Global| Jun 05 2014

Global| Jun 05 2014U.S. Financial Accounts Show Less Total Credit Demand, Even as Households and Corporations Borrow More

Summary

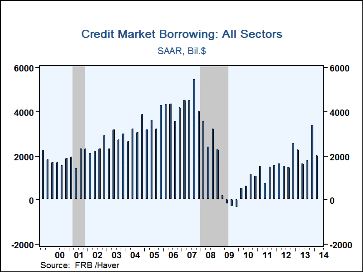

The Federal Reserve's financial accounts data (formerly known as the "flow of funds") for Q1 tally total credit market borrowing at a $2.00 trillion annual rate, down from $3.37 trillion in Q4. Q4 is mildly revised from $3.12 trillion [...]

The Federal Reserve's financial accounts data (formerly known as the "flow of funds") for Q1 tally total credit market borrowing at a $2.00 trillion annual rate, down from $3.37 trillion in Q4. Q4 is mildly revised from $3.12 trillion reported in March. The Q1 amount represents 11.7% of GDP, compared to 19.7% in Q4. The 20-year average ratio to GDP has ranged around 17-18%; it peaked at 37.5% in Q3 2007, just at the peak of the business cycle; there were total net paydowns during 2009, during the depth of the recession.

The Federal Reserve's financial accounts data (formerly known as the "flow of funds") for Q1 tally total credit market borrowing at a $2.00 trillion annual rate, down from $3.37 trillion in Q4. Q4 is mildly revised from $3.12 trillion reported in March. The Q1 amount represents 11.7% of GDP, compared to 19.7% in Q4. The 20-year average ratio to GDP has ranged around 17-18%; it peaked at 37.5% in Q3 2007, just at the peak of the business cycle; there were total net paydowns during 2009, during the depth of the recession.

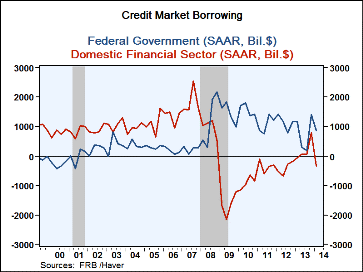

A good part of the borrowing reduction in Q1 came from the federal government, reversing some of its surge in Q4, as it used $874 billion in Q1 after $1.39 trillion the period before.

Also reversing its Q4 move was the domestic financial sector; this group of institutions paid down $319 billion on net in Q1, following borrowings of $787 billion in Q4. Government-sponsored enterprises, mostly Fannie Mae and Freddie Mac, liquidated $356 billion in Q1, and asset-backed securities issuers paid down $111 billion; this latter group continues a long, post-recession trend of net paydowns, albeit much smaller than during the recession itself. Holding companies had borrowed somewhat more heavily in Q4, but used just $11 billion in Q1, closer in line with their usual pattern of marginal swings in credit usage; holding companies are the parent companies of depository institutions, not those institutions themselves.

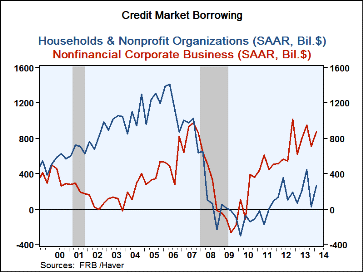

Domestic private borrowers also reversed their Q4 patterns in Q1, as both households and nonfinancial corporations increased their borrowing after cutting it down in Q4. Households used $267 billion in the latest period after a mere $29 billion in Q4. They did continue to liquidate home mortgages, by $84 billion in Q1 following $105 billion in Q4. But consumer credit use increased to $203 billion from $163 billion in Q4; student loans contributed the most with an upside in their usual sawtooth pattern, surging to $154 billion from a relatively small $48 billion in Q4. Auto loans moved moderately, $54 billion in Q1 after $48 billion in Q4; credit card debt grew $16 billion, similar to other recent quarters; and "other consumer credit" was liquidated by $21 billion in the latest quarter.

Nonfinancial corporations borrowed $873 billion in Q4, up moderately from $711 billion in Q4. Bonds remained the largest source of credit, at $662 billion, very similar to the $666 billion in Q4. Depository institution loans in Q1 were still modest, at $34 billion, and a bit less than the $50 billion in Q4. Corporations did increase commercial paper usage by $72 billion, and "other loans" were up $118 billion, while they paid down mortgages by $15 billion.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.