Global| Aug 15 2018

Global| Aug 15 2018U.S. Home Builder Index Drifts Lower

Summary

The Composite Housing Market Index (HMI) from the National Association of Home Builders-Wells Fargo decreased 1 point in August to 67 from 68 during July, which was unrevised; this month’s reading is unchanged from August 2017. It [...]

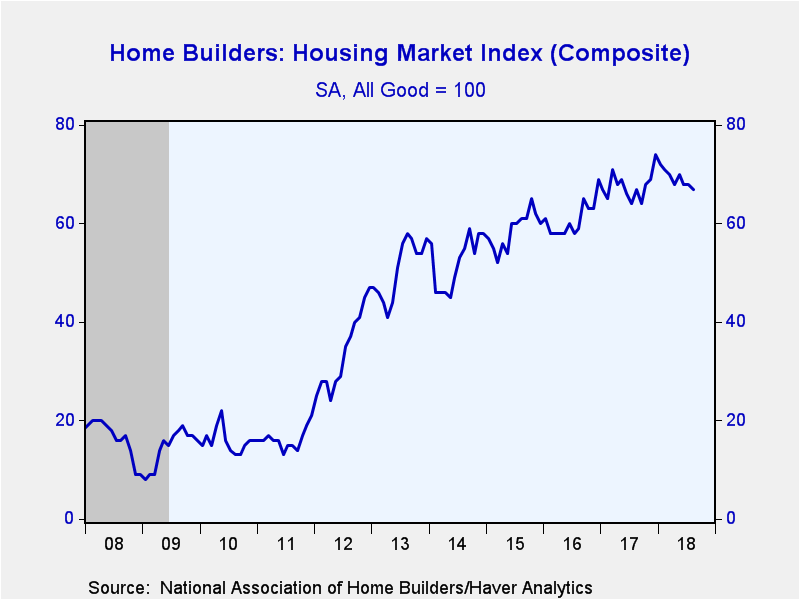

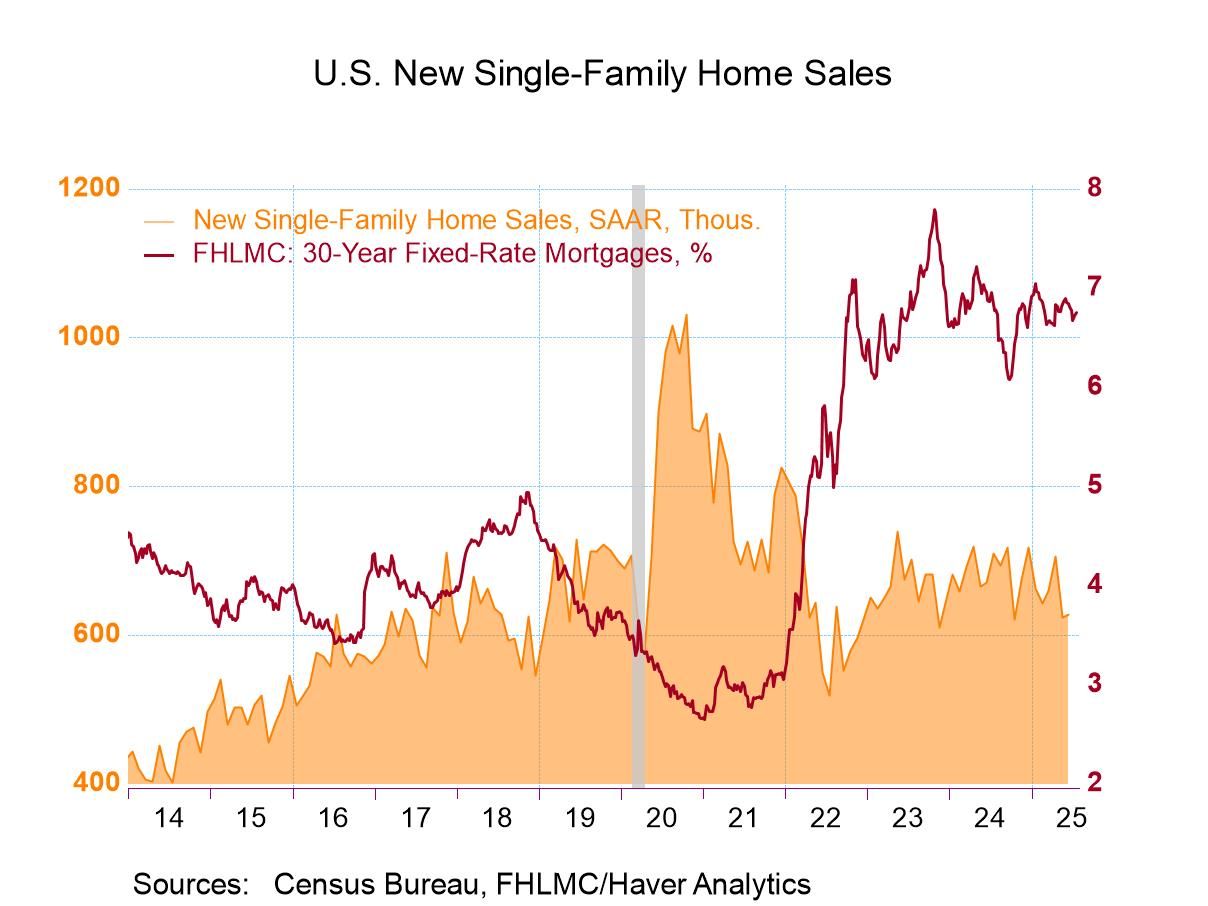

The Composite Housing Market Index (HMI) from the National Association of Home Builders-Wells Fargo decreased 1 point in August to 67 from 68 during July, which was unrevised; this month’s reading is unchanged from August 2017. It also is equal to expectations for 67 in the Informa Global Markets Survey. The NAHB figures are seasonally adjusted. During the last ten years, there has been a 61% correlation between the y/y change in the home builders index and the y/y change in new home sales.

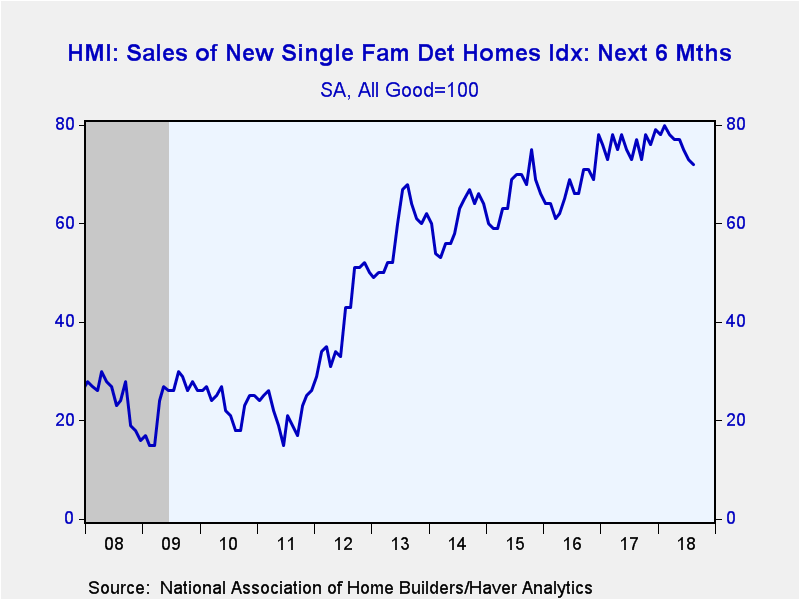

The three components of the HMI all went down in August. The index of present sales conditions eased to 73 in August from 74 in July, which also happened to have been the reading for August 2017. It reached a recent peak of 80 last December. The index for conditions participants expect in the next six months dipped to 72 this month from 73 in July and compared to 77 in August last year. The recent peak in that outlook index was 80 back in February.

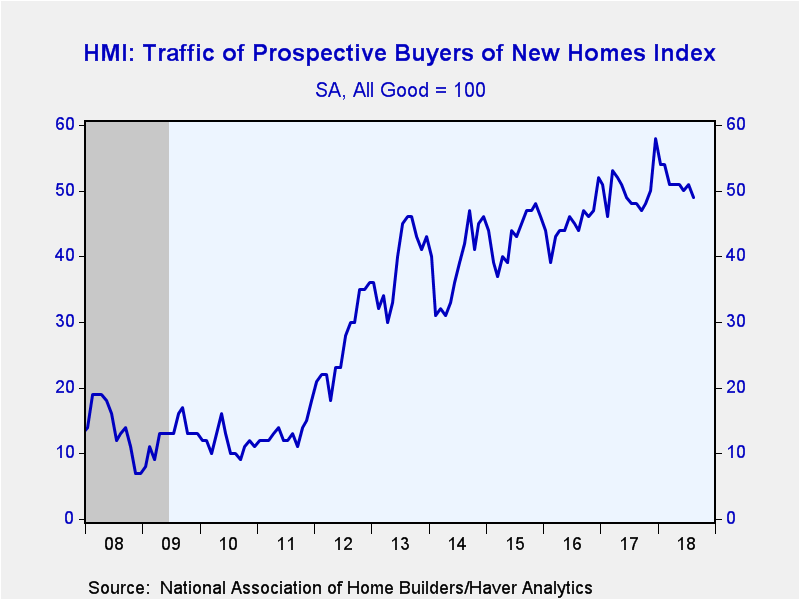

The index of traffic of prospective buyers, which had picked up in July to 52, was revised down to 51 then and it declined to 49 this month. While it is slightly higher than the year-ago 48, it is noticeably lower than the recent peak of 58 in back in December.

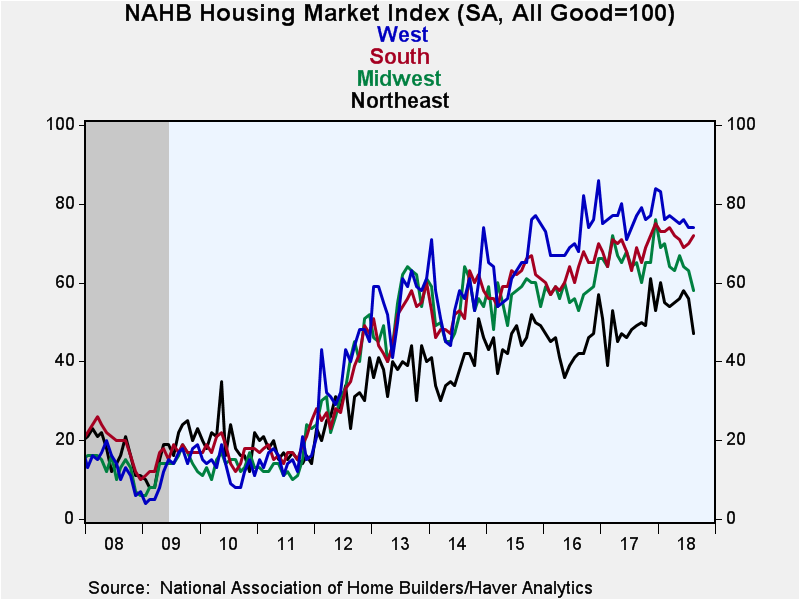

The decrease in the national index reflects noticeable declines the Northeast and the Midwest regions. The Northeast region saw its index drop to 47 for August from 56 in July; it was 49 a year ago. in the Midwest, the August reading was 58, down from 63 in July and 65 in August 2017. The HMI in the West was steady m/m in August at 74 and down somewhat from 77 a year ago. The m/m reading in the South actually went up, reaching 72 from 71 in July and 69 a year ago. While up in August, this region is seeing a gentle downtrend, as evident in the fourth graph shown here

The NAHB has compiled the Housing Market Index since 1985. It reflects survey questions asking builders to rate market conditions as "good," "fair," "poor" or "very high" to "very low." The figure is thus a diffusion index with numerical results six over 50 indicating a predominance of "good" readings. The weights assigned to the individual index components are 0.5920 for single-family detached sales, present time, 0.1358 for single-family detached sales, next months and 0.2722 for traffic of prospective buyers. The results are included in Haver's SURVEYS database. The expectations figure is available in Haver's MMSAMER database.

| National Association of Home Builders | Aug | Jul | Jun | Aug '17 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Composite Housing Market Index, SA (All Good=100) | 67 | 68 | 68 | 67 | 68 | 61 | 59 |

| Single-Family Sales: Present | 73 | 74 | 74 | 74 | 74 | 67 | 64 |

| Single-Family Sales: Next Six Months | 72 | 73 | 75 | 77 | 76 | 67 | 66 |

| Traffic of Prospective Buyers | 49 | 51 | 50 | 48 | 50 | 45 | 43 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.