Global| Sep 15 2020

Global| Sep 15 2020U.S. Oil Prices Head Lower

Summary

• Crude oil prices decline to lowest level since June. • Gasoline prices edge down. The price for a barrel of West Texas Intermediate crude oil fell to an average of $37.39 per barrel (-33.4% y/y) in the week ended September 11. It [...]

• Crude oil prices decline to lowest level since June.

• Gasoline prices edge down.

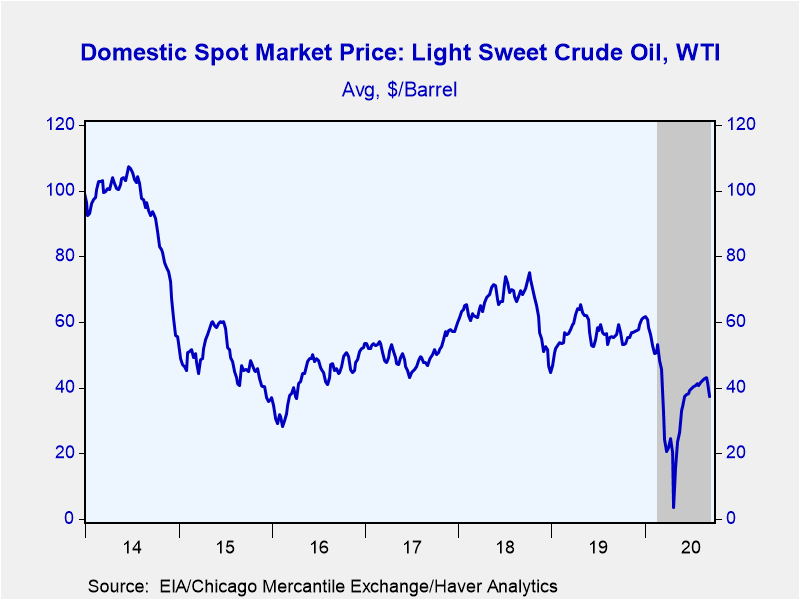

The price for a barrel of West Texas Intermediate crude oil fell to an average of $37.39 per barrel (-33.4% y/y) in the week ended September 11. It was the lowest weekly price since early-June, though nowhere near the single digit weekly average experienced in late April. After dropping to a three-month low last Tuesday, daily prices have been range-bound. Brent crude oil prices fell to an average $40.47 per barrel (-33.9% y/y) last week. Daily prices have been flat to down in the last week.

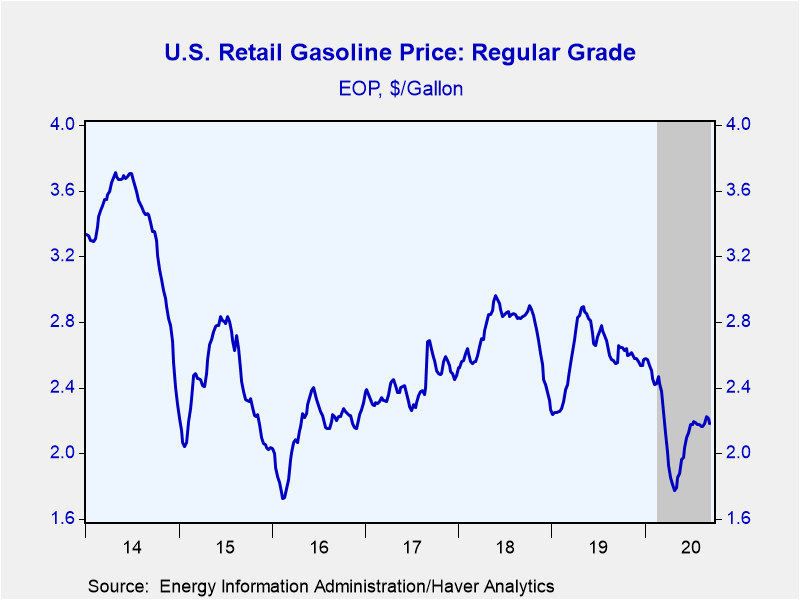

Regular gasoline prices slipped to $2.18 per gallon (-14.5% y/y) in the week ended September 14. Gasoline prices have been trading sideways since late June. Haver Analytics adjusts the gasoline price series for usual seasonal variation. The seasonally adjusted price ticked down one penny to $2.14 per gallon last week.

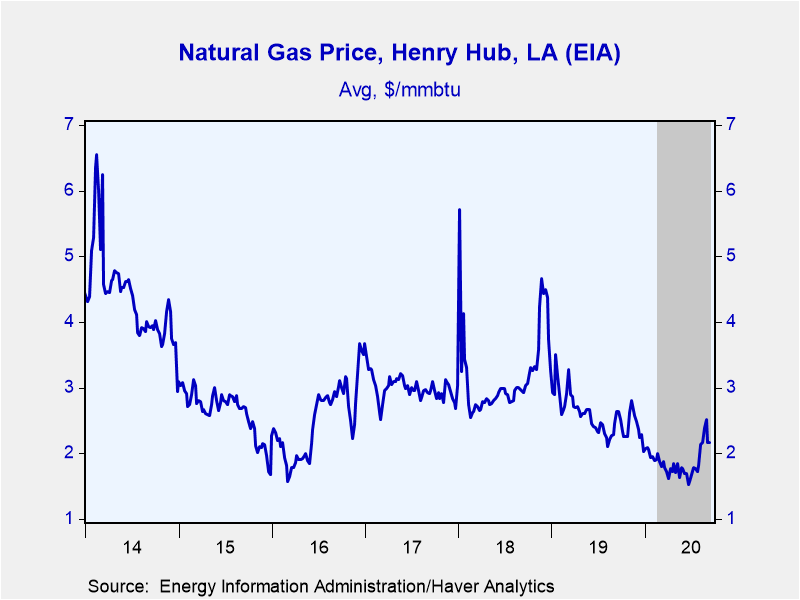

Natural gas prices were unchanged at $2.16/mmbtu (-18.2% y/y) in the week ended September 11. Daily prices have been range-bound for the last week.

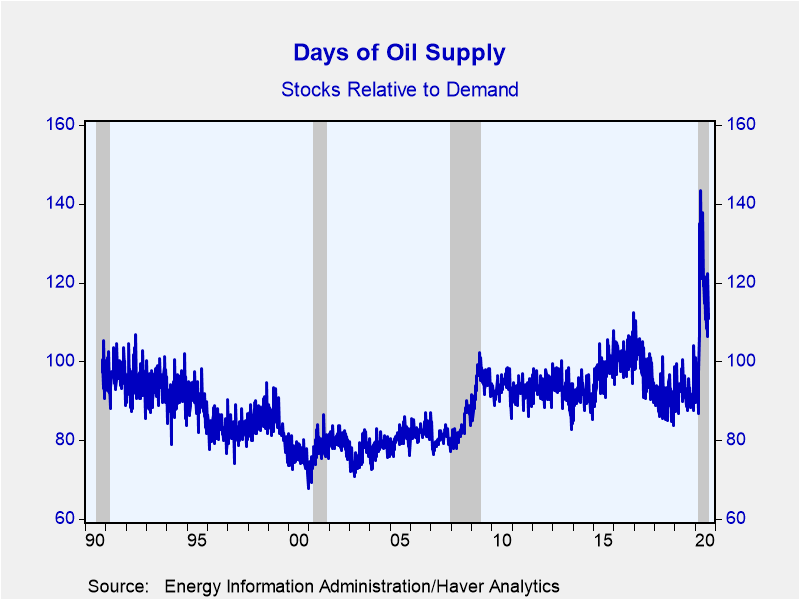

In the four weeks ended September 4, gasoline demand declined 9.9% y/y. Total petroleum product demand fell 16.0% y/y. Crude oil input to refineries was down 20.2% y/y in the past four weeks. Gasoline inventories were 1.3% above a year ago and stocks of all petroleum products were 7.0% higher y/y. The ratio of oil inventories-to-demand jumped to a record 143 days in mid-April. In early September they stood at a still-elevated 111 days.

These data are reported by the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data, along with regional breakdowns, are in OILWKLY.

| Weekly Energy Prices | 09/14/20 | 09/07/20 | 08/31/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Retail Gasoline ($ per Gallon Regular, Monday Price, End of Period) | 2.18 | 2.21 | 2.22 | -14.5 | 2.57 | 2.27 | 2.47 |

| Light Sweet Crude Oil, WTI ($ per bbl, Previous Week's Average) | 37.39 | 41.59 | 43.00 | -33.4 | 56.91 | 64.95 | 50.87 |

| Natural Gas ($/mmbtu, LA, Previous Week's Average) | 2.16 | 2.16 | 2.52 | -18.2 | 2.57 | 3.18 | 2.99 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.