Global| Sep 09 2015

Global| Sep 09 2015U.S. JOLTS: Job Openings Rate Gains, While Hiring Slows

Summary

The job openings rate rose to 3.9% during July, a new high, from 3.6% in June and 3.3% a year ago. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job [...]

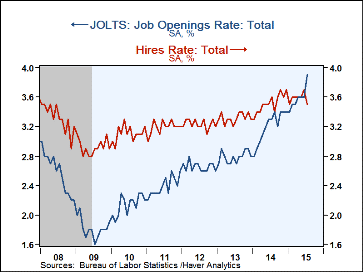

The job openings rate rose to 3.9% during July, a new high, from 3.6% in June and 3.3% a year ago. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings. The hires rate, however, dropped back to 3.5% from June's 3.7% and 3.6% in July 2014. The hires rate is the number of hires during the month divided by employment. The Bureau of Labor Statistics reports these figures in its Job Openings & Labor Turnover Survey (JOLTS).

The job openings rate rose to 3.9% during July, a new high, from 3.6% in June and 3.3% a year ago. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings. The hires rate, however, dropped back to 3.5% from June's 3.7% and 3.6% in July 2014. The hires rate is the number of hires during the month divided by employment. The Bureau of Labor Statistics reports these figures in its Job Openings & Labor Turnover Survey (JOLTS).

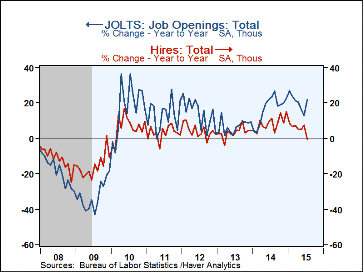

The actual number of job openings rose 21.7% y/y to 5.753 million. As seen in the rates, the apparent strength in job openings was not matched by firms' ability to fill positions, as hiring fell 3.8% from June to July, when it numbered 4.983 million, the lowest since August 2014 and 0.4% below a year ago. Thus, the larger number of openings partly reflects the reduced amount of hiring.

The private-sector job openings rate also rose, reaching 4.2% in July from 3.9% in June. Several industry sectors had larger openings rates. That in manufacturing was up from 2.5% in June to 2.7%, that in trade, transportation and utilities increased from 3.4% to 3.6%, and the education and health sector edged up from 4.4% to 4.5%. Larger increases came in leisure and hospitality, up to 4.8% from 4.4%, and professional and business services to 6.3% from 5.8%. Only the construction sector did not see a rise, as that openings rate held at June's 2.1%. The job openings rate in the government sector returned to 2.2% in July after June's rate was revised down to 2.1%.

The private sector hires rate fell to 3.9% in July from June's 4.0%, and most sectors had declines. Construction was down to 4.7% from 5.1%, trade, transportation and utilities to 4.2% from 4.3%, and education and health to 2.6% from 2.7%. The largest decline was in professional and business services, which dropped to 4.8% from 5.3%; this decline may explain the sizable rise in that sector's openings rate. Only the leisure and hospitality group had an increase, as its hiring rate moved to 6.2% in July from 6.1% in June. The hiring rate in government was steady at 1.5% for a fifth consecutive month.

The number of private sector hires fell back by 4.1% in July from June and was 1.4% below July 2014. Year-to-year comparisons show the largest drops in construction, where hiring fell 22.1%, and in professional and business services, down 5.2%. Leisure and hospitality, by contrast, saw a 7.2% y/y gain, and trade, transportation and utilities had a 2.5% y/y increase. Hiring in manufacturing was nearly steady with a 0.4% rise and that in education and health a 0.2% uptick. Government hiring was up 15.1%.

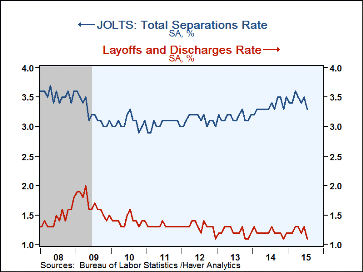

The total job separations rate fell back to 3.3% in July from 3.5% and the actual number of separations was up a mere 0.1% y/y. Separations include quits, layoffs, discharges, and other separations as well as retirements. The private sector separations rate also edged down, to 3.7% from 3.8% and the government sector's rate was steady at 1.4%. The layoff & discharge rate fell to 1.1% from June's 1.3%. The rate in the private sector was 1.3%, down from 1.4%; its peak during the recession was 2.3%. The rate in government was 0.4% for a third consecutive month.

The JOLTS survey dates to December 2000 and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey, SA) | Jul | Jun | May | Jul '14 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Job Openings, Total | |||||||

| Rate (%) | 3.9 | 3.6 | 3.6 | 3.3 | 3.4 | 2.8 | 2.6 |

| Total (000s) | 5,753 | 5,323 | 5,357 | 21.7% | 22.6% | 9.3% | 3.2% |

| Hires, Total | |||||||

| Rate (%) | 3.5 | 3.7 | 3.6 | 3.6 | 42.2 | 39.8 | 38.8 |

| Total (000s) | 4,983 | 5,182 | 5,060 | -0.4% | 8.4% | 3.4% | 4.2% |

| Layoffs & Discharges, Total | |||||||

| Rate (%) | 1.1 | 1.3 | 1.2 | 1.3 | 14.5 | 14.6 | 15.5 |

| Total (000s) | 1,609 | 1,779 | 1,660 | -11.9 | 2.4% | -4.9% | 1.1% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates