Global| Feb 04 2003

Global| Feb 04 2003U.S. Light Vehicle Sales Fell

by:Tom Moeller

|in:Economy in Brief

Summary

Unit sales of light vehicles fell sharply in January. The 11.5% m/m decline reversed virtually all of the sharp gain the prior month. January sales were slightly below Consensus expectations for a 16.4 mil. unit sales rate. Sales of [...]

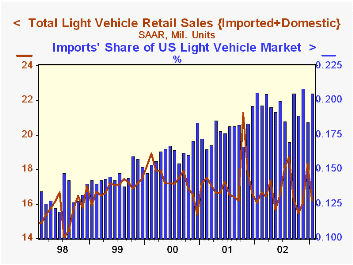

Unit sales of light vehicles fell sharply in January. The 11.5% m/m decline reversed virtually all of the sharp gain the prior month. January sales were slightly below Consensus expectations for a 16.4 mil. unit sales rate.

Sales of domestically built vehicles fell 13.8% m/m. Auto sales fell a moderate 4.3% m/m (+8.1% y/y) but sales of light trucks plunged 20.4% (-4.3% y/y).

Imported vehicle sales were relatively strong, falling only 1.5% m/m. Imported auto sales fell 0.5% (+0.3% y/y) but truck sales fell 3.5% (+1.8% y/y).

Imports' share of the US light vehicle market rose to 20.5% in January versus 19.5% for all of last year.

| Light Vehicle Sales (SAAR, Mil.Units) | Jan | Dec | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total | 16.21 | 18.32 | 1.0% | 16.80 | 17.26 | 17.40 |

| Domestic | 12.88 | 14.94 | 1.0% | 13.54 | 14.19 | 14.58 |

| Imported | 3.33 | 3.38 | 0.7% | 3.26 | 3.07 | 2.82 |

by Tom Moeller February 4, 2003

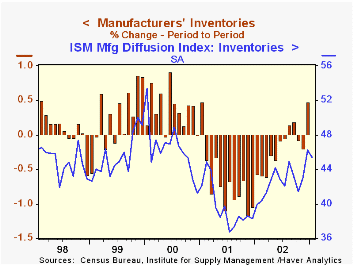

Manufacturing inventories rose last month for the third monthly gain in the last five months. The declines follow a brief two months of accumulation.

An end to factory inventory decumulation had been heralded by a rising ISM inventory index. Over the last five years there has been a 72% correlation between the level of the ISM inventory index and the month to month change in factory inventories.

Inventory decumulation in December was limited to the transportation sector (aircraft, light trucks and ships). Outside of transportation, inventories fell for the third straight month (-1.9% y/y) following three months of accumulation.

Inventory declines also continued in a broad range of durable goods industries including computers and electronic products, electrical equipment and furniture. Inventories of machinery rose for the first month since March of 2001.

Nondurable goods inventories fell 0.3% (+0.8% y/y).

Factory shipments fell sharply for the second consecutive month. Excluding transportation, shipments rose 0.2% (2.8% y/y) following a moderate 0.4% November decline.

Factory orders rose slightly. The advance report that durable goods orders rose 0.2% was revised to show a 0.2% decline.

| Factory Survey (NAICS) | Dec | Nov | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Inventories | 0.5% | -0.2% | -2.0% | -2.0% | -8.0% | 4.5% |

| New Orders | 0.4% | -0.8% | 2.7% | -0.8% | -7.2% | 5.2% |

| Shipments | -0.6% | -1.1% | -0.6% | -1.1% | -5.3% | 4.4% |

by Tom Moeller February 4, 2003

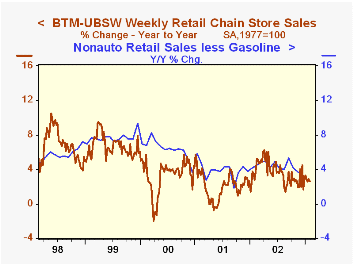

Chain store sales fell last week following three consecutive weeks of gain according to the BTM-UBSW survey.

For the full month, January sales rose 2.3% (2.9% y/y) from December.

During the last ten years there has been a 56% correlation between the year-to-year percent change in monthly chain store sales and the change in nonauto retail sales less gasoline.

| BTM-UBSW (SA, 1977=100) | 2/01/03 | 1/25/03 | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total Weekly Retail Chain Store Sales | 408.8 | 412.7 | 2.7% | 3.6% | 2.1% | 3.4% |

by Tom Moeller February 4, 2003

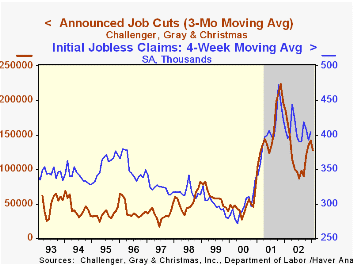

According to Challenger, Gray & Christmas, announced job cuts surged last month.

The three month moving average of job cut announcements nevertheless fell 10.3% from the prior month and was 31.1% below the year ago level.

Job cut announcements differ from layoffs in that many are achieved through attrition or just never occur.

Announcements of job cuts rose sharply in the aerospace, media, commodities and retail industries. Job cut announcements in a wide range of other industries fell.

| Challenger, Gray & Christmas | Jan | Dec | Y/Y | 2002 | 2001 |

|---|---|---|---|---|---|

| Announced Job Cuts | 132,222 | 92,917 | -37.8% | 1,431,052 | 1,956,876 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates