Global| May 21 2008

Global| May 21 2008U.S. Inflation Pressures -- Demand-Pull, Cost-Push & Money

by:Tom Moeller

|in:Economy in Brief

Summary

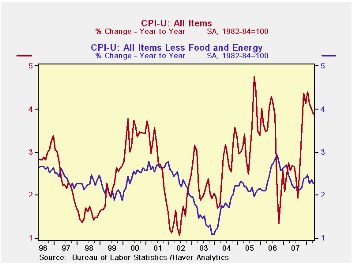

Worry abounds that inflationary pressure has built in the U.S. Indeed, the Consumer Price Index rose 4.5% at an annual rate during the last six months versus a 2.9% increase during all of last year. Typically, however, underlying [...]

Worry abounds that inflationary pressure has built in the U.S. Indeed, the Consumer Price Index rose 4.5% at an annual rate during the last six months versus a 2.9% increase during all of last year. Typically, however, underlying price pressures do not build overnight.

It's handy to look at the "core" CPI to gauge those underlying pressures, and the news is not bad. The 2.2% rate of six month increase in core prices is down from a 2.3% rise last year. Though this simple measure does approximate what rate price inflation will return to after some short term shock has passed, it also misses the underlying process that generates longer-lived price pressure.

Real worry about pricing power should focus on pressure from

any one of three fronts, the first is from demand-pull forces.

They can be thought of as how fast is economic growth, on a medium term

five year basis, exceeding its potential? The latter is measured by

adding labor productivity growth to the growth in the labor force.

From this perspective, there has been little buildup of price pressure. Productivity growth during the last five years averaged 2.3%. When added to the 1.0% growth in the labor force that's generating the productivity, the resulting potential for overall real economic growth of 3.3% even exceeds slightly the 2.9% GDP growth rate averaged during the past five years.

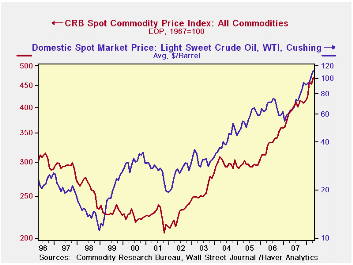

The second source of potential pressure is from cost-push pressures. Here is where current concerns about inflation are rampant. Commodity prices have shot higher with surging prices for energy, foods and metals. Overall these components account for a quarter to one third of a product's retail price with the rest coming from processing and distribution. As an aside, these increases have been quite sufficient to squash corporate profitability. The recent 2.4% year-to-year growth rate profits, as of 4Q08, is well off the 24.0% rise during 2004 and well off the double digit gains logged during the last five consecutive years. During the last two quarters, profits have fallen at an average 8.7% annual rate. With a few exceptions, that's a decline of recession proportion.

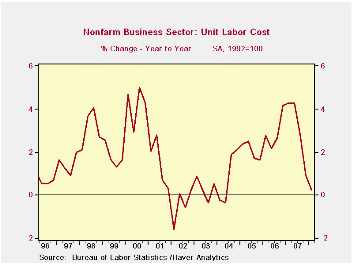

And indeed, labor costs have risen as shown by 5.0% growth in

compensation last year which was up from 4.0% growth during the prior

several years. But again, workers seem to have earned the higher pay by

working more productively. Nonfarm productivity grew 3.2% during the

last four quarters versus 1.8% growth last year and 1.0% in 2006. That

improvement limited the growth in unit labor costs to 0.2% during the

last year, down from 3.0% in 2006 and 2007.

But whether costs get passed along to consumers, and

sustained, depends on two things. The first is whether the economy is

strong enough to support faster price increases. The recent slowdown in

economic growth to 0.6% (AR) during the last two quarters is well off

the 2.0-3.5% growth averaged during the last five years. While the

forecast for growth from the National Association for Business

Economists projects improvement during the next year, it doesn't ramp

up to a barely inflation-neutral 2.7% rate until 2Q09. Additionally,

global forces need examination and growth is up slightly. In the OECD

economic growth during the last ten years averaged 2.6%. Last year it

was a slightly quicker 2.8% and was 3.1% in 2006. The nature of the

global relationship between growth and prices is examined in Globalization,

Aggregate Productivity, and Inflation from the

Federal Reserve Bank of Dallas.

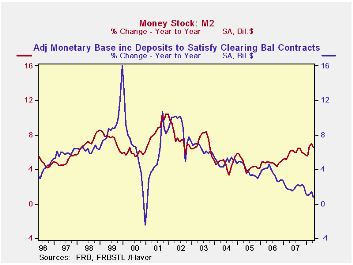

The third, and probably the more important, factor which will determine price inflation (with a lag) is liquidity growth, i.e., money. The basics behind this relationship are examined in this 1976 paper from the Federal Reserve Bank of St. Louis and the recent picture should not be disturbing. Narrowly defined money (M2) in the U.S. during the last year did grow 6-6.5% and it was enough to raise the three year growth rate to 5.5%. That was up moderately from 4.2% as of 3Q06 but still well below 8% growth back in 2003. Growth in bank reserves has been even weaker. The St. Louis Fed's adjusted monetary base last year grew 1.2% and 2.4% on a three year basis, well below the 6-8% rates of growth earlier this decade. Finally, non-borrowed bank reserves fell 3.1% last year. The liquidity to fuel higher prices just seems not to be there.

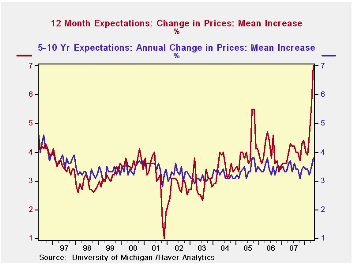

Despite any good news about the prospect that inflation will

remain contained, consumer's aren't buying it ... for the time being.

The University of Michigan's May survey indicated that the expected

twelve month rate of consumer price inflation rose to 7.0% from a low

of roughly 4.0% from 2005-2007. Yet expectations for the five to ten

year rate of inflation rose much more moderately, to 3.8% from lows in

the 3.0-3.5% range earlier this decade.

Is it possible that the U.S. consumer's long term price expectations reflect the potential suggested by the demand-pull and the liquidity forces outlined above and that the short term expectations are formed by the cost-push pressures? In a word; probably. After all, the consumer has been called "rational." With luck the current expectations are right.

The data behind the comments above can be found in Haver's USECON,

USWEEKLY, SURVEYS, UMSCA (Michigan Survey) and the OECDMEI

databases.

The minutes to the latest FOMC meeting can be found here.

The Federal Funds Rate in Extraordinary Times is today's speech by Fed Governor Kevin Warsh and it is available here.

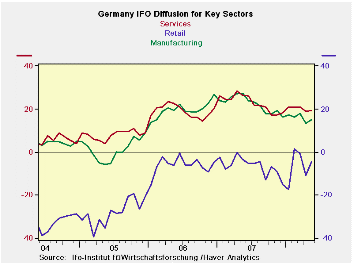

Germany’s IFO in Surprise Riseby Robert BruscaMay 21, 2008

Germany continues to show resilience even in the face of weak reports it has issued. Here is a reversal that fits in with the strong 2008-Q1 GDP that Germany reported. Not surprisingly this report also boosted the euro. Oddly with this rebound in hand the stronger GDP behind us the IFO’s Gernot Nerb declares autumn as the proper time for the ECB to cut rates. With Germany showing such ‘strength’ and with inflation pressures swirling and engulfing even core inflation measures why should the ECB do any such thing, let alone ponder it?

IFO measures remain at firm level in their respective ranges since 1991. The total index is in the 75th percentile of its range and most readings are in the 70s in terms of percentile readings. Wholesaling is a bit weaker and services sports a percentile reading that is pushing the 80th percentile (79.4). All sector readings also are well above their averages since 1991. The monthly rebound in May is robust and spans alls sectors except construction.

So is Germany recovering now? Is it merely cutting the losses from last month? Where does it stand?

Clearly the Nerb comments view this as a bit of a wry smile in the land of bad jokes. The improvement is not expected to continue if he is calling for an ECB rate cut buy August. But any continued strength could be a greater conduit for inflation pressures in the meantime. Those pressures clearly still are dogging the EMU economy. Granted that Germany is the strongest economy of all of these, and still it has the best inflation record. Those weaker economies in EMU have been pushing higher inflation results for some time. On the whole that growth/inflation mix remains a nettlesome problem for the ECB to attack.

The rise in the euro to a new one-month high Vs the dollar is telling. This report has shattered a paradigm that was in place. We cannot be sure how much staying power this monthly rise really has. But the Zew financial experts also saw it and flagged it correctly. Looking back at history it is hard to see how Germany and the rest of EMU can do well with such a strong euro value – looking at it in trade-weighted and inflation-adjusted terms. Orders data have been withering too. There are signs that weakness is still the operative trend.

The April diffusion reading from the IFO was the lowest since January of 2006. Plus it represents a sharp 4.7 point drop from its March value. The drop in March was the largest overall index drop since Sept of 2001. Even with the rebound in May, weakness shows though. May can be viewed as technical rebound and as still preserving the down-trend that has been put in place for the IFO barometer. But for the moment the outlook is confused enough to have boosted the euro FX rate. That strength is not going to be able to last either. But a stronger Germany makes the ECB more wary of rate-cutting and that, in turn, gives the stronger euro some fundamental support, at least for a while.

| Summary of IFO Sector Diffusion readings: CLIMATE | ||||||||

|---|---|---|---|---|---|---|---|---|

| CLIMATE Sum | Current | Last Mo | Since Jan 1991* | |||||

| May-08 | Apr-08 | Average | Median | Max | Min | range | % range | |

| All Sectors | 6.2 | 4.0 | -6.8 | -10.0 | 16.7 | -26.4 | 43.1 | 75.6% |

| Manufacturing | 15.0 | 13.3 | 3.5 | 3.5 | 27.4 | -22.7 | 50.1 | 75.2% |

| Construction | -20.3 | -20.0 | -33.4 | -39.2 | -8.0 | -50.5 | 42.5 | 71.1% |

| Wholesale | 4.0 | 1.6 | -10.6 | -15.7 | 23.4 | -39.4 | 62.8 | 69.1% |

| Retail | -4.4 | -10.9 | -20.3 | -19.6 | 1.3 | -39.7 | 41.0 | 86.1% |

| Services | 19.4 | 18.9 | 9.8 | 9.0 | 28.5 | -15.7 | 44.2 | 79.4% |

| * May 2001 for Services | ||||||||

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates