Global| Feb 17 2021

Global| Feb 17 2021U.S. Industrial Production Beats Expectations in January

by:Sandy Batten

|in:Economy in Brief

Summary

• Production up 0.9%, more than twice expectations. • Led by a 1.0% m/m gain in manufacturing output; motor vehicle output down for fifth month of past six. • Manufacturing output only 1% below pre-pandemic level. Industrial [...]

• Production up 0.9%, more than twice expectations.

• Led by a 1.0% m/m gain in manufacturing output; motor vehicle output down for fifth month of past six.

• Manufacturing output only 1% below pre-pandemic level.

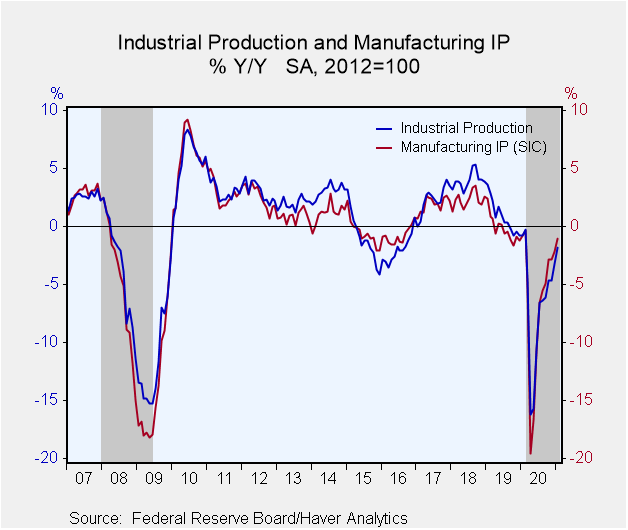

Industrial production increased 0.9% m/m (-1.8% y/y) in January. The Action Economics Forecast Survey had expected a more modest 0.4% m/m gain. Manufacturing output rose 1.0% m/m (-1.0 y/y), about the same as its average gain over the previous five months. Mining production advanced 2.3% m/m (-11.5% y/y), while the output of utilities declined 1.2% m/m (+6.6% y/y).

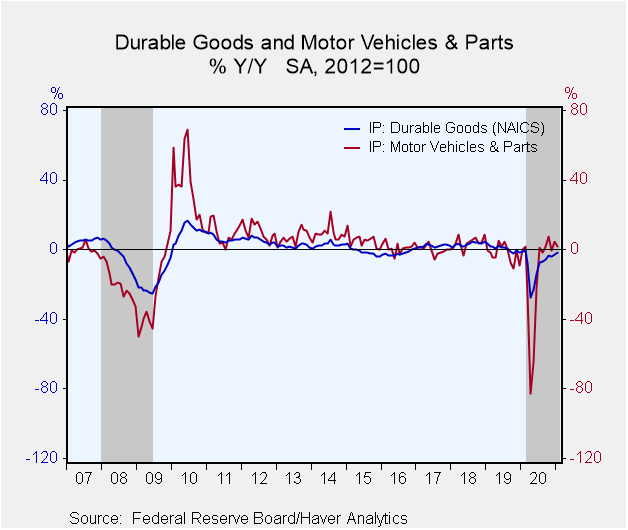

Durable manufacturing advanced 0.9% m/m (-1.4% y/y) in January while nondurable manufacturing recorded a stronger advance of 1.2% m/m (-0.2% y/y). Among durables, the largest gain was posted by primary metals (3.9% m/m), while the only declines were posted by nonmetallic mineral products (-1.8% m/m) and by motor vehicles and parts (-0.7% m/m). The output of motor vehicles was reportedly held down by a global shortage of semiconductors used in vehicle components. Most nondurable sectors recorded growth rates in the 1% to 2% range. The only exceptions were the indexes for paper (-0.7% m/m) and for printing and support (-0.6% m/m).

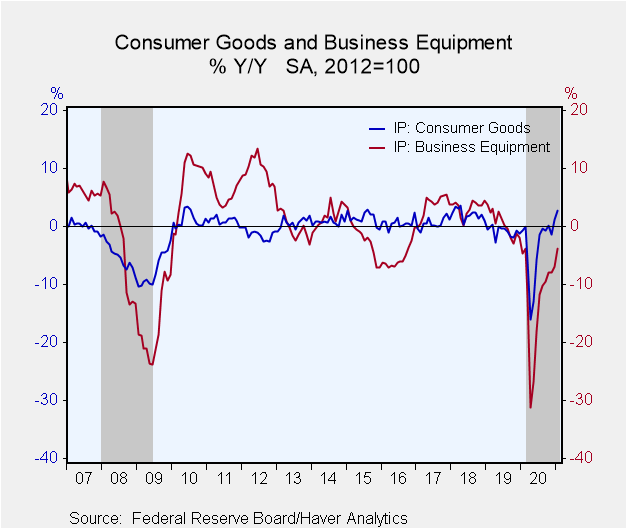

Most market groups posted gains in January, with the only noteworthy declines coming for consumer paper products (-1.4% m/m), paper materials (-0.8% m/m), transit equipment (-0.6% m/m), information processing equipment (-0.6% m/m), and consumer energy products (-0.5% m/m). Materials recorded large gains (+1.3% m/m), with increases of 1.2%-1.3% m/m for each of its major components.

Total industrial production has yet to return to its pre-pandemic levels of early last year. In January, the indexes for about half of the market groups were still below their year-earlier readings. Notably, weakness in the oil patch during most of last year has left the production of energy materials 6.2% below its level of twelve months earlier.

The output of utilities fell 1.2% m/m in January, largely because of a 5.7% m/m drop in output of natural gas utilities. The index for mining jumped 2.3% m/m. Oil and gas well drilling continued its climb with an advance of 11.3% m/m, though it remains 50.5% percent below its year-earlier level. A 1.3% m/m increase in oil and natural gas extraction also contributed significantly to the gain for mining in January.

Output of selected high technology equipment rose 1.5% m/m (6.8% y/y) in January, more than reversing the 0.4% m/m decline in December. Excluding these products, overall production expanded 0.9% m/m (-2.0% y/y). Excluding both high tech products & motor vehicles, factory production rose 1.1% m/m (-1.5% y/y).

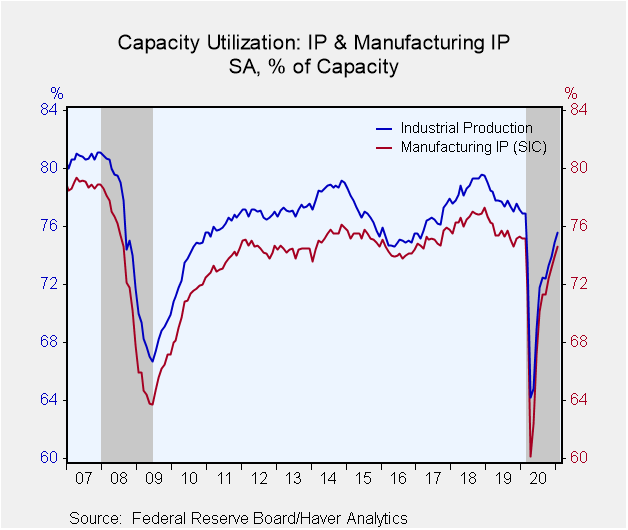

Capacity utilization for the industrial sector increased 0.7%-point in January to 75.6%. Factory sector utilization also rose to 0.7%-point 74.6%, its highest point since February 2020 and only 0.6%-point below its pre-pandemic level.

Industrial production and capacity are located in Haver's USECON database. Additional detail on production and capacity can be found in the IP database. The expectations figures come from the AS1REPNA database.

| Industrial Production (SA, % Change) | Jan | Dec | Nov | Jan Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total Output | 0.9 | 1.3 | 0.9 | -1.8 | -6.6 | 0.9 | 3.9 |

| Manufacturing | 1.0 | 0.9 | 1.0 | -1.0 | -6.5 | -0.2 | 2.3 |

| Durable Goods | 0.9 | 0.8 | 1.4 | -1.4 | -8.6 | 0.7 | 3.4 |

| Motor Vehicles | -0.7 | -0.2 | 4.1 | 1.7 | -15.1 | -2.4 | 4.1 |

| Selected High Tech | 1.5 | -0.4 | 0.3 | 6.8 | 4.4 | 5.1 | 6.4 |

| Nondurable Goods | 1.2 | 1.1 | 0.8 | -0.2 | -3.9 | -0.7 | 1.9 |

| Utilities | -1.2 | 4.9 | -3.1 | 6.6 | -2.5 | -0.8 | 4.4 |

| Mining | 2.3 | 0.7 | 3.4 | -11.5 | -10.3 | 7.1 | 12.4 |

| Capacity Utilization (%) | 75.6 | 74.9 | 73.9 | 76.9 | 72.0 | 77.8 | 78.7 |

| Manufacturing | 74.6 | 73.9 | 73.2 | 75.2 | 70.3 | 75.6 | 76.6 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.