Global| Sep 12 2019

Global| Sep 12 2019U.S. Initial Claims for Unemployment Insurance Fall; Labor Day Holiday and Hurricane Create Challenges

Summary

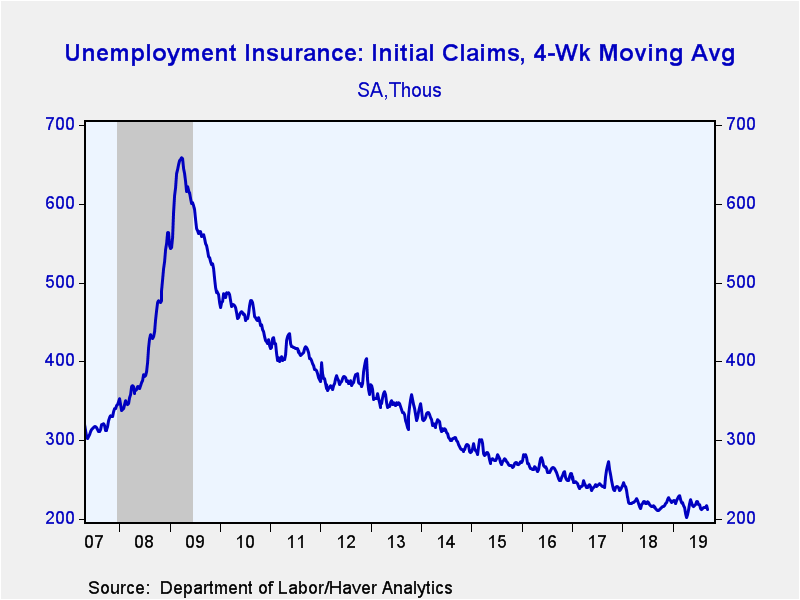

Initial claims for unemployment insurance fell 15,000 to 204,000 (-1.9% year-on-year) during the week ending September 7 from a slightly upwardly-revised reading of 219,000 in the previous week (was 217,000). This is the lowest level [...]

Initial claims for unemployment insurance fell 15,000 to 204,000 (-1.9% year-on-year) during the week ending September 7 from a slightly upwardly-revised reading of 219,000 in the previous week (was 217,000). This is the lowest level of claims since mid-April when they hit a 50-year low of 193,000. However, this week included the Labor Day holiday when seasonal adjustment and reporting challenges make this data more difficult to interpret. Moreover, Hurricane Dorian may have lowered filing rates in affected areas -- initial claims declined in Florida, Georgia, and North Carolina (in both not seasonally adjusted and Haver Analytics seasonally adjusted data). The Action Economics Forecast Survey expected overall claims of 215,000. The four-week moving average of initial claims declined to 212,500 from 216,750.

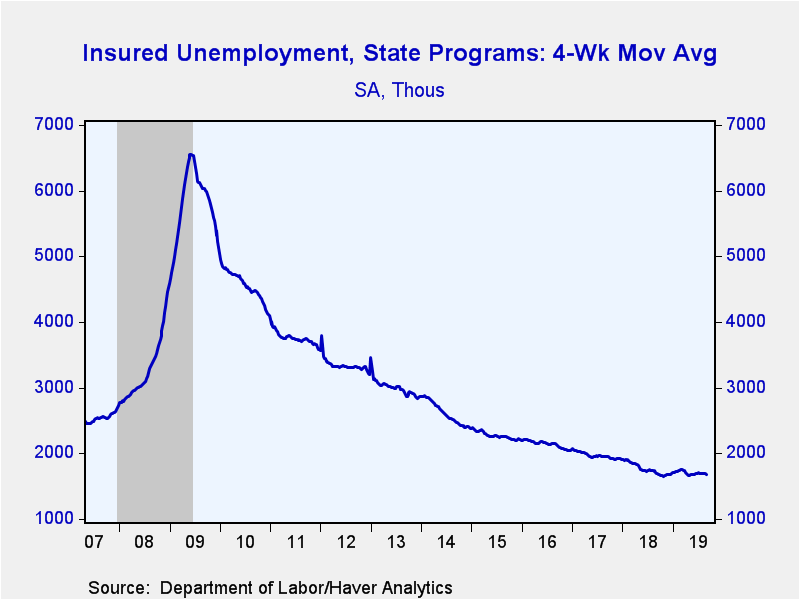

Continuing claims for unemployment insurance decreased 4,000 to 1.670 million (-2.1% y/y) in the week ending August 31, from an upwardly-revised 1.674 million in the prior week. The four-week moving average of claimants declined to 1.680 million from 1.695 million.

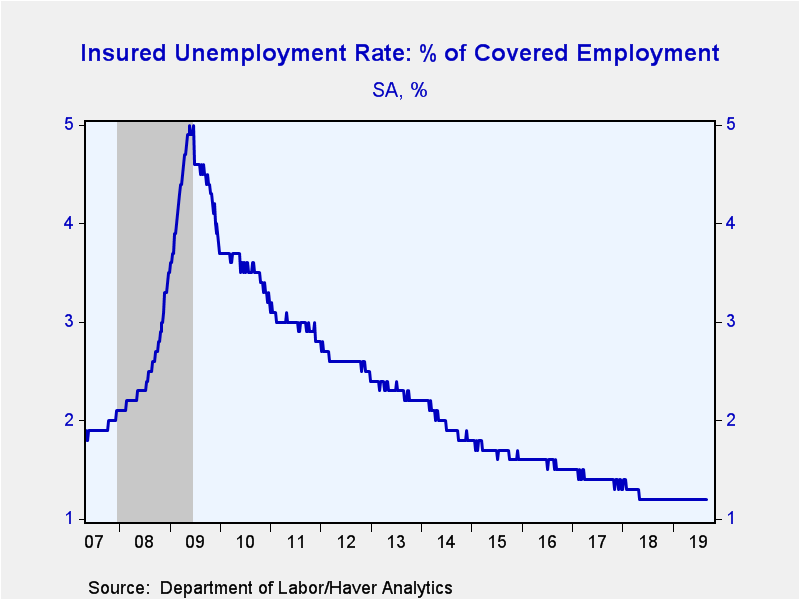

The insured rate of unemployment remained at the record low 1.2%, where it has been since May 2018. Data on the insured unemployment rate go back to 1971.

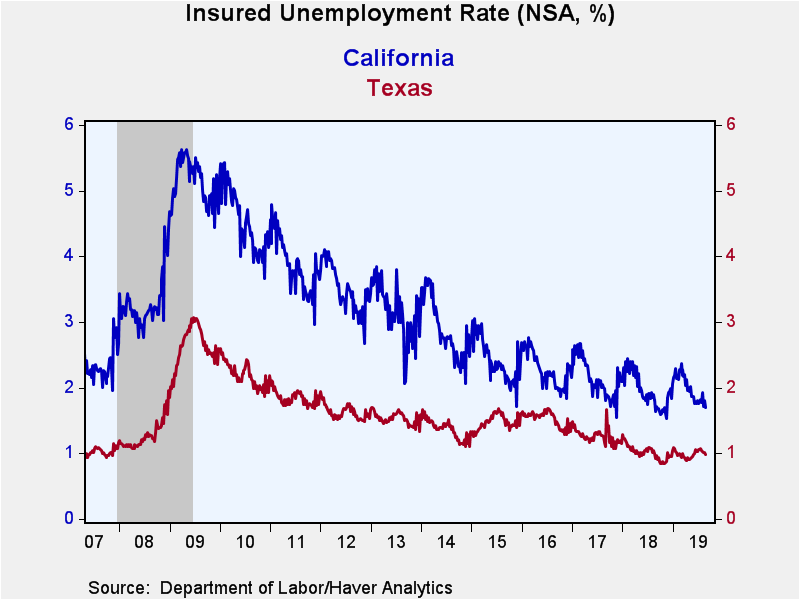

Insured rates of unemployment vary widely by state. During the week ending August 24, the lowest rates were in South Dakota (0.21%), Nebraska (0.29%), Utah (0.41%), Indiana (0.44%), and North Carolina (0.45%). The highest rates were in California (1.70%), Rhode Island (1.78%), Pennsylvania (1.87%), Connecticut (2.14%), and New Jersey (2.37%). Among the other largest states by population not mentioned above the rate was 0.98% in Texas, 0.48% in Florida, and 1.47% in New York. These state data are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 09/07/19 | 08/31/19 | 08/24/19 | Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 204 | 219 | 216 | -1.9 | 220 | 244 | 262 |

| Continuing Claims | -- | 1,670 | 1,674 | -2.1 | 1,756 | 1,961 | 2,135 |

| Insured Unemployment Rate (%) | -- | 1.2 | 1.2 |

1.2 |

1.2 | 1.4 | 1.6 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates