Global| Feb 18 2021

Global| Feb 18 2021U.S. Import and Export Prices Jump Up Again in January

by:Sandy Batten

|in:Economy in Brief

Summary

• Import prices rose 1.4% in January with fuel prices up 7.4%. • Export prices increased 2.5%, the largest monthly increase in the series history. • Higher prices for industrial supplies were a key driver of the increases for both [...]

• Import prices rose 1.4% in January with fuel prices up 7.4%.

• Export prices increased 2.5%, the largest monthly increase in the series history.

• Higher prices for industrial supplies were a key driver of the increases for both export and import prices, signaling continued manufacturing recovery.

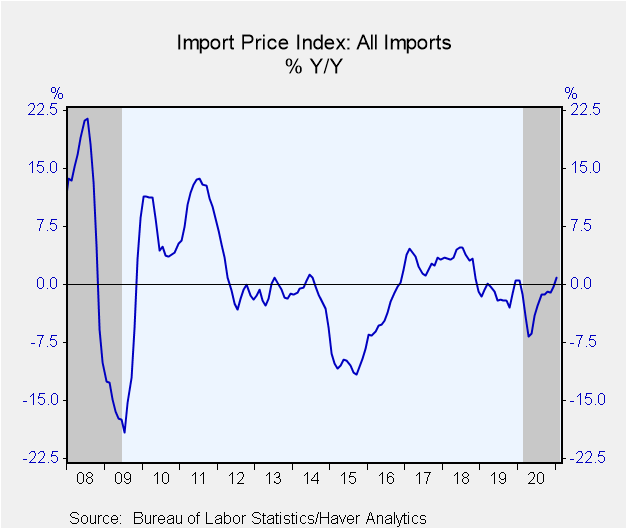

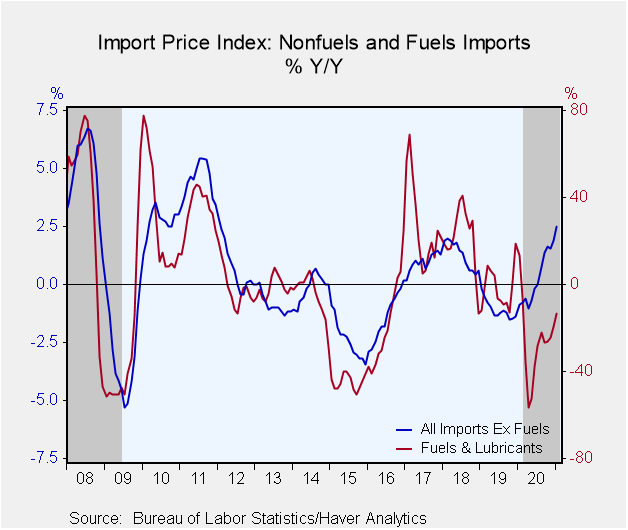

Import prices increased a larger-than-expected 1.4% m/m (0.9% y/y) in January on top of an upwardly revised 1.0% m/m gain in December (initially +0.9%). The Action Economics Forecast Survey anticipated a 1.0% m/m gain in January. Both higher fuel and nonfuel prices contributed to the increases in January and December. The 0.9% y/y increase was the first yearly increase since January 2020. Imported fuel prices posted another outsized gain in January, rising 7.4% m/m (-13.4% y/y) on top of an upwardly revised 8.1% m/m rise in December. Nonfuel prices rose 0.8% m/m (+2.5% y/y) in January, their largest monthly rise since April 2011, after a 0.4% m/m increase in December. The rise in import prices was widespread, reflecting higher prices for nonfuel industrial supplies and materials (4.2% m/m); foods, feeds, and beverages (2.1% m/m); capital goods (0.2% m/m); and automotive vehicles (0.2% m/m). Of the major end-use categories, only prices of imported consumer goods posted a monthly decline (-0.1% m/m). These figures are not seasonally adjusted and do not include import duties.

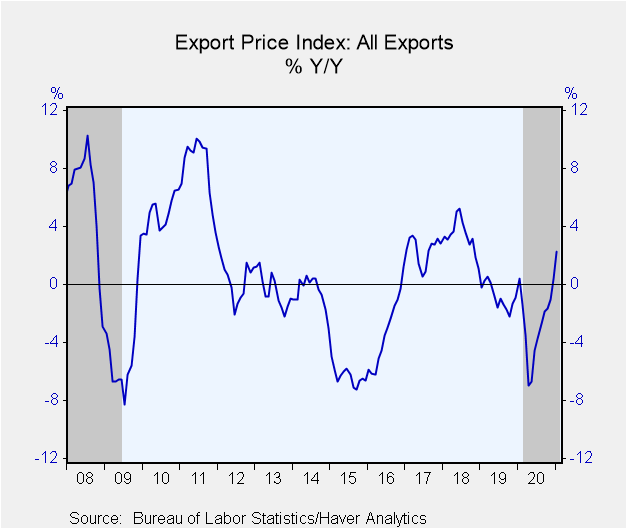

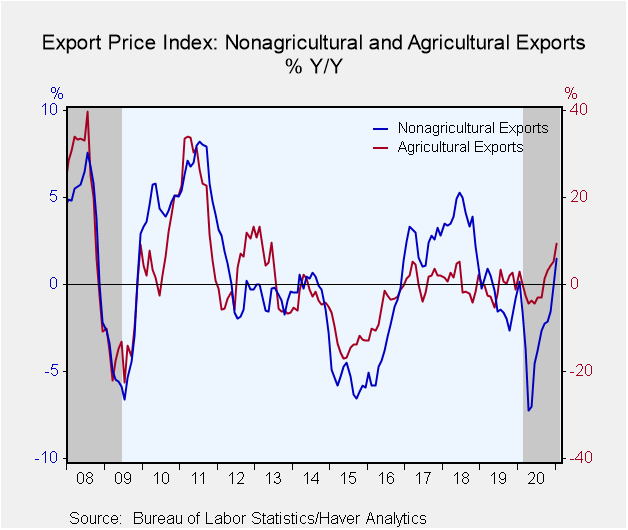

Export prices jumped up 2.5% m/m (2.3% y/y) in January, their largest monthly increase in the series dating back to 1989, on top of an upwardly revised 1.3% m/m gain in December (initially +1.1%). The Action Economics Forecast Survey anticipated only a 0.6% m/m increase in January. Both agricultural and nonagricultural prices contributed to the January gain. Agricultural prices rose 6.0% m/m (9.4% y/y), their largest monthly increase since July 2012. The 9.4% y/y rise was the largest since June 2013. Higher prices for soybeans, corn, wheat, cotton, meat, fruit, vegetables, and nuts all contributed to the January advance. Prices of nonagricultural exports advanced 2.2% m/m (1.5% y/y) in January, the largest monthly increase in the series history. The January gain was driven by higher prices for nonagricultural industrial supplies and materials (6.0% m/m); capital goods (0.1% m/m); and automotive vehicles (0.3% m/m) which more than offset declining consumer goods prices (-0.7% m/m).

The import and export price series can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database.

| Import/Export Prices (NSA, %) | Jan | Dec | Nov | Jan Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | 1.4 | 1.0 | 0.1 | 0.9 | -2.5 | -1.3 | 3.1 |

| Fuels | 7.4 | 8.1 | 4.4 | -13.4 | -27.8 | -2.1 | 20.8 |

| Nonfuels | 0.8 | 0.4 | -0.2 | 2.5 | 0.3 | -1.1 | 1.3 |

| Exports - All Commodities | 2.5 | 1.3 | 0.7 | 2.3 | -2.8 | -0.9 | 3.4 |

| Agricultural | 6.0 | 0.9 | 3.5 | 9.4 | -0.3 | -0.4 | 0.6 |

| Nonagricultural | 2.2 | 1.3 | 0.5 | 1.5 | -3.0 | -0.9 | 3.7 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.