% in the Middle Atlantic region. Annual advances were at series highs in four of the nine regions.

The FHFA house price index is a weighted purchase-only index that measures average price changes in repeat sales of the same property. An associated quarterly index includes refinancings on the same kinds of properties. The indexes are based on transactions involving conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. Only mortgage transactions on single-family properties are included. The FHFA data are available in Haver's USECON database.

| FHFA U.S. House Price Index, Purchase Only (SA %) |

Dec | Nov | Oct | Dec Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total | 1.1 | 1.0 | 1.5 | 11.4 | 7.7 | 5.3 | 6.4 |

| New England | 0.9 | 1.4 | 2.1 | 13.7 | 8.2 | 4.7 | 5.1 |

| Middle Atlantic | 1.0 | 0.8 | 1.6 | 11.3 | 7.3 | 4.5 | 5.2 |

| East North Central | 1.4 | 1.0 | 1.5 | 11.5 | 7.6 | 5.4 | 6.3 |

| West North Central | 0.8 | 0.4 | 0.8 | 9.6 | 7.1 | 5.1 | 5.8 |

| South Atlantic | 0.8 | 1.2 | 1.7 | 11.3 | 8.0 | 5.7 | 6.9 |

| East South Central | 1.7 | 1.2 | 0.7 | 12.1 | 8.2 | 5.8 | 6.0 |

| West South Central | 1.3 | 0.3 | 1.3 | 8.8 | 6.3 | 4.6 | 5.1 |

| Mountain | 1.4 | 1.3 | 1.7 | 13.6 | 9.7 | 7.1 | 9.0 |

| Pacific | 1.1 | 1.6 | 1.7 | 12.5 | 7.9 | 4.7 | 7.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates