Global| Oct 22 2020

Global| Oct 22 2020U.S. Leading Indicators: Growth Decelerating

Summary

• Leading index rises 0.7% in September. • Coincident indicators up just 0.2%, suggesting slowing growth. • Coincident measure jumped at a 25.0% annual rate in Q3; base effects play an important role as June-to-September growth is at [...]

• Leading index rises 0.7% in September.

• Coincident indicators up just 0.2%, suggesting slowing growth.

• Coincident measure jumped at a 25.0% annual rate in Q3; base effects play an important role as June-to-September growth is at a 10.9% annual pace.

The Conference Board reported that its Composite Index of Leading Economic Indicators increased 0.7% during September (-3.9% year-on-year) following an upwardly revised 1.4% gain in August (was 1.2%). The Action Economics Forecast Survey anticipated a 0.8% gain. The Leading Index is comprised of 10 components which tend to precede changes in overall economic activity. Half of those components contributed positively -- led by a declining jobless claims -- three were unchanged, while two were a drag. Given the dependence of the economy on the progression of COVID-19, the normally forward-looking measures of the Leading Index are less telling.

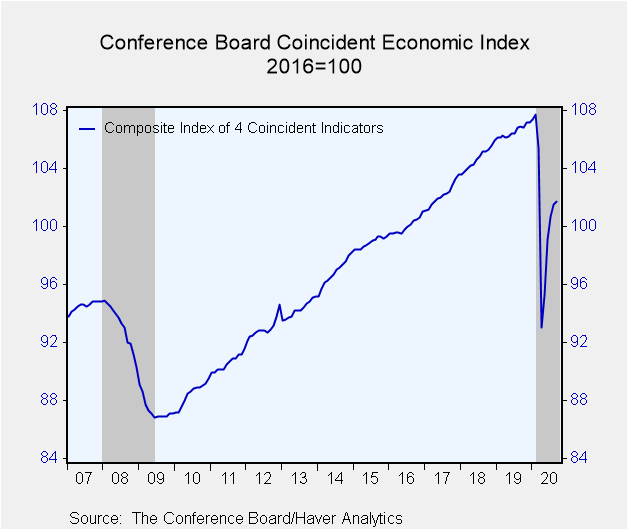

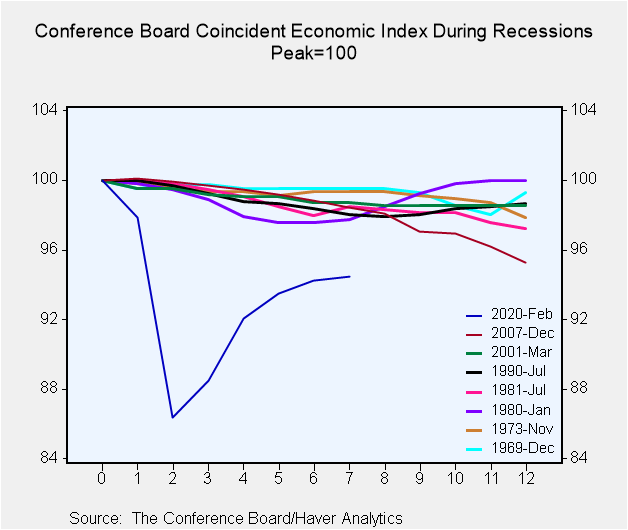

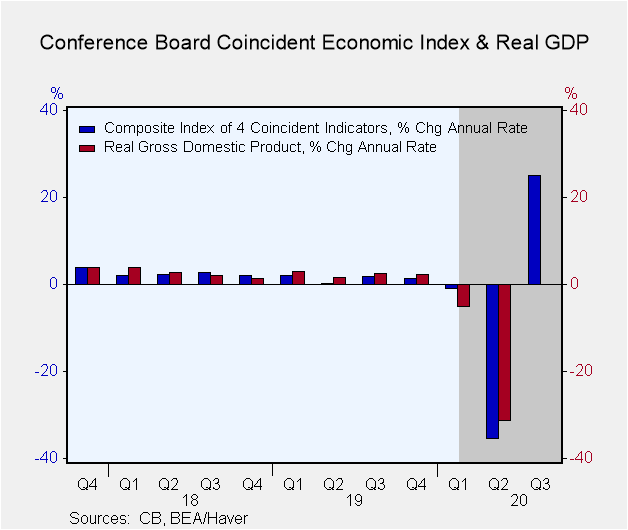

The Index of Coincident Economic Indicators increased 0.2% in September (-4.9% y/y), suggesting continued, albeit slower, growth as the third quarter came to a close. For Q3 as a whole, the coincident index jumped at a 25.0% annual rate. However, much of this is the result of strength at the end of the second quarter; this index grew at 10.9% pace from June to September. Even with its rebound in the last five months, the coincident index is still down 5.6% from its February peak. Three of the four component series increased, led by higher payroll employment, which was somewhat offset by a decline in industrial production.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The expectations are in the AS1REPNA database. Visit the Conference Board's site for coverage of leading indicator series from around the world.

| Business Cycle Indicators (%) | Sep | Aug | Jul | Sep Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Leading | 0.7 | 1.4 | 2.0 | -3.9 | 1.6 | 5.7 | 3.9 |

| Coincident | 0.2 | 0.8 | 1.6 | -4.9 | 1.8 | 2.5 | 2.2 |

| Lagging | -0.1 | -0.1 | -1.0 | -0.6 | 2.8 | 2.5 | 2.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates