Global| Feb 01 2018

Global| Feb 01 2018U.S. Initial Claims for Unemployment Insurance Little Changed

Summary

Initial unemployment insurance applications edged down to 230,000 (-8.0% y/y) during the week ended January 27 from 231,000 claims in the prior week, revised from 233,000. Expectations in the Action Economics Forecast Survey had been [...]

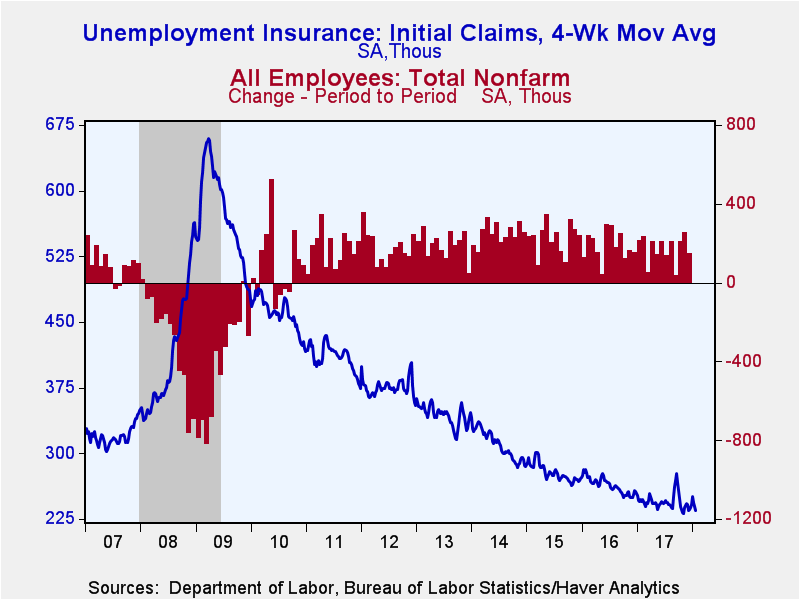

Initial unemployment insurance applications edged down to 230,000 (-8.0% y/y) during the week ended January 27 from 231,000 claims in the prior week, revised from 233,000. Expectations in the Action Economics Forecast Survey had been for a modest increase to 235,000 claims. The four-week moving average fell to 234,500. During the last ten years, there has been a 74% correlation between the level of initial claims and the m/m change in nonfarm payrolls.

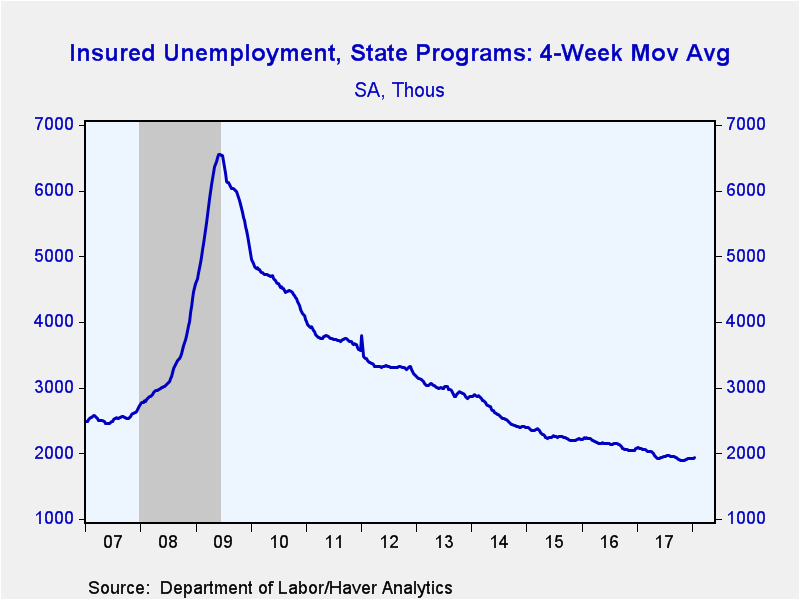

In the week ended January 20, continuing claims for unemployment insurance increased to 1.953 million (-5.3% y/y) from 1.940 million. The four-week moving average of claimants rose to 1.933 million.

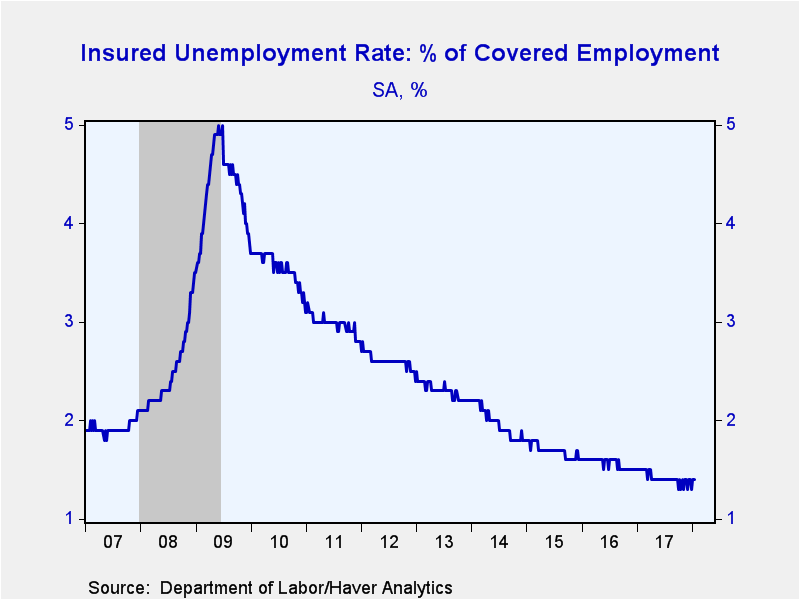

The insured rate of unemployment held steady at 1.4%.

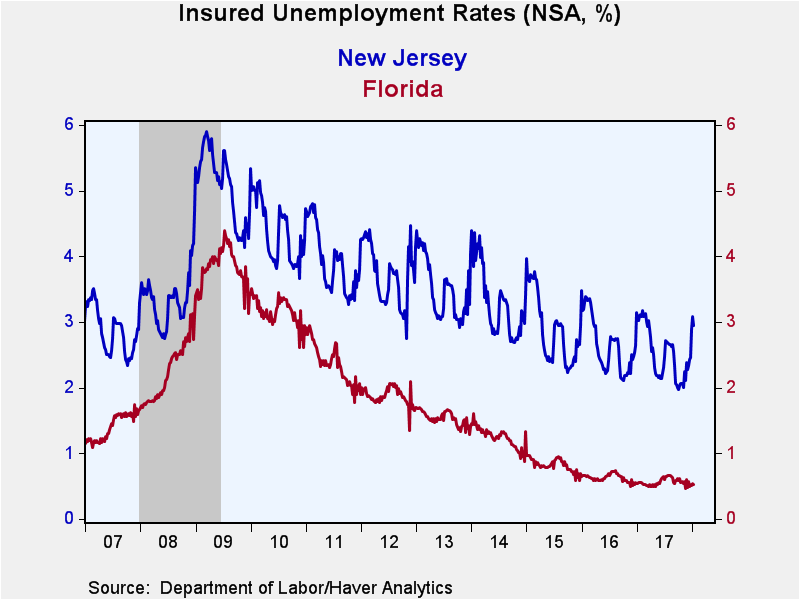

Insured rates of unemployment varied widely by state. During the week ended January 13, the lowest rates were in several southern states: Florida (0.52%), North Carolina (0.54%), Georgia (0.75%), and Tennessee (0.76%); Indiana was fifth lowest (0.77%). Alaska was again the high (4.02%); next were New Jersey (2.95%), Montana (2.77%), Connecticut (2.70%) and Pennsylvania (2.61%). These state data are not seasonally adjusted.

Data on weekly unemployment insurance are contained in Haver's WEEKLY database and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 01/27/18 | 01/20/18 | 01/13/18 | Y/Y % | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 230 | 231 | 216 | -8.0 | 245 | 263 | 278 |

| Continuing Claims | -- | 1,953 | 1 ,940 | -5.3 | 1,962 | 2,136 | 2,267 |

| Insured Unemployment Rate (%) | -- | 1.4 | 1.4 |

1.5 |

1.4 | 1.6 | 1.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.