Global| May 28 2010

Global| May 28 2010U.S. Personal Spending Mixed & Income Firm

by:Tom Moeller

|in:Economy in Brief

Summary

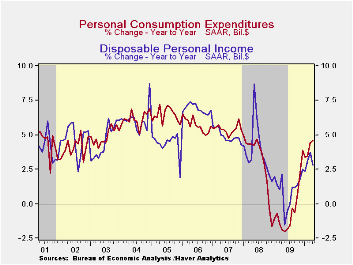

Lower gasoline prices and a pause in auto purchases braked consumer spending last month. Personal consumption expenditures were unchanged during April after an unrevised 0.6% March gain. A 0.3% increase had been expected. Spending on [...]

Lower gasoline prices and a pause in auto purchases braked

consumer spending last month. Personal consumption

expenditures were unchanged during April after an unrevised

0.6% March gain. A 0.3% increase had been expected. Spending on

gasoline slipped for the third straight month due to price declines.

The price influence is clear when observing that during the last year

nominal spending rose 35.9%; but in constant dollars, spending was

roughly unchanged. A large contribution from spending on autos also is

clear, but the trend is improved. Real spending fell 1.3% in April

after an 8.9% gain in March; but versus last year, spending on motor

vehicles has increased 11.3%.

Elsewhere, spending looked firm. April spending on home

furnishings rose 1.4% (7.4% y/y) for the third such monthly increase.

Even after allowing for higher prices, real spending was up 1.8% y/y

following the 5.9% decline during 2009. Apparel spending took a

breather, falling 0.8% last month after gains between 1.7% and 2.1%

during March & February. More impressive was that spending rose

5.7% y/y after the 3.5% decline last year. Adjusting for lower prices

spending jumped 6.8% y/y after falling 4.3% in 2009. Spending on

services continued firm at 2.8% y/y following last year's 1.6%

increase. The gain still was bloated by the 4.3% y/y jump in health

care expenditures but spending on financial services (4.3% y/y),

restaurants & accommodations (2.8% y/y) and recreation (0.8%

y/y) each was greatly improved.

Last month an expected 0.4% gain in personal income

accompanied the spending numbers. April disposable income rose an even

firmer 0.5% (2.8% y/y). Year-to-year, both are much improved versus

2009 but tax cuts have fueled take-home pay more. Higher gasoline

prices also cut into income growth. The 0.9% y/y gain in real

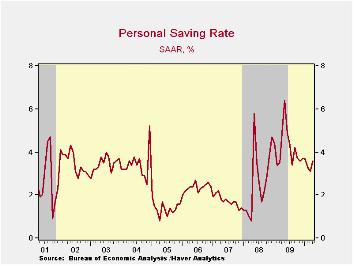

disposable income just equaled last year's increase. The outgrowth of

spending gains that exceeded income growth during the last twelve

months lowered the personal savings rate to 3.6%

from its high of 6.4% when the tax cuts were enacted. The latest rate

still was up, however, from the 1.0% low at the beginning of the last

recession.

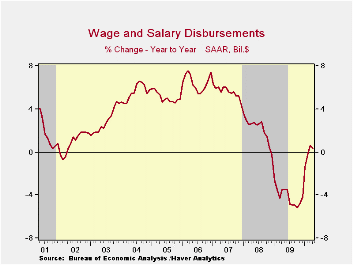

Employment declines left wages & salaries up just 0.3%

y/y, though that followed a sharp 4.1% decline last year. Wages in the

factory sector, however, rose a firmer 0.7% in April (-3.4% y/y) and

compared to last year's 11.3% shortfall. In the private service sector,

wages increased 0.8% y/y after last year's 4.0% decline. Improvement in

the housing market pulled proprietors' income up 5.4% y/y, its

strongest gain since early 2006 while the stabilization of interest

rates left interest income up 0.3% y/y following last year's 5.3%

decline. Dividend income remained down 1.6% y/y but that compared

favorably to last year's 19.3% drop and the 10.3% 2008 decline.

Finally, gains in unemployment insurance benefits (13.1% y/y) have

tapered off with the improved labor market.

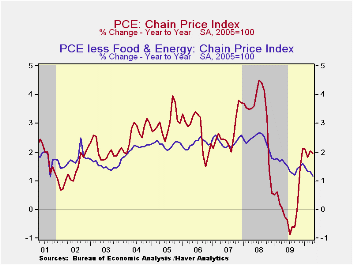

The PCE chain price index was unchanged

with the 2.3% slip (+38.1% y/y) in gasoline prices. The core PCE price

deflator ticked up 0.1%, held back by a 0.9% decline (-1.0% y/y) in

apparel prices and a 0.4% decline (-4.3% y/y) in furniture &

appliance prices. Services prices also gained 0.2% (1.7% y/y), while

health care prices rose 0.3% (2.6% y/y).

The personal income & consumption figures are available in Haver's USECON and USNA databases.

| Disposition of Personal Income (%) | April | March | February | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Personal Income | 0.4 | 0.4 | 0.0 | 2.5 | -1.8 | 2.9 | 5.6 |

| Disposable Personal Income | 0.5 | 0.4 | 0.0 | 2.8 | 1.0 | 3.9 | 4.9 |

| Personal Consumption Expenditures | 0.0 | 0.6 | 0.5 | 4.6 | -0.4 | 3.1 | 5.4 |

| Saving Rate | 3.6 | 3.1 | 3.3 | 4.9 (April '09) | 4.2 | 2.6 | 1.7 |

| PCE Chain Price Index | 0.0 | 0.1 | 0.0 | 2.0 | 0.2 | 3.3 | 2.7 |

| Less food & energy | 0.1 | 0.1 | 0.0 | 1.2 | 1.5 | 2.4 | 2.4 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.