Global| Dec 19 2019

Global| Dec 19 2019U.S. Initial Claims for Unemployment Insurance Ease by 18,000

Summary

Initial claims for unemployment insurance decreased 18,000 in the week ended December 14 to 234,000 (+6.4% y/y) from the prior week's 252,000, which was unrevised. The Action Economics Forecast Survey expected a somewhat larger [...]

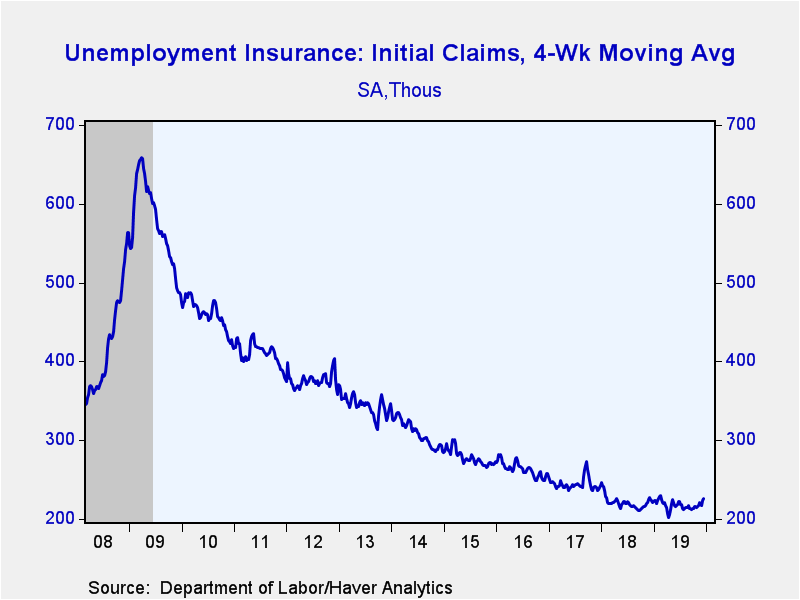

Initial claims for unemployment insurance decreased 18,000 in the week ended December 14 to 234,000 (+6.4% y/y) from the prior week's 252,000, which was unrevised. The Action Economics Forecast Survey expected a somewhat larger decline to 222,000 claims. The four-week moving average of initial claims rose to 225,500 from 224,000.

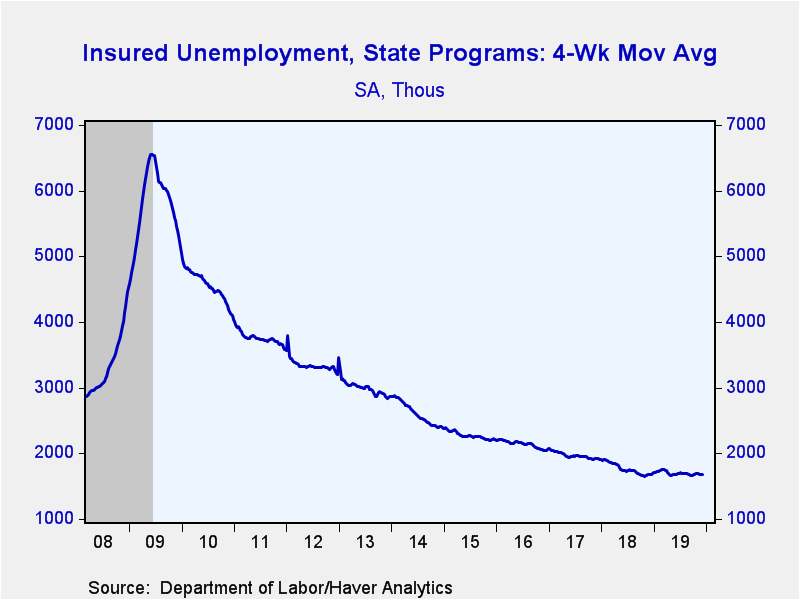

Continuing claims for unemployment insurance in the week ended December 7 rose 51,000 to 1.722 million (+1.3% y/y). The November 30 figure was revised up 4,000 to 1.671 million. The four-week moving average of claimants edged upward to 1.684 million.

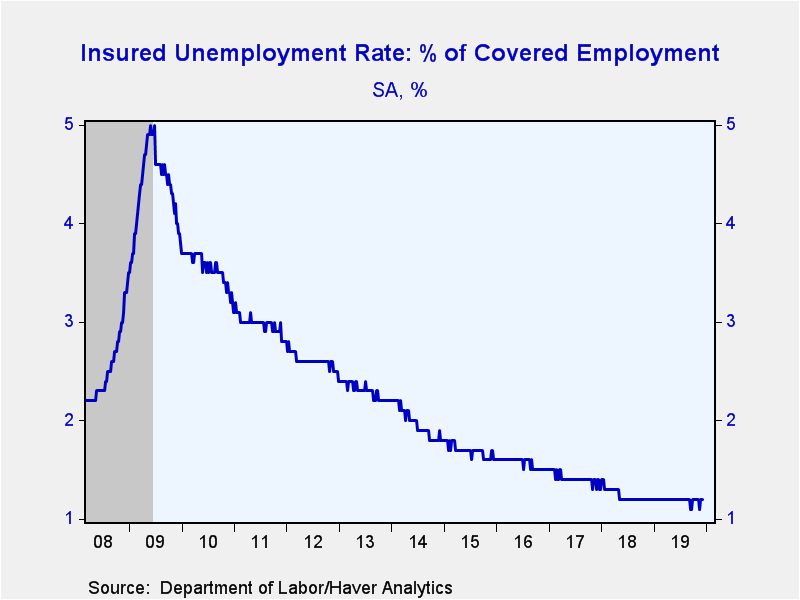

The insured rate of unemployment remained at 1.2% in the week of December 7. Except for two weeks in September and one week in mid-November, when the rate was at 1.1%, it has been 1.2% since May 2018.

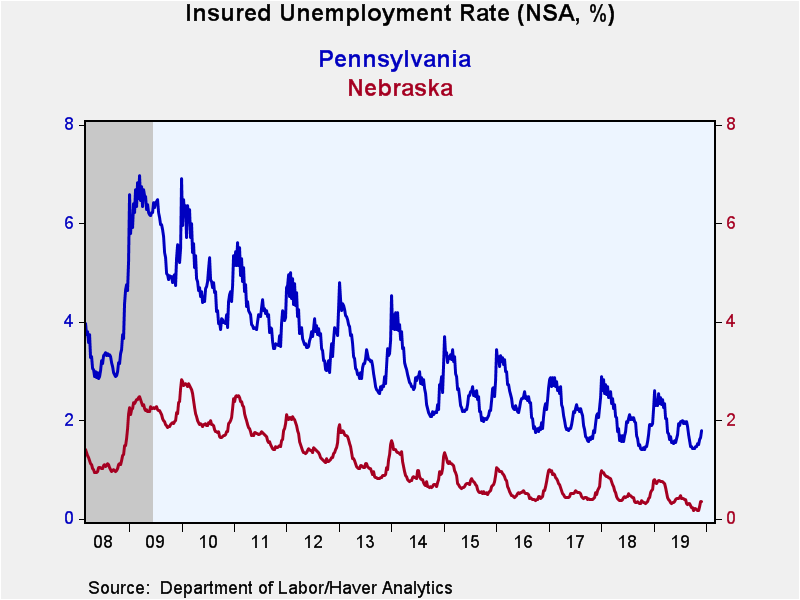

Insured unemployment rates vary widely by state. During the week ending November 30, the lowest rates were in Nebraska (0.36%), South Dakota (0.41%), Florida and North Carolina (0.45%), and New Hampshire (0.50%). The highest rates were in California (1.90%), Montana (1.96%) West Virginia (2.09%), New Jersey (2.19%), and Alaska (3.11%). Among the other largest states by population not mentioned above the rate was 1.12% in Texas, 1.49% in New York and 1.79% in Pennsylvania. These state data are not seasonally adjusted, thus Alaska has particularly large seasonal swings in insured rates of unemployment.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 12/14/19 | 12/07/19 | 11/30/19 | Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 234 | 252 | 203 | 6.4 | 220 | 244 | 262 |

| Continuing Claims | -- | 1,722 | 1,671 | 1.3 | 1,756 | 1,961 | 2,135 |

| Insured Unemployment Rate (%) | -- | 1.2 | 1.2 |

1.2 |

1.2 | 1.4 | 1.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates