Global| Jul 13 2009

Global| Jul 13 2009U.S. Foreign Trade Activity: Recently A Smaller Share of U.S. GDP

by:Tom Moeller

|in:Economy in Brief

Summary

Until the current recession started, the U.S. level of foreign trade (exports PLUS imports) was rising sharply with the expansion of the worldwide economy. As a percentage of overall U.S. economic activity, trade was just shy of 30% [...]

Until the current recession started, the U.S. level of foreign

trade (exports PLUS imports) was rising sharply with the expansion of

the worldwide economy. As a percentage of overall U.S. economic

activity, trade was just shy of 30% for roughly per year as economic

activity rose. Foreign trade's importance to the U.S. economy increased

from 25% of real GDP as recently as 2003 and it nearly doubled since

the early 1980s. It bares emphasizing that the total trade figures

matter because they not only reflect foreign demand for U.S.-made

products but the U.S. demand for products made elsewhere.

Until the current recession started, the U.S. level of foreign

trade (exports PLUS imports) was rising sharply with the expansion of

the worldwide economy. As a percentage of overall U.S. economic

activity, trade was just shy of 30% for roughly per year as economic

activity rose. Foreign trade's importance to the U.S. economy increased

from 25% of real GDP as recently as 2003 and it nearly doubled since

the early 1980s. It bares emphasizing that the total trade figures

matter because they not only reflect foreign demand for U.S.-made

products but the U.S. demand for products made elsewhere.

The data used for this analysis are the real foreign trade figures from the U.S. National Income and Product Accounts. These are available in Haver's USECON database.

Since the recession began, the level of U.S. foreign trade has

contracted sharply. Trade's share of real GDP fell to 26%, a decline

back to the level of late-2003. These figures do not, of course,

reference the U.S. trade deficit which is more a function of the

foreign exchange value of the dollar and relative economic growth rates

in the U.S. versus those abroad. Though the U.S. employment figures do

not reflect the "substitution" effects of foreign for domestic workers,

clearly both groups have suffered from the reduced level of trade

activity.

Since the recession began, the level of U.S. foreign trade has

contracted sharply. Trade's share of real GDP fell to 26%, a decline

back to the level of late-2003. These figures do not, of course,

reference the U.S. trade deficit which is more a function of the

foreign exchange value of the dollar and relative economic growth rates

in the U.S. versus those abroad. Though the U.S. employment figures do

not reflect the "substitution" effects of foreign for domestic workers,

clearly both groups have suffered from the reduced level of trade

activity.

The recent decline in trade reflects both lower exports and imports. As an aside, the trade deficit recently fell sharply with the increase in U.S. competitiveness. The dollar's value fell 25% since 2001 and U.S. productivity surged. Behind the decline in trade is an 11.7% share that exports maintain of the U.S. economy. That's down from the 13.0% average for all of last year, however, it still roughly equals the share during all of 2006. More importantly, it's up from 10% in the mid-1990s and from 5%-to-6% in the '80s. In the early 1950s, exports accounted for just 3% of U.S. economic activity.

Imports have fallen to an even greater degree of late than exports; hence, the improvement in the real U.S. trade deficit. Imports fell to 14.3% of real GDP last quarter after the increase to a peak of 17.1% during 2007. Like exports, however, their presence in the economy has steadily surged. It's still up slightly from ten years ago and from 8% in the late- 1980s. In the early 1950s imports accounted for a miniscule 3% of U.S. economic activity.

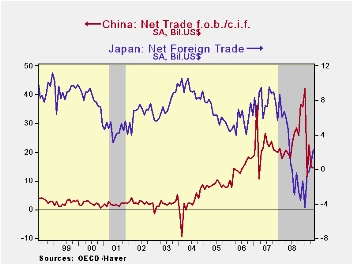

Individual countries' trade figures give some background to

the trends addressed above. Overall, the huge increase in China's trade

surplus to $32B by the end of last year from a modest surplus as

recently as 2004 was driven by a ten-fold jump in exports from the

late-1990s. It fell slightly early this year. In Japan, exports last

year were up seven times from the early-1980s and the trade surplus had

been running a fairly stable, large $5 to $10B for twenty years.

However, that position collapsed to a deficit last year and continued

so early this year at -$2B. Germany's net foreign trade balance also

ballooned to a $22B surplus last year from $6B ten years earlier as

exports rose four-fold. The surplus fell back to $10 early in 2009.

Individual countries' trade figures give some background to

the trends addressed above. Overall, the huge increase in China's trade

surplus to $32B by the end of last year from a modest surplus as

recently as 2004 was driven by a ten-fold jump in exports from the

late-1990s. It fell slightly early this year. In Japan, exports last

year were up seven times from the early-1980s and the trade surplus had

been running a fairly stable, large $5 to $10B for twenty years.

However, that position collapsed to a deficit last year and continued

so early this year at -$2B. Germany's net foreign trade balance also

ballooned to a $22B surplus last year from $6B ten years earlier as

exports rose four-fold. The surplus fell back to $10 early in 2009.

These Main Economic Indicators from the OECD are available in Haver's OECDMEI database.

OECD's Gurría welcomes strengthening of G8/G5

dialogue through HAP from the OECD is available here.

| Foreign Trade | 1Q09 | 4Q08 | 3Q08 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| U.S. Trade Deficit % of Real GDP | 26.0 | 28.4 | 29.6 | 29.3 | 29.5 | 28.7 |

| Exports % Real GDP | 11.7 | 12.6 | 13.3 | 13.0 | 12.4 | 11.6 |

| Imports % Real GDP | 14.3 | 15.8 | 16.3 | 16.3 | 17.1 | 17.1 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates