Global| Jun 05 2014

Global| Jun 05 2014U.S. Initial Unemployment Insurance Claims Are Near 2007 Low

by:Tom Moeller

|in:Economy in Brief

Summary

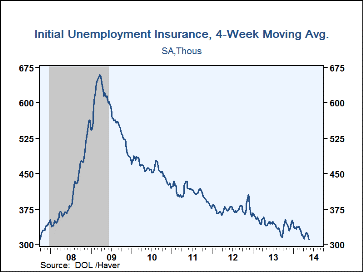

Initial claims for jobless insurance nudged up to an expected 312,000 in the week ended May 31 from 304,000 in the prior week, revised from 300,000. Despite the rise, claims remained near the 2007 low. The four-week moving average of [...]

Initial claims for jobless insurance nudged up to an expected 312,000 in the week ended May 31 from 304,000 in the prior week, revised from 300,000. Despite the rise, claims remained near the 2007 low. The four-week moving average of initial claims fell to 310,250, the lowest level since June 2007. During the last ten years there has been a 75% correlation between the level of claims and the m/m change in nonfarm payrolls.

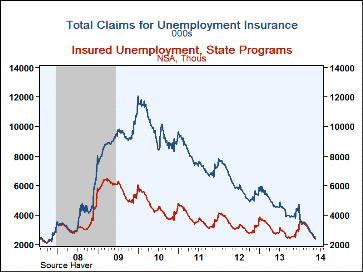

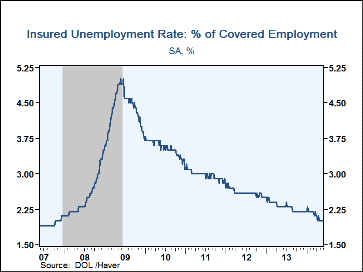

Continuing claims for unemployment insurance in the week ended May 24 decreased to 2.603 million (-12.6% y/y). The four-week moving average fell to 2.635 million, also a seven year low. The insured rate of unemployment remained at 2.0% for the fifth straight week, its cycle low. This particular count covers only "regular" programs and does not include all extended benefit and other specialized jobless insurance programs. In the week of May 17, the latest available, the total of all benefit recipients fell to 2.513 million (-45.9% y/y), also the cycle low. This broader measure is not seasonally adjusted. It compares to a cycle peak of 12.060 million in January 2010 and pre-recession figures that averaged 2.596 million in 2007. Year-on-year comparisons are impacted by the expiration of the Emergency Unemployment Compensation program at the end of 2013.

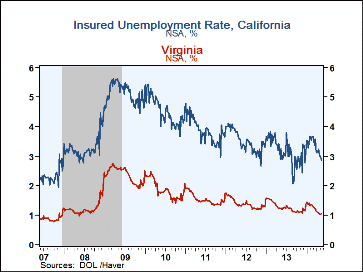

By state in the May 17th week, the insured rate of unemployment continued to vary greatly with Nebraska (0.79%), South Carolina (0.99%), Louisiana (1.02%), Virginia (1.04%), Tennessee (1.14%) and Texas (1.39%) at the low end of the range. At the high end were Illinois (2.49%), Pennsylvania (2.75%), Connecticut (2.79%), California (2.87%), New Jersey (2.94%) and Alaska (4.32%). These data are not seasonally adjusted.

Data on weekly unemployment insurance are contained in Haver's WEEKLY database and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics survey, carried in the AS1REPNA database.

| Unemployment Insurance (000s) | 05/31/14 | 05/24/14 | 05/17/14 | Y/Y % | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 312 | 304 | 327 | -10.1 | 343 | 375 | 409 |

| Continuing Claims | -- | 2,603 | 2,623 | -12.6 | 2,977 | 3,319 | 3,742 |

| Insured Unemployment Rate (%) | -- | 2.0 | 2.0 | 2.3 (5/13) |

2.3 | 2.6 | 3.0 |

| Total "All Programs" (NSA) | -- | -- | 2.513 mil. | -45.9 | 4.651 mil. | 6.049 mil. | 7.725 mil. |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.