Global| Oct 05 2018

Global| Oct 05 2018U.S. Nonfarm Payrolls Rise Modestly But Jobless Rate Falls; Earnings Growth Is Steady

by:Tom Moeller

|in:Economy in Brief

Summary

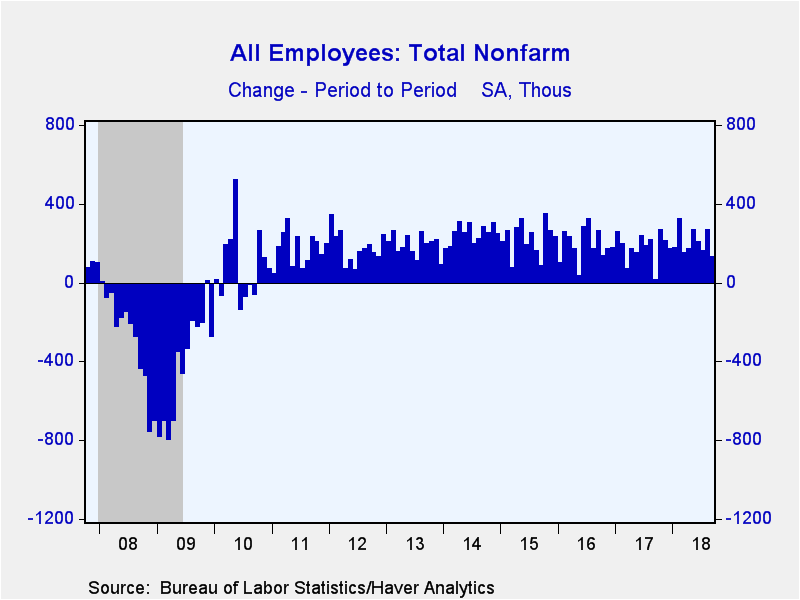

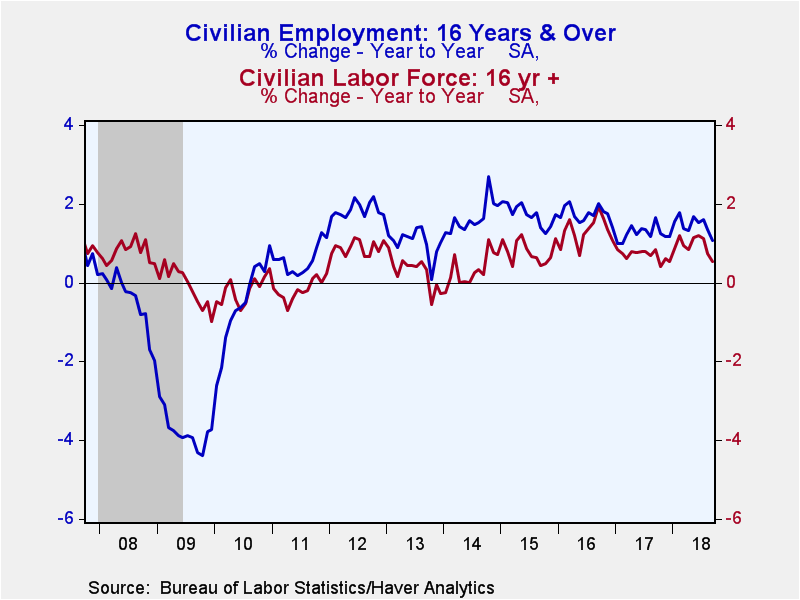

The labor market remains on a firm footing. Nonfarm payrolls increased 134,000 (1.7% y/y) during September, though it was the weakest increase in twelve months. The August rise, however, was revised to 270,000 from 201,000, and the [...]

The labor market remains on a firm footing. Nonfarm payrolls increased 134,000 (1.7% y/y) during September, though it was the weakest increase in twelve months. The August rise, however, was revised to 270,000 from 201,000, and the July gain was increased to 165,000 from 147,000. A 190,000 rise in September employment had been expected in the Action Economics Forecast Survey.

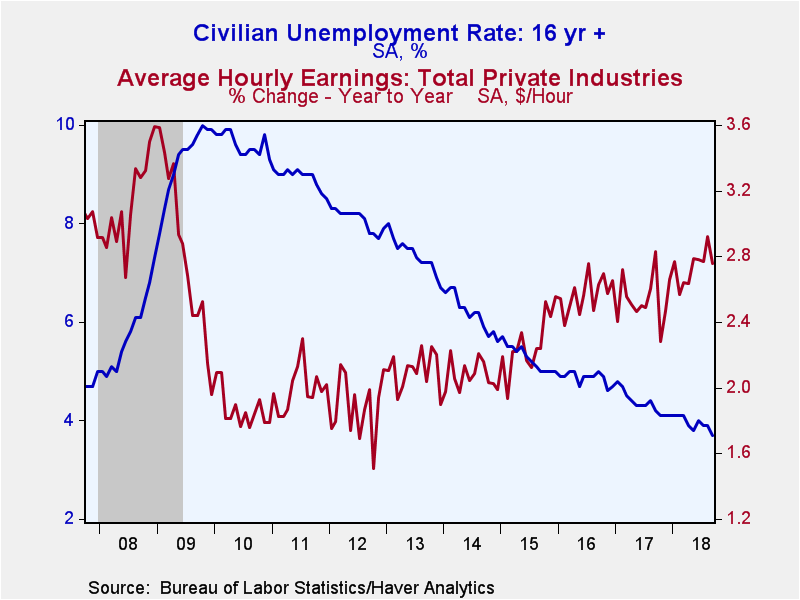

The unemployment rate declined to 3.7% last month, the lowest level since December 1969. A dip to 3.8% had been expected. The total unemployment rate, including those marginally attached and working part-time for economic reasons, notched higher to 7.5% from 7.4%, but remained nearly the lowest since 2001.

Average hourly earnings increased 0.3% during September for the fourth month in the last five. The 2.8% y/y increase was slightly below August's cycle high of 2.9%. The monthly gain matched expectations.

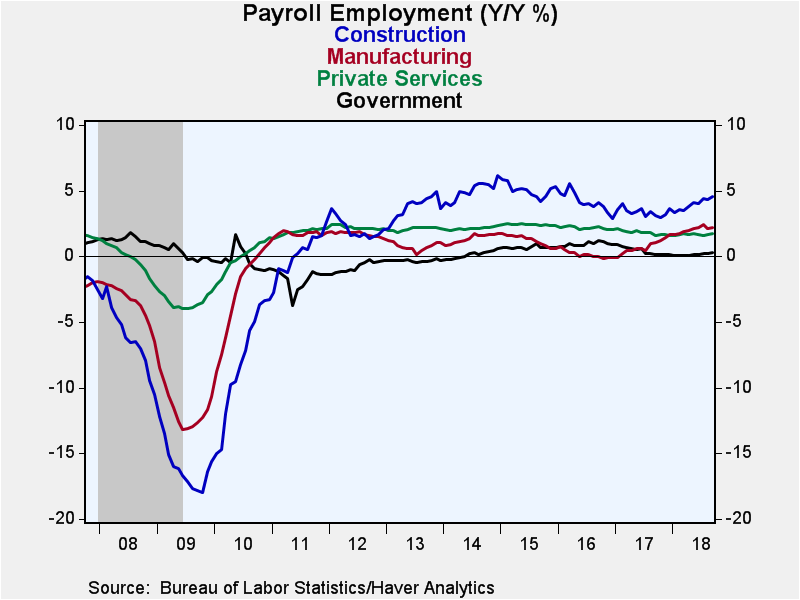

The 134,000 increase in nonfarm payrolls last month was disappointing as the rise in private service employment fell to 75,000 (1.7% y/y). The gain followed a 217,000 August increase which was strengthened from 178,000 reported last month. Weakness in service sector hiring centered on a 20,000 decline (+0.4% y/y) in retail trade jobs which came after an 11,500 rise. Leisure & hospitality employment also was weak and posted a 17,000 decline (+1.7% y/y) which followed a 21,000 rise. It was the only decline in twelve months. Another source of weakness was educational employment which fell 12,000 (+1.0% y/y) after a 15,600 increase. Hiring in the information sector was unchanged m/m and eased slightly y/y. Health care & social services jobs rose a weakened 29,800 (2.1% y/y). Professional & business services employment rose a slightly diminished 54,000 (2.8% y/y) and financial services jobs gained a steady 13,000 (1.4% y/y). A source of steady strength was provided by the transportation & warehousing sector where employment rose 23,800 (3.3% y/y). Jobs in wholesale trade gained a diminished 4,400 (1.6% y/y).

Employment in the public sector improved 13,000 (0.5% y/y), the weakest rise in four months. Local government employment fell 8,000 (+0.5% y/y) and reversed August's rise. Federal government employment also slipped 1,000 (-0.4% y/y) for the second straight month. These declines were countered by a 22,000 increase (0.7% y/y) in the number of state government jobs which followed declines in 2017 that extended to early this year.

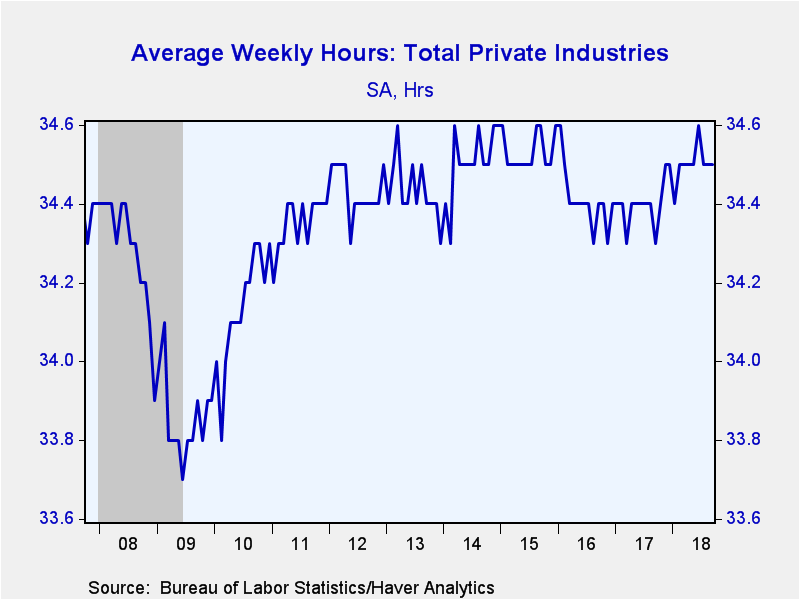

The length of the average workweek held steady at 34.5 hours for the third straight week. Mining & logging sector hours slipped to 45.8 while factory sector hours declined to 40.8. In the construction sector, the length of the workweek fell to 38.9, the shortest in twelve months. Private service sector hours held at a greatly reduced 33.3. Professional & business service hours held at a reduced 36.1 hours and education & health services also were steady at 33.0. Leisure & hospitality hours fell sharply, however, to 26.0, down from a peak 26.3 early in 2016.

The 0.3% increase in average hourly earnings was powered by a 0.7% gain (2.8% y/y) in mining & logging, as well as a 0.6% rise (3.1% y/y) in construction. Factory sector earnings held steady (1.3% y/y). Private service sector earnings increased a strengthened 0.3% (2.9% y/y). The gain was powered by a 1.2% surge (4.7% y/y) in information sector pay. Professional & business service sector earnings grew 0.2% (2.7% y/y) and financial sector pay also rose 0.2% (4.6% y/y), the weakest gain in three months. Leisure & hospitality earnings rose 0.2% (2.9% y/y), down from the 4.0% y/y growth last year, and education & health services earnings grew a steady 0.1% (2.1% y/y).

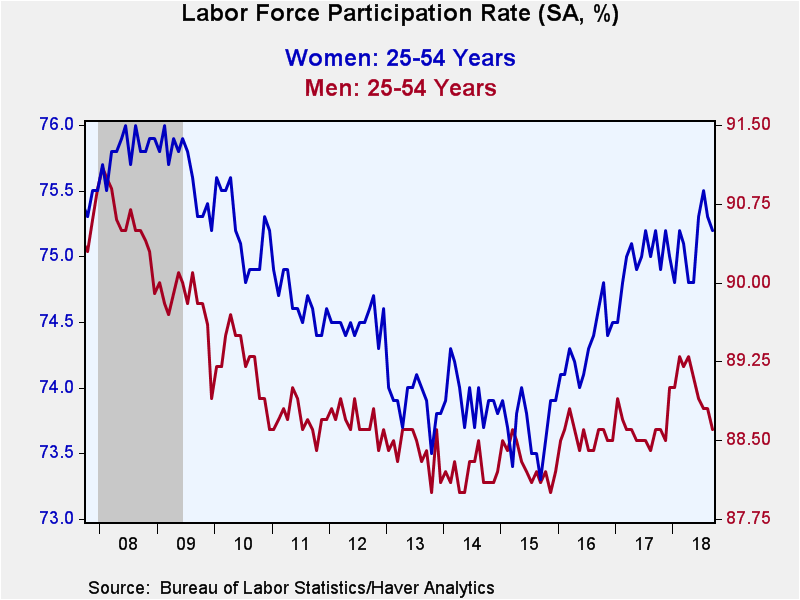

From the household employment survey, the decline in the unemployment rate to 3.7% was the result of a 420,000 jump in employment, which reversed August's decline. The labor force grew 150,000 after a 469,000 decline. The labor force participation rate held steady m/m at 62.7% which was at the low end of the range since early-2016. The teenage participation rate improved to 34.7% and for those aged 20-24, it increased to 71.0%. For individuals aged 25-54 years old the rate slipped to 81.8% but still was higher than the 80.8% low in 2014 and 2015. The participation rate for individuals aged 55 and over eased m/m to 40.1%. The duration of unemployment rose to an average 24.0 weeks, up from the 21.2 week low three months earlier.

The unemployment rate for individuals with less than a high school degree was a low 5.5%. High school graduates with no college were 3.7% unemployed. Individuals with some college but less than a bachelors degree were 3.2% unemployed and college graduates were 2.0% without work.

By age group, the teenage unemployment rate held steady at a reduced 12.8%. For individuals aged 20-24, the rate ticked up to 6.9%. For those aged 25-54, it fell to 3.0%, the lowest level since 2000. The unemployment rate for those aged 55 and over slipped to 2.8%.

The labor market data are contained in Haver's USECON database. Detailed figures are in the EMPL and LABOR databases. The expectations figures are in the AS1REPNA database.

| Employment: (SA, M/M Change, 000s) | Sep | Aug | Jul | Sep Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Payroll Employment | 134 | 270 | 165 | 1.7% | 1.6% | 1.8% | 2.1% |

| Previous Estimate | -- | 201 | 147 | -- | -- | -- | -- |

| Manufacturing | 18 | 5 | 22 | 2.2 | 0.7 | 0.1 | 1.2 |

| Construction | 23 | 26 | 19 | 4.2 | 3.4 | 4.1 | 5.0 |

| Private Service-Producing | 75 | 217 | 96 | 1.7 | 1.8 | 2.2 | 2.4 |

| Government | 13 | 16 | 28 | 0.5 | 0.4 | 0.9 | 0.7 |

| Average Weekly Hours - Private Sector | 34.5 | 34.5 | 34.5 | 34.3 | 34.4 | 34.4 | 34.5 |

| Private Sector Average Hourly Earnings (%) | 0.3 | 0.3 | 0.3 | 2.8 | 2.5 | 2.6 | 2.3 |

| Unemployment Rate (%) | 3.7 | 3.9 | 3.9 | 4.2 | 4.4 | 4.9 | 5.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.