Global| Sep 04 2014

Global| Sep 04 2014U.S. ISM Nonmanufacturing Index Shows Further Strength

by:Sandy Batten

|in:Economy in Brief

Summary

The pace of nonmanufacturing activity continued to accelerate in August with the Institute for Supply Management's (ISM) composite nonmanufacturing index rising to 59.6 from 58.7 in July. This is a diffusion index with a reading above [...]

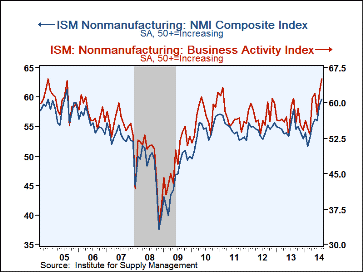

The pace of nonmanufacturing activity continued to accelerate in August with the Institute for Supply Management's (ISM) composite nonmanufacturing index rising to 59.6 from 58.7 in July. This is a diffusion index with a reading above 50 indicating expansion of nonmanufacturing activity. The July figure reflected an outsized 2.7-point jump from June. Consequently, the median expectation for August from the Action Economics Forecast Survey had looked for a small payback to 57.5. In the event, the index climbed further to its highest level since August 2005. (The ISM began calculating the composite nonmanufacturing index in January 2008. However, it published the composite index's four components prior to that. Data for the composite index prior to January 2008 were calculated by Haver Analytics from these components.) This is the fourth highest reading in the history of the Haver-constructed series.

The August gain was led by the business activity index (a gauge of nonmanufacturing production). It jumped to 65.0, its highest reading since December 2004. The new orders index slipped a bit in August, to 63.8 from 64.9 in July, but this was the highest reading in the current expansion. The employment index rose to 57.1, its highest reading of the current expansion. And the supplier deliveries index increased to 52.5.

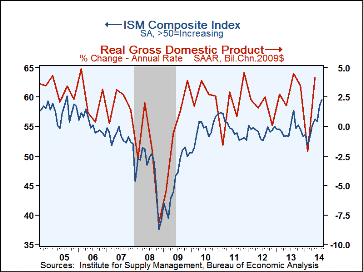

Haver Analytics calculates a weighted average of the ISM manufacturing and nonmanufacturing indexes to provide a broader view of activity across the entire economy. This weighted average rose to 59.5 in August from 58.5 in July. This is the highest reading since August 2005. Over the past ten years, there has been a 76% correlation between this weighted average index and quarterly real GDP growth. So, the recent strength of this index points to a further robust GDP growth. However, one must remember that these ISM figures are diffusion indexes. They provide a very useful and accurate indication of the breadth of economic activity, but may not be a particularly accurate gauge of the magnitude of activity. It is unlikely that the economy is currently as robust as it was in 2005. Nonetheless, it is clearly getting stronger and at a more rapid pace.

The ISM data are available in Haver's USECON database. The expectations figure from Action Economics is in the AS1REPNA database.

| ISM Nonmanufacturing Survey (SA) | Aug | Jul | Jun | Aug'13 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Composite Diffusion Index | 59.6 | 58.7 | 56.0 | 57.9 | 54.7 | 54.6 | 54.4 |

| Business Activity | 65.0 | 62.4 | 57.5 | 61.0 | 56.7 | 57.7 | 57.2 |

| New Orders | 63.8 | 64.9 | 61.2 | 59.7 | 55.9 | 56.6 | 56.3 |

| Employment | 57.1 | 56.0 | 54.4 | 56.3 | 54.4 | 53.5 | 52.4 |

| Supplier Deliveries (NSA) | 52.5 | 51.5 | 51.0 | 54.5 | 51.7 | 50.6 | 51.9 |

| Prices Index | 57.7 | 60.9 | 61.2 | 53.6 | 55.6 | 59.3 | 65.1 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.