Global| Mar 12 2015

Global| Mar 12 2015U.S. Import and Export Price Totals Turn Mixed with Upturn in Petroleum

Summary

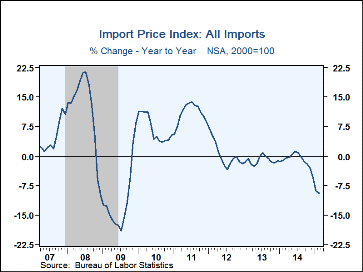

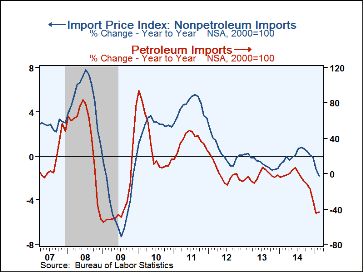

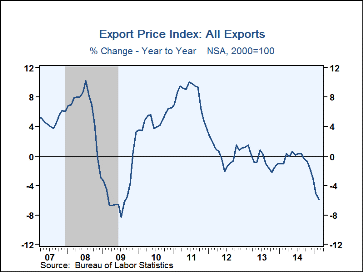

Prices of most internationally traded goods remained weak in February, but petroleum was a notable exception for both imports and exports. Overall import prices rose 0.4% (-9.4% y/y), including an 8.1% surge in petroleum; nonpetroleum [...]

Prices of most internationally traded goods remained weak in February, but petroleum was a notable exception for both imports and exports. Overall import prices rose 0.4% (-9.4% y/y), including an 8.1% surge in petroleum; nonpetroleum commodity imports were still down in price, by 0.4% (-1.8% y/y). January's import price result was revised to -3.1% from -2.8% reported before. Total export commodity prices were still off, by 0.1% (-5.9% y/y), but that included a 5.4% rise in prices of fuels & lubricants. The total export price index had fallen 1.9% in January, revised from -2.0% initially reported. The Action Economics Forecast Survey anticipated a 0.1% rise in total import prices for February and a 0.5% decline in total export prices.

Prices of imported industrial materials excluding petroleum continued weak in February, down 1.9% (-7.6% y/y). Most other broad end-use categories also continued to fall, with capital goods down 0.4% (-1.0% y/y), food, feed & beverages down 0.2% (-1.8% y/y) and autos & parts also 0.2% (-1.3% y/y). Consumer goods, though, rose 0.3% (-0.3% y/y), with increases in all major sub-categories, manufactured durables, manufactured nondurables and nonmanufactured goods.

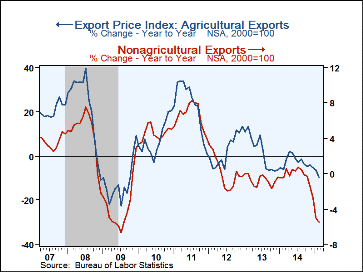

Among export prices, agricultural products continued to drop, falling 2.0% in February and cumulating to -9.5% year-on-year. Nonagricultural export prices did rise last month, by 0.2% (-5.5% y/y). Much of the latter reflects the upturn in fuel & lubricants. Overall industrial materials & supplies were up 0.6% (-5.3% y/y). Capital goods export prices also rose, by 0.2% (+0.8% y/y). Other categories, though, were still down, especially food, feed & beverages by 2.1% (-8.6% y/y), autos & parts by 0.3% (+0.1% y/y) and consumer goods by 0.5% (-1.4% y/y).

The import and export price series can be found in Haver's USECON database. Detailed figures, including the industrial materials ex petroleum imports and the fuel & lubricant export items mentioned above, are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database.

| Import/Export Prices (NSA, %) | Feb | Jan | Dec | Feb Y/Y | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | +0.4 | -3.1 | -1.9 | -9.4 | -1.1 | -1.1 | 0.3 |

| Petroleum | +8.1 | -20.6 | -12.4 | -43.2 | -5.6 | -2.6 | -0.3 |

| Nonpetroleum | -0.4 | -0.6 | 0.0 | -1.8 | 0.1 | -0.6 | 0.3 |

| Exports - All Commodities | -0.1 | -1.9 | -1.0 | -5.9 | -0.5 | -0.4 | 0.4 |

| Agricultural | -2.0 | -1.2 | -0.7 | -9.5 | -2.7 | 1.6 | 2.4 |

| Nonagricultural | -0.2 | -2.0 | -1.0 | -5.5 | -0.3 | -0.7 | 0.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates