Global| Oct 06 2008

Global| Oct 06 2008U.S. Misery Index Highest Since 1991

by:Tom Moeller

|in:Economy in Brief

Summary

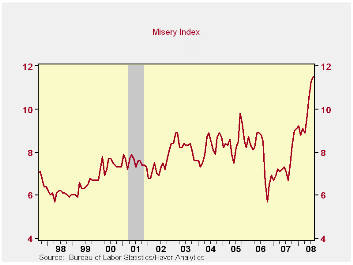

The so-called misery index is a constructed U.S. business cycle indicator. It adds the year-to-year change in the CPI to the unemployment rate. Thus, for those who are employed it measures the degree to which their incomes are being [...]

The so-called misery index is a constructed U.S. business cycle indicator. It adds the year-to-year change in the CPI to the unemployment rate. Thus, for those who are employed it measures the degree to which their incomes are being eroded by higher prices. For those who are unemployed that erosion hits the diminished level of dollars from an unemployment benefit.

During the past year, the misery index has climbed to 11.5 which was its highest level since early 1991.

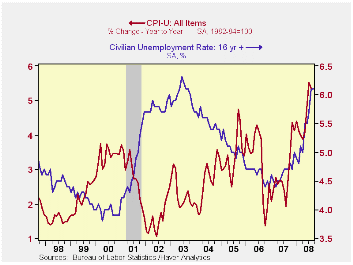

The increase during the past year from 6.7 is due to gains in both of the two components of the index, but the 4.8 point jump since August of last year has been more driven by the rise in energy prices. Higher gasoline prices drove the change in the CPI up 3.5 points to 5.4%. Higher unemployment caused the unemployment rate to rise a lesser 1.4 points.

Over the very short term the recent decline in gasoline prices likely will cause the misery index to level out. The CPI's increase should drop to roughly 4.0%. However, a continued increase in the unemployment rate will offset at least some of that decline. The combination would leave the index still above last year's average and on a monthly basis near the highest level since 2005.

The misery index can be found in Haver's USECON database under Business Cycle Indicators.

Oil Prices and Inflation from the Federal Reserve Bank of San Francisco can be found here.

Back to the Future with Keynes from the Federal Reserve Bank of Minneapolis is available here.

| U.S. Misery Index | August | July | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| Misery Index | 11.5 | 11.3 | 6.7 | 2.9 | 3.2 | 3.4 |

| CPI | 5.4 | 5.5 | 1.9 | 2.9 | 3.2 | 3.5 |

| Unemployment Rate | 6.1 | 5.7 | 4.7 | 4.6 | 4.6 | 5.1 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.