Global| Jun 17 2014

Global| Jun 17 2014U.S. Housing Starts Lose Upward Momentum

by:Tom Moeller

|in:Economy in Brief

Summary

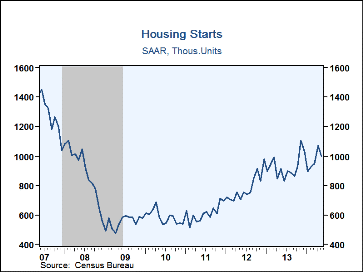

Housing starts during May declined 6.5% to 1.001 million (+8.0% y/y from 1.071 million in April, revised from 1.072 million. The latest figure fell short of expectations for 1.028 million starts in the Action Economics Forecast [...]

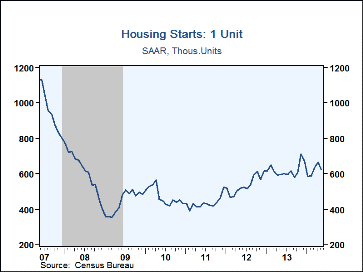

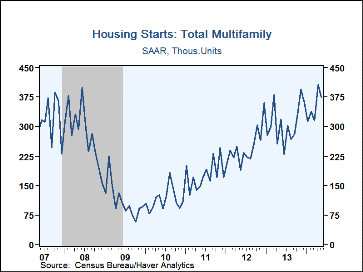

Housing starts during May declined 6.5% to 1.001 million (+8.0% y/y from 1.071 million in April, revised from 1.072 million. The latest figure fell short of expectations for 1.028 million starts in the Action Economics Forecast Survey. Last month's decline reflected a 7.6% retreat (+17.7% y/y) in starts of multi-family homes and a 5.9% drop (+3.1% y/y) in starts of single-family homes.

By region, starts in the Northeast declined 25.2% (-5.3% y/y) to 95,000 while starts in the Midwest fell 16.5% (+24.3% y/y) to 172,000. Starts in the West were off 16.3% (-0.5% y/y) to 205,000 while starts in the South improved 7.3% (9.7% y/y) to 529,000.

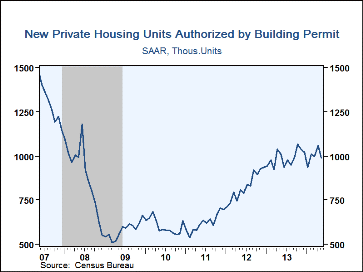

Building permits reversed April's gain with a 6.4% fall (-6.4% y/y) to 991,000. Permits to build single-family homes rebounded 3.7% (-5.3% y/y) to 619,000, the highest level in six months. Permits to build multi-family homes, however, declined 19.5% (-8.4% y/y) to 372,000.

The housing starts figures can be found in Haver's USECON database. The expectations figure is contained in the AS1REPNA database.

Forecast Disagreement in the Survey of Professional Forecasters from the Federal Reserve Bank of Philadelphia can be found here.

| Housing Starts (000s, SAAR) | May | Apr | Mar | May Y/Y % | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Total | 1,001 | 1,071 | 950 | 8.0 | 929 | 783 | 612 |

| Single-Family | 625 | 664 | 635 | 3.1 | 621 | 537 | 434 |

| Multi-Family | 376 | 407 | 315 | 17.7 | 308 | 247 | 178 |

| Starts By Region | |||||||

| Northeast | 95 | 127 | 124 | -5.3 | 96 | 80 | 68 |

| Midwest | 172 | 206 | 143 | 24.3 | 149 | 128 | 103 |

| South | 529 | 493 | 478 | 9.7 | 467 | 400 | 309 |

| West | 205 | 245 | 205 | -0.5 | 217 | 175 | 132 |

| Building Permits | 991 | 1,059 | 1,000 | -6.4 | 964 | 829 | 624 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.