Global| Oct 27 2010

Global| Oct 27 2010U.S. New Home Sales Nudge Higher

by:Tom Moeller

|in:Economy in Brief

Summary

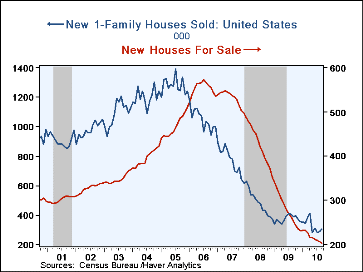

Home sales remain in the doldrums. The Census Department reported September new home sales rose 6.6% to 307,000 from an unrevised 288,000. Nevertheless the latest remained near the series' low. Expectations were for September sales of [...]

Home sales remain in the doldrums. The Census Department reported September

new home sales rose 6.6% to 307,000 from an unrevised 288,000. Nevertheless the

latest remained near the series' low. Expectations were for September sales of

300,000. The stability of home sales last month reflected varied changes across

the country's regions. Sales in the Midwest rose slightly m/m and to the highest

level since April. Sales in the South also improved slightly. In the Northeast

sales ticked up but in the West they fell.

Home sales remain in the doldrums. The Census Department reported September

new home sales rose 6.6% to 307,000 from an unrevised 288,000. Nevertheless the

latest remained near the series' low. Expectations were for September sales of

300,000. The stability of home sales last month reflected varied changes across

the country's regions. Sales in the Midwest rose slightly m/m and to the highest

level since April. Sales in the South also improved slightly. In the Northeast

sales ticked up but in the West they fell.

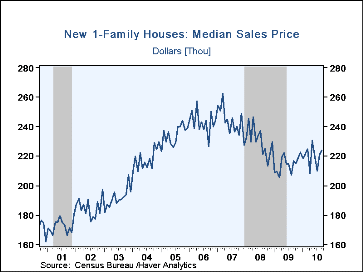

Upward revisions to earlier months' figures helped a 1.5% m/m rise in the median home prices to $223,800 cause the y/y comparison to total a modest 3.3%. The gain was accompanied by a slight rise in the average price of a new home to $257,500 (-11.3% y/y).

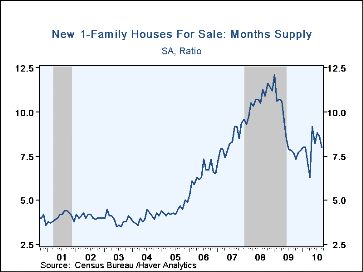

At the current sales rate, the months' supply of unsold homes slipped to 8.0, still nearly the highest in a year. The latest remained well below the early-2009 high of 12.1 months. The inventory of unsold homes was down 19.0% from 12 months ago and down roughly two-thirds from the 2006 peak. The data in this report are available in Haver's USECON database.

The Current Landscape of the California Housing Market from the Federal Reserve Bank of San Francisco is available here.

| US New Homes | September | August | July | Y/Y % | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Total Sales (SAAR, 000s) | 307 | 288 | 285 | -21.5 | 372 | 481 | 769 |

| Northeast | 30 | 29 | 30 | -18.9 | 32 | 35 | 64 |

| Midwest | 53 | 33 | 44 | -20.9 | 54 | 69 | 118 |

| South | 160 | 155 | 166 | -16.2 | 201 | 264 | 409 |

| West | 64 | 71 | 45 | -33.3 | 87 | 113 | 178 |

| Median Price (NSA, $) | 223,800 | 220,500 | 209,800 | 3.3 | 214,500 | 230,408 | 243,742 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.