Global| Aug 21 2008

Global| Aug 21 2008U.S. Leading Indicators Dragged Down by Building Permits, Jobless Claims

Summary

The composite index of leading economic indicators, reported by the Conference Board fell 0.7% in July after being unchanged in June (revised from -0.1%). Forecasts had anticipated only a 0.2% decline. Last month the drop in building [...]

The composite index of leading economic indicators, reported by the Conference Board fell 0.7% in July after being unchanged in June (revised from -0.1%). Forecasts had anticipated only a 0.2% decline.

Last month the drop in building permits, higher claims for unemployment insurance and lower stock prices made the largest negative contributions to the leaders' decline. These were partially offset by a steepening of the yield curve (10-year Treasury yield vs. fed funds rate) and improvement in the University of Michigan index of consumer expectations.

The breadth of one-month increase amongst the leaders' 10 components eroded slightly to 40% from 45% in June. Over a six-month period the breadth of gain amongst the leaders' components fell back to 30% after rising to a revised 40% the month before.

The leading index is based on actual reports for eight economic data series. The Conference Board estimates two series, orders for consumer goods and orders for capital goods.

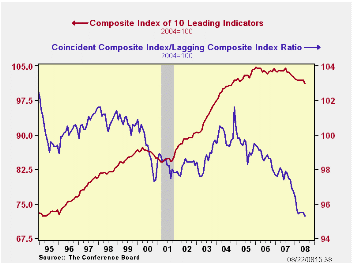

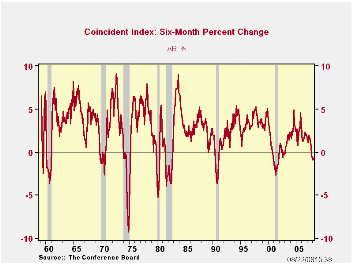

The coincident indicators rose 0.1% after a marginal downward revision of June's index to unchanged from +0.1%. Three of its components were positive in July but over the last six months all of them have declined. The index is off 0.5% from its peak last October. As Tom Moeller pointed out here last month, this is far more modest than the declines generally associated with recessions, as illustrated in the second graph here. Over the last ten years there has been an 86% correlation between the y/y changes in the coincident indicators and real GDP.

The lagging index 0.4% in July; the previously reported 0.3% decrease in June was revised to unchanged. The ratio of coincident to lagging indicators (a measure of economic excess) edged down from 95.5 during April, May and June to 95.3 in July. This indicator, which tends to lead the leading indicator index, fell steeply across the second half of 2007 and has since stabilized. While this looks like a hint that the precursors to an economic pick-up are coming in view, a major caveat would be the significant revisions, even in direction, that characterize the lagging index. So making firm, but hasty conclusions can be problematic.Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators | July | June | May | April, 6 Month % (AR) | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Leading | -0.7 | 0.0% | -0.1% | -1.8% | -0.4% | 1.3% | 2.7% |

| Coincident | 0.1 | 0.0% | -0.1% | -0.7% | 1.7% | 2.4% | 2.5% |

| Lagging | 0.4 | 0.0% | -0.2% | 1.6% | 2.9% | 3.1% | 3.1% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates