Global| Jan 20 2021

Global| Jan 20 2021U.S. Home Builder Sentiment Slips in January

by:Sandy Batten

|in:Economy in Brief

Summary

• Housing market activity weakens again from record high in November. • Activity in each region declines. The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo declined 3.5% m/m (+10.7% y/y) in [...]

• Housing market activity weakens again from record high in November.

• Activity in each region declines.

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo declined 3.5% m/m (+10.7% y/y) in January, its second consecutive monthly decline after having risen to a record 90 in November. The January decline compared to expectations for an unchanged reading of 86 in the INFORMA Global Markets survey. The NAHB figures are seasonally adjusted. Over the past 15 years, there has been a 70% correlation between the y/y change in the home builders index and the y/y change in new plus existing home sales.

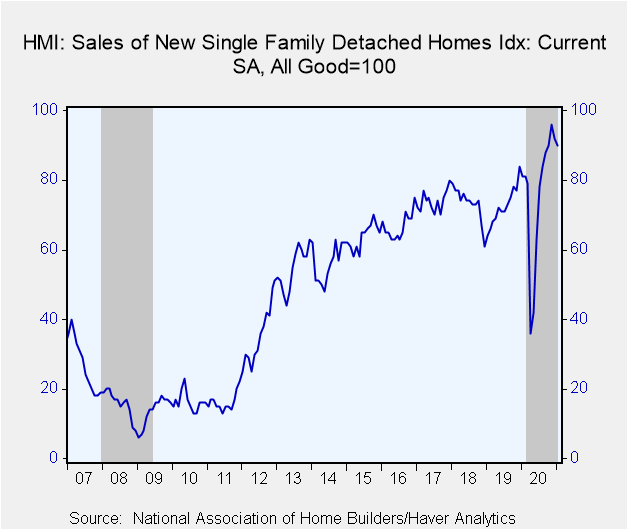

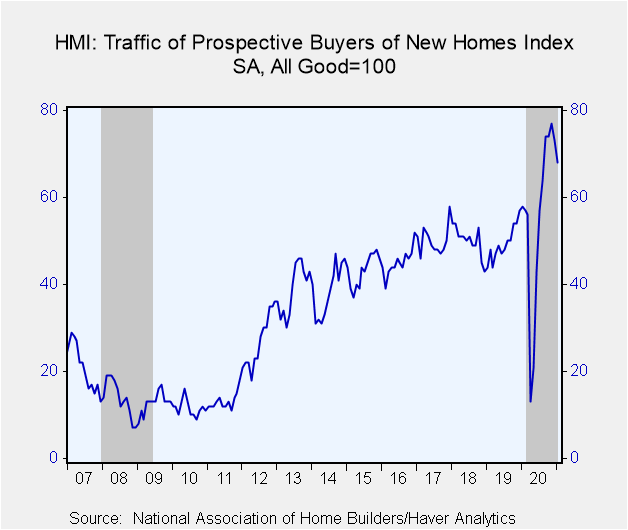

Each of the composite index's three components declined in January. The index of present sales conditions fell 2.2% to 90 in January but was up 11.1% from a year ago. The index of expected sales six months ahead fell 2.4% m/m to 83 but was 3.8% higher y/y. The index measuring traffic of prospective buyers slid 6.8% m/m (+17.2% y/y) to 68. The November readings had been record highs for each of the three components.

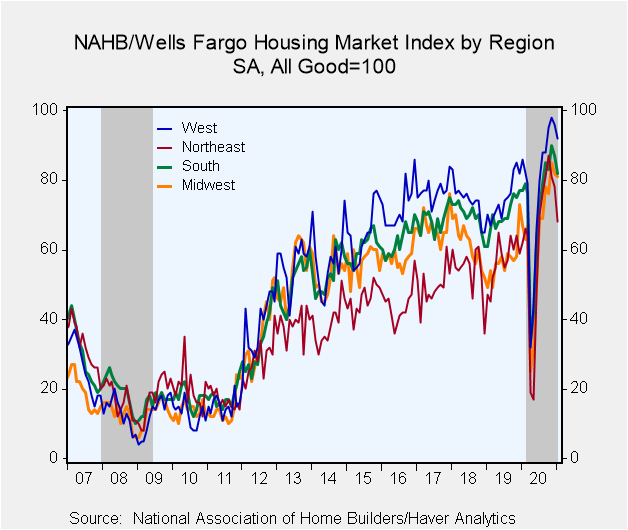

The regional indexes also decline in January in each region. The index for the Northeast slumped 12.8% m/m (+9.7%), its third monthly decline after having reached a record high of 87 in October. The index for the Midwest edged down 1.2% m/m (+20.9% y/y). The index for the South declined 5.7% m/m (+6.5% y/y). And the index for the West fell 4.2% m/m (+7.0% y/y). The January declines for the Midwest, South and West indexes were the second consecutive monthly falls after each had reached a record high in November. These regional series begin in December 2004.

The NAHB has compiled the Housing Market Index since 1985. It reflects survey questions which ask builders to rate sales and sales expectations as "good," "fair" or "poor" and traffic as "very high," "average" or "very low." The figures are diffusion indexes with values over 50 indicating a predominance of "good"/"very high" readings. In constructing the composite index, the weights assigned to the individual index components are: 0.5920 for single-family detached sales, present time, 0.1358 for single-family detached sales, next six months, and 0.2722 for traffic of prospective buyers. These data are included in Haver's SURVEYS database.

| National Association of Home Builders | Jan | Dec | Nov | Jan'20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Composite Housing Market Index, SA (All Good=100) | 83 | 86 | 90 | 75 | 70 | 66 | 67 |

| Single-Family Sales: Present | 90 | 92 | 96 | 81 | 76 | 72 | 73 |

| Single-Family Sales: Next Six Months | 83 | 85 | 89 | 80 | 74 | 72 | 74 |

| Traffic of Prospective Buyers | 68 | 73 | 77 | 58 | 56 | 49 | 50 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.