Global| May 29 2014

Global| May 29 2014U.S. GDP Revised to 1% Decline for Q1

Summary

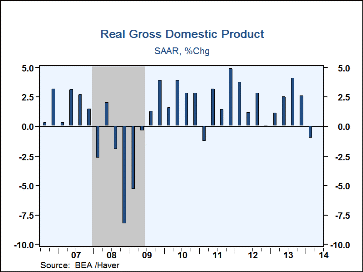

Real GDP was revised to a 1.0% rate of decline in Q1 (2.0% y/y) from the minuscule 0.1% increase reported initially. It was also modestly worse than consensus forecasts of a 0.5% decrease. The chain-type price index remained at the [...]

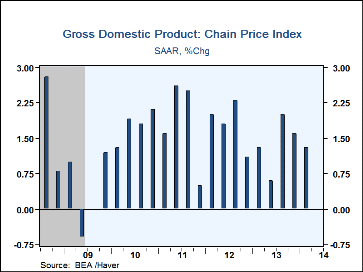

Real GDP was revised to a 1.0% rate of decline in Q1 (2.0% y/y) from the minuscule 0.1% increase reported initially. It was also modestly worse than consensus forecasts of a 0.5% decrease. The chain-type price index remained at the 1.3% rate reported before (also 1.3% y/y).

Real GDP was revised to a 1.0% rate of decline in Q1 (2.0% y/y) from the minuscule 0.1% increase reported initially. It was also modestly worse than consensus forecasts of a 0.5% decrease. The chain-type price index remained at the 1.3% rate reported before (also 1.3% y/y).

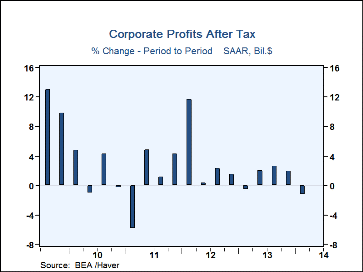

Corporate profits for Q1 were reported for the first time today. Pretax profits were up just 0.1% (6.6% y/y). After-tax profits fell 1.3% (5.3% y/y). By sector, before-tax profits for nonfinancial corporations were up 7.0% in Q1 and 11.6% y/y. Financial sector pretax profits fell 10.1% in the quarter and were down 2.5% y/y. Foreign sector earnings fell 9.1% q/q and rose 1.0% y/y.

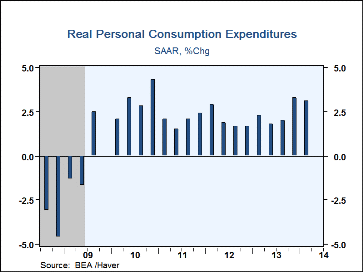

Personal consumption expenditures were even a bit firmer than initially estimated for Q1, being revised from a 3.0% growth rate to 3.1%. Outlays for durable goods were revised from 0.8% to 1.4% (4.5% y/y) and those on nondurable goods from 0.2% to 0.4% (2.0% y/y). Spending on services was lowered slightly from a 4.4% growth rate to 4.3% (2.4% y/y).

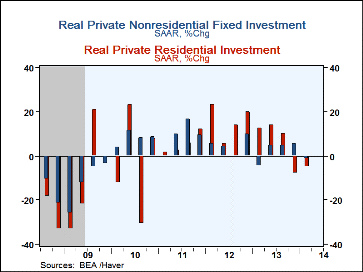

Business investment was also revised upward slightly; it decreased at a 1.6% rate (+3.4 y/y) compared to 2.0% reported before. The revisions to the components were mixed; they included a 3.1% decline in equipment (+2.7% y/y), revised upward from -5.5%, and a 7.5% drop in structures (+4.9% y/y), sharply lower than the +0.2% reported before. Intellectual property products investment was then firmer, growing at a 5.1% rate, compared to 1.5% in the advance report. Residential investment fell at a 5.0% pace (+2.5% y/y), not quite as weak as the 5.8% drop reported earlier.

Government spending was reduced a bit in the revised data, to an 0.8% rate of decline in Q1 (-1.5% y/y) from 0.5% initially. National defense remained at its earlier 2.4% decline (-4.7% y/y). Spending by state & local governments was cut to a 1.8% decrease (+0.1% y/y) from 1.3% indicated before.

Foreign trade took GDP growth down 1.0% in Q1, more than the 0.8% reported before. This came from an upward revision to imports, from -1.4% to +0.7% (+2.9% y/y); exports fell, but less than originally estimated, at a 6.0% rate (+3.7% y/y) versus the 7.6% before. Inventories were also cut further, now showing a 1.6% drag versus 0.6% indicated before.

Broad price indexes were largely unrevised. The total GDP chain price index rose at a 1.3% pace (+1.3% y/y), the same as before, and the total PCE price index was up at a 1.4% pace (1.4% y/y) also basically unchanged. The PCE "core" less food and energy was up 1.2%, (1.1% y/y) down a bit from the 1.3% reported earlier.

The latest GDP figures can be found in Haver's USECON and USNA databases; USNA contains basically all of the Bureau of Economic Analysis' detail in the national accounts, including the integrated economic accounts and the recently added GDP data for U.S. Territories. The Action Economics consensus estimates can be found in AS1REPNA.

| Chained 2009 $, %, AR | Q1'14 (2nd Estimate) | Q1'14 (Advance) | Q4'13 | Q3'13 | Q1 Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|

| Gross Domestic Product | -1.0 | 0.1 | 2.6 | 4.1 | 2.0 | 1.9 | 2.8 | 1.8 |

| Inventory Effect | -1.6 | -0.6 | -0.0 | 1.7 | 0.0 | 0.2 | 0.2 | -0.2 |

| Final Sales | 0.6 | 0.7 | 2.7 | 2.5 | 2.0 | 1.7 | 2.6 | 2.0 |

| Foreign Trade Effect | -1.0 | -0.8 | 1.0 | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 |

| Domestic Final Sales | 1.6 | 1.5 | 1.6 | 2.3 | 1.9 | 1.5 | 2.4 | 1.8 |

| Demand Components | ||||||||

| Personal Consumption Expenditures | 3.1 | 3.0 | 3.3 | 2.0 | 2.5 | 2.0 | 2.2 | 2.5 |

| Business Fixed Investment | -1.6 | -2.0 | 5.7 | 4.8 | 3.4 | 2.7 | 7.3 | 7.6 |

| Residential Investment | -5.0 | -5.8 | -7.9 | 10.3 | 2.5 | 12.2 | 12.9 | 0.5 |

| Government Spending | -0.8 | -0.5 | -5.2 | 0.4 | -1.5 | -2.3 | -1.0 | -3.2 |

| Chain-Type Price Index | ||||||||

| GDP | 1.3 | 1.3 | 1.6 | 2.0 | 1.3 | 1.4 | 1.7 | 2.0 |

| Personal Consumption Expenditures | 1.4 | 1.4 | 1.1 | 1.9 | 1.4 | 1.1 | 1.8 | 2.4 |

| Less Food/Energy | 1.2 | 1.3 | 1.3 | 1.4 | 1.1 | 1.2 | 1.8 | 1.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates