Global| Nov 12 2020

Global| Nov 12 2020U.S. Jobless Claims Data: Initial Improves, Continuing Mixed

Summary

• State initial claims fall to their lowest level since March 14. • Federal Pandemic Unemployment Assistance declined to mid-April level. • Continuing claims decreased for state, while PUA and PEUC increase. • First time since late [...]

• State initial claims fall to their lowest level since March 14.

• Federal Pandemic Unemployment Assistance declined to mid-April level.

• Continuing claims decreased for state, while PUA and PEUC increase.

• First time since late March that all state insured rates below 10%.

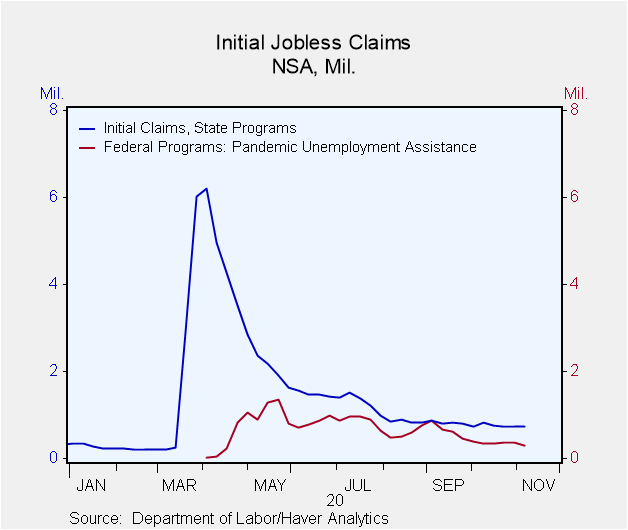

Seasonally adjusted state initial jobless claims for unemployment insurance fell to 709,000 in the week ending November 7 from an upwardly revised 757,000 in the previous week (was 751,000). This is the lowest level of claims since March 14. The Action Economics Forecast Survey anticipated 740,000. A change in the calculation of seasonal adjustment factors created a break in the series in late August. Though the current week-to-week comparison is valid, the comparison to before August 22 is not. For more details, please see the September 3 commentary on jobless claims.

The not seasonally adjusted data, which is comparable across all periods for initial claims declined to 723,105 in the week ending November 7 from an upwardly revised 743,904 (was 738,709). Haver Analytics has calculated methodologically-consistent seasonally adjusted data which matches the Department of Labor seasonally adjusted data since the late-August break. Both the not seasonally adjusted and Haver seasonally adjusted series are also at their lowest level since March 14.

Claims for the federal Pandemic Unemployment Assistance (PUA) program, which covers individuals such as the self-employed who are not qualified for regular/state unemployment insurance, dropped to 298,154, This is the lowest since April 18. Data for this program only goes back to April 4 and initial processing backlogs make comparisons to the early figures challenging. Numbers for this and other federal programs are not seasonally adjusted.

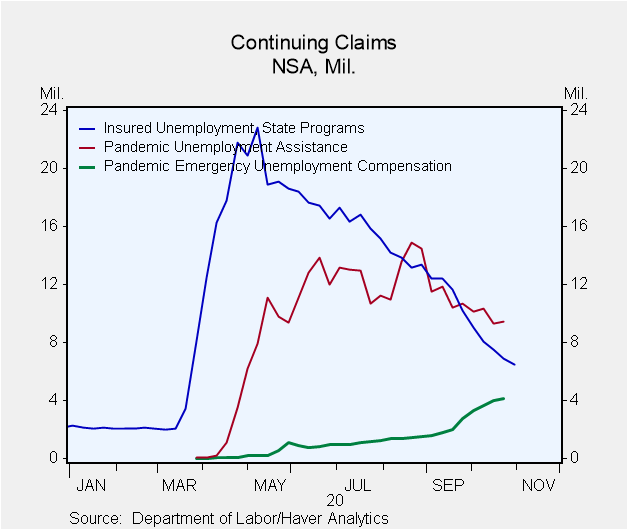

Seasonally adjusted state continuing claims for unemployment insurance fell to 6.786 million in the week ending October 31, from 7.222 million. Haver Analytics methodologically-consistent seasonally adjusted continuing claims showed the same readings for those weeks and finds the October 31 number is the lowest level of continuing claims since late March. Not seasonally adjusted continuing claims dropped to 6.486 from 6.888 million, also the lowest since late March.

Continuing PUA claims, which are lagged an additional week and not seasonally adjusted, increased to 9.433 million from 9.333 million. Meanwhile, Pandemic Emergency Unemployment Compensation claims continued their upward climb to a new high of 4.143 million in the week ending October 24. This program covers people who were unemployed before COVID but exhausted their state benefits and are now eligible to receive an additional 13 weeks of unemployment insurance, up to a total of 39 weeks.

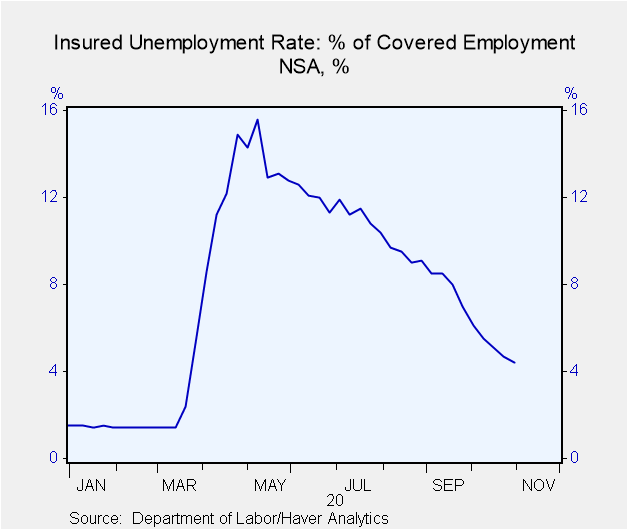

The seasonally adjusted state insured rate of unemployment declined to 4.6% in the week ending October 31 from 4.9%. The not-seasonally-adjusted data decreased to 4.4% from 4.7%, the lowest since late March. This data does not include the federal pandemic assistance programs. If you include the latest data available, which is lagged one additional week, the total number of state, PUA and PEUC continuing claims edged down to 20.1 million or 12.5% of the labor force. This is the lowest since late April.

The state insured rates of unemployment -- which do not include federal programs -- continued to show wide variation with South Dakota at just 0.9% and Hawaii at 9.9%. This is the first time since late March that no state was above 10%. The largest states ranged between 2.4% for Florida and 8.9% for California. The state rates are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 11/07/20 | 10/31/20 | 10/24/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 709 | 757 | 758 | 219 | 218 | 221 | 244 |

| Initial Claims (NSA) | 723 | 744 | 739 | 203 | 218 | 221 | 243 |

| Initial Claims Pandemic Unemployment Assistance (NSA) | 298 | 362 | 359 | -- | -- | -- | -- |

| Continuing Claims | -- | 6,786 | 7,222 | 299 | 1,701 | 1,756 | 1,961 |

| Continuing Claims (NSA) | -- | 6,486 | 6,888 | 347 | 1,704 | 1,763 | 1,964 |

| Continuing Claims Pandemic Unemployment Assistance (NSA) | -- | -- | 9,433 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 4.6 | 4.9 |

1.2 |

1.2 | 1.2 | 1.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates