Global| Dec 10 2015

Global| Dec 10 2015U.S. Financial Accounts Show Less Borrowing But Also Smaller Net Wealth

Summary

Total borrowing in the U.S. decreased to $933 billion at a seasonally adjusted annual rate in Q3, according to the Financial Accounts of the U.S., which were released today by the Federal Reserve Board. This was less than half the [...]

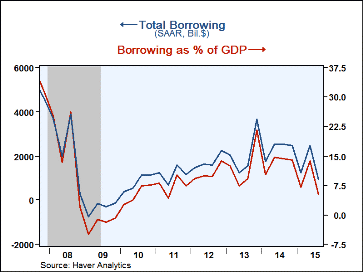

Total borrowing in the U.S. decreased to $933 billion at a seasonally adjusted annual rate in Q3, according to the Financial Accounts of the U.S., which were released today by the Federal Reserve Board. This was less than half the pace of the $2.470 trillion in Q2, and it amounted to just 5.2% of GDP, down from Q2's 13.8%. All major sectors of the domestic economy as well as the foreign sector borrowed noticeably less in Q3.

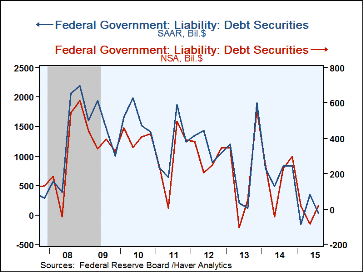

The federal government needed only $22 billion at a seasonally annual rate in Q3, down from $350 billion in Q2. The actual budget deficit for that quarter was $122.5 billion, about the same as a year ago, but far smaller than the deficit for Q3 in prior recent years. So it's not surprising that seasonally adjusted borrowing by the federal government was quite moderate.

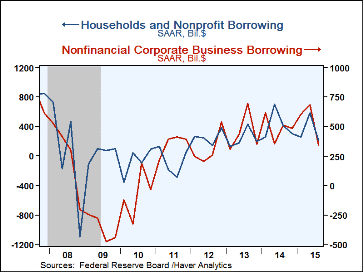

Household borrowing in Q3, at $211 billion, SAAR, was less than half the pace of Q2, $585 billion. Home mortgages increased $147 billion, SAAR versus Q2's $226 billion, and consumer credit rose at a $246 billion pace, compared to Q2's $286 billion. Other institutions, such as hedge funds, which are included in "households" because they are not covered by specific published source data, had net paydowns of about $172 billion in Q3 in depository institution and "other" loans.

Nonfinancial corporate business borrowing retreated to $343 billion, SAAR, in Q3 from $685 billion in Q2. Corporate bond issuance was $326 billion, SAAR, compared to Q2's $626 billion. Depository institution loans were paid down at a $60 billion annual rate after Q2's net borrowing of $73 billion. But commercial paper issuance did pick up, with a net increase of $68 billion, SAAR, after a net paydown of $50 billion in Q2 and net paydowns the previous two quarters as well.

The financial sector basically maintained its Q2 borrowing pace, $368 billion, with $324 billion in Q3.

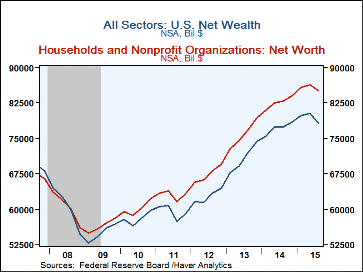

Press reports of these Financial Accounts highlight household balance sheets and net worth. Despite households' reduced borrowing, their net worth fell to $78.2 trillion (not seasonally adjusted) at the end of Q3 from $80.3 trillion at mid-year. This was largely due to the stock market decline over the summer, which reduced holdings of equities by $1.45 trillion (actual quarterly amount, not seasonally adjusted), the second largest quarterly decline ever. The largest was $1.50 trillion in Q1 2008.

The summer's stock price decline also cut the net wealth of the total economy. The Fed's recently devised measure, "U.S. net wealth" fell $2.12 trillion (not seasonally adjusted quarterly rate) as the overall market value of domestic corporations fell $2.54 trillion. The value of nonfinancial assets held by various sectors did increase, while U.S. financial claims on the "rest of the world" decreased, that by $778 billion. The opposite item, foreign claims on U.S. assets, also fell, by $489 billion, its first decline since Q3 2011 and the largest since Q1 2009, in the midst of the financial crisis.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.