Global| Mar 09 2012

Global| Mar 09 2012U.S. Jobs Growth & Unemployment Rate Are Stable

by:Tom Moeller

|in:Economy in Brief

Summary

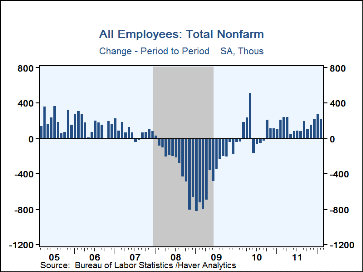

Labor market improvement may have hit a moderate & steady cruising speed. Nonfarm payrolls grew 227,000 (1.5% y/y) during February following a 284,000 January rise and a 223,000 December increase, both of which were revised up [...]

Labor market improvement may have hit a moderate & steady cruising speed. Nonfarm payrolls grew 227,000 (1.5% y/y) during February following a 284,000 January rise and a 223,000 December increase, both of which were revised up slightly. Expectations had been for a 210,000 job gain for last month. From the household survey, the unemployment rate matched expectations and was unchanged at 8.3%.

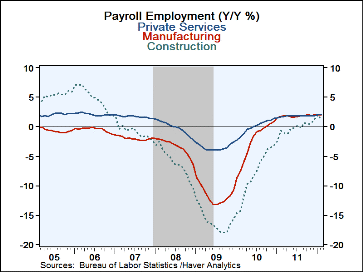

The 227,000 increase in February nonfarm payrolls was fueled by growth in private service-producing jobs. Here, the stable 209,000 increase (2.1% y/y) was driven by an 82,000 gain (3.8% y/y) in professional & business services, bolstered by a 45,200 (9.5% y/y) jump in temporary hiring. Education & health services jobs grew 71,000 (2.3% y/y) and leisure & hospitality employment rose 44,000 (2.7% y/y). Factory sector employment gained 31,000 (1.9% y/y) but construction jobs fell 13,000 (+1.2% y/y) despite mild temperatures. Jobs in retail trade fell 7,400 (+1.3% y/y). Also to the downside were government payrolls. The 6,000 (-1.0% y/y) overall decline reflected a 7,000 (-1.9% y/y) drop in federal jobs, a 1,000 dip (-1.0% y/y) in state hiring but a 2,000 increase (-0.9% y/y) in local employment.

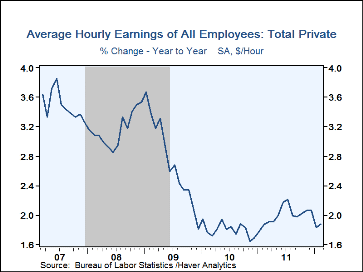

Moderate job gains are generating steady and slow growth in earnings. Last month's 0.2% increase in average hourly earnings was a slight improvement after three months of 0.1% uptick, but the 1.6% y/y increase remained near its record low. Factory sector earnings grew 0.8% y/y while private service sector earnings rose 1.6%.

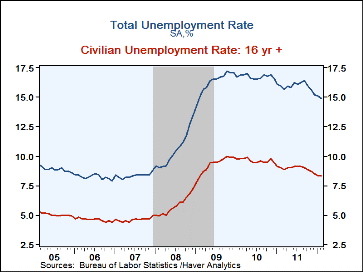

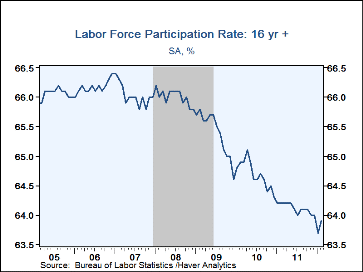

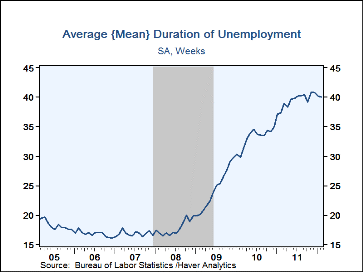

Also stable was the unemployment rate at 8.3%. That was, however, its lowest level since January 2009. The overall rate of unemployment including those who were marginally attached or part-time for economic reasons was 14.9%. Employment rose 428,000 last month (1.8% y/y) while the labor force grew 476,000 (1.0% y/y). This slow labor force growth reflects a decline in the labor force participation rate to 63.9%. That's down from 66.2% in 2006 and the peak of 67.1% in 2000. Dropouts from the labor force are rising at a 2.4% rate. The average duration of unemployment last month dipped to 40.0 weeks and those who were out of work 52 weeks or longer fell to 29.2% of the total, versus the high of 32.6% reached last spring.

The figures referenced above are available in Haver's USECON database. Additional detail can be found in the LABOR and in the EMPL databases. The expectation figures are from Action Economics and are in the AS1REPNA database.

Starting Off on the Wrong Foot: Early Careers and High Unemployment from the Federal Reserve Bank of Cleveland can be found here.

| Employment: (M/M Chg., 000s) | Feb | Jan | Dec | Y/Y | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|

| Payroll Employment | 227 | 284 | 223 | 1.5% | 1.2% | -0.7% | -4.4% |

| Previous | -- | 243 | 203 | -- | -- | -- | -- |

| Manufacturing | 31 | 52 | 28 | 1.9 | 1.8 | -2.7 | -11.6 |

| Construction | -13 | 21 | 26 | 1.2 | -0.2 | -8.2 | -16.0 |

| Private Service Producing | 209 | 202 | 172 | 2.1 | 1.8 | -0.1 | -3.5 |

| Government | -6 | -1 | -11 | -1.0 | -1.7 | -0.3 | 0.2 |

| Average Weekly Hours - Private Sector | 34.5 | 34.5 | 34.5 | 34.3 (Feb.'11) |

34.4 | 34.1 | 33.9 |

| Average Hourly Earnings (%) | 0.2 | 0.1 | 0.1 | 1.6 | 2.0 | 2.4 | 3.0 |

| Unemployment Rate(%) | 8.3 | 8.3 | 8.5 | 9.0 (Feb.'11) |

9.0 | 9.6 | 9.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.