Global| Jun 16 2021

Global| Jun 16 2021U.S. Import and Export Prices Surged in May

by:Sandy Batten

|in:Economy in Brief

Summary

• May increases significantly exceeded expectations with upward revisions to April. • Highest y/y advance for export prices in series history, led by agricultural prices. • Higher fuel prices a major factor behind rise in import [...]

• May increases significantly exceeded expectations with upward revisions to April.

• Highest y/y advance for export prices in series history, led by agricultural prices.

• Higher fuel prices a major factor behind rise in import prices.

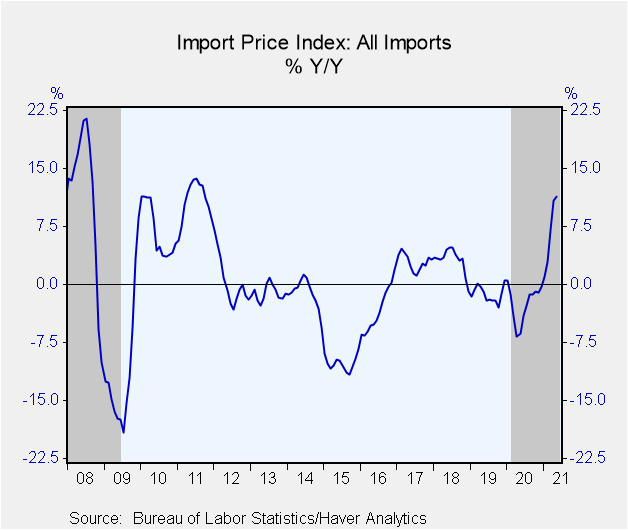

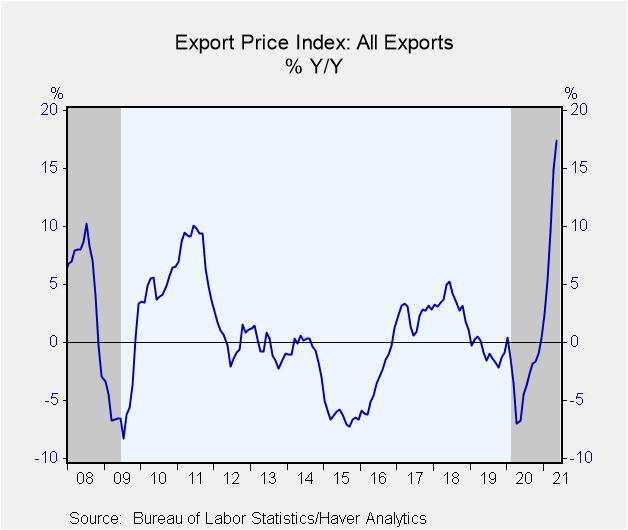

Import and export prices surged in May. Export prices jumped 2.2% m/m (17.4% y/y) after an upwardly revised 1.1% m/m increase in April (initially 0.8% m/m). Import prices rose 1.1% m/m (11.3% y/y) in May versus an upwardly revised 0.8% m/m gain in April (initially 0.7%). The 17.4% y/y gain in export prices was the largest in the series history, dating back to 1983. The previous high was the 14.9% y/y increase in April. The 11.3% y/y rise in import prices was the largest since September 2011. The Action Economics Forecast survey had looked for both export and import prices to increase 0.8% m/m in May.

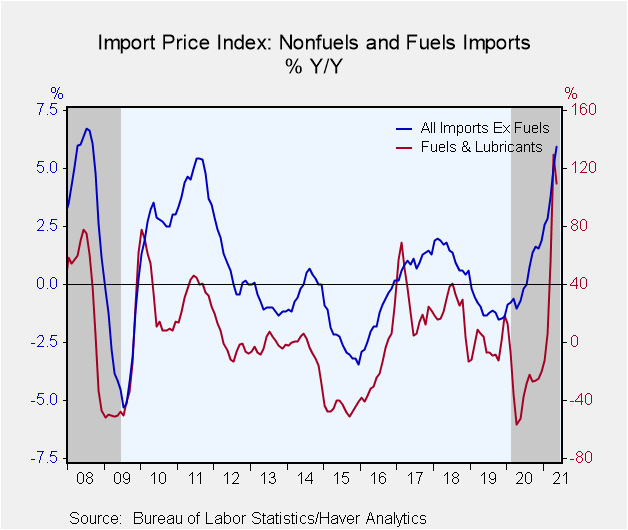

Prices of imported fuel rose 4.0% m/m (109.6% y/y) in May following a 1.6% advance in April. Price increases for petroleum and natural gas drove both the May increase and the 12-month advance. Petroleum prices increased 3.8% m/m (114.8% y/y) in May, after rising 2.2% m/m in the previous month. The price index for natural gas rose 7.8% m/m (64.1% y/y) in May following a 10.4% monthly drop in April. Nonfuel import prices increased 0.9% m/m (6.0% y/y) in May, due mostly to higher prices for nonfuel industrial supplies and materials (4.9% m/m). Prices of food, feeds and beverages declined 0.4% m/m in May following a 2.3% jump in April and a 2.1% increase in March.

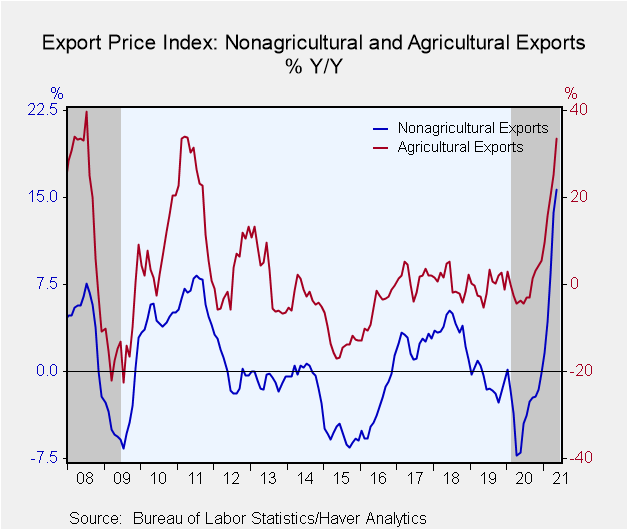

The 2.2% m/m jump in export prices in May was the sixth consecutive month in which export prices have increased more than 1.0%. Higher prices for nonagricultural and agricultural exports each contributed to the overall advance in May. The price index for agricultural exports rose 6.1% m/m (33.6% y/y) in May following a 0.6% m/m increase in the previous month. The May advance was the largest monthly rise since the index increased 7.6% m/m in November 2010. The 33.6% y/y increase was the largest since April 2011 In May, the rise in agricultural prices was driven by an 11.1% m/m rise in soybean prices, a 27.5% m/m increase in corn prices, and an 18.8% m/m advance in wheat prices.

Nonagricultural export prices advanced 1.7% m/m (15.7% y/y) percent in May, after rising 1.2% m/m in April. The y/y gain was the largest in the series history dating back to 1985. The May increase was driven by higher prices for nonagricultural industrial supplies and materials (4.1% m/m) and consumer goods (0.6% m/m), which more than offset lower prices for automotive vehicles (-0.3% m/m) and nonagricultural foods (-0.9% m/m).

The import and export price series can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database.

| Import/Export Prices (NSA, %) | May | Apr | Mar | May Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | 1.1 | 0.8 | 1.5 | 11.3 | -2.5 | -1.3 | 3.1 |

| Fuels | 4.0 | 1.6 | 7.8 | 109.6 | -27.8 | -2.1 | 20.8 |

| Nonfuels | 0.9 | 0.7 | 0.9 | 6.0 | 0.3 | -1.1 | 1.3 |

| Exports - All Commodities | 2.2 | 1.1 | 2.5 | 17.4 | -2.8 | -0.9 | 3.4 |

| Agricultural | 6.1 | 0.6 | 2.5 | 33.6 | -0.3 | -0.4 | 0.6 |

| Nonagricultural | 1.7 | 1.2 | 2.5 | 15.7 | -3.0 | -0.9 | 3.7 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.