Global| Jun 12 2018

Global| Jun 12 2018U.S. Petroleum Prices Ease Slightly

Summary

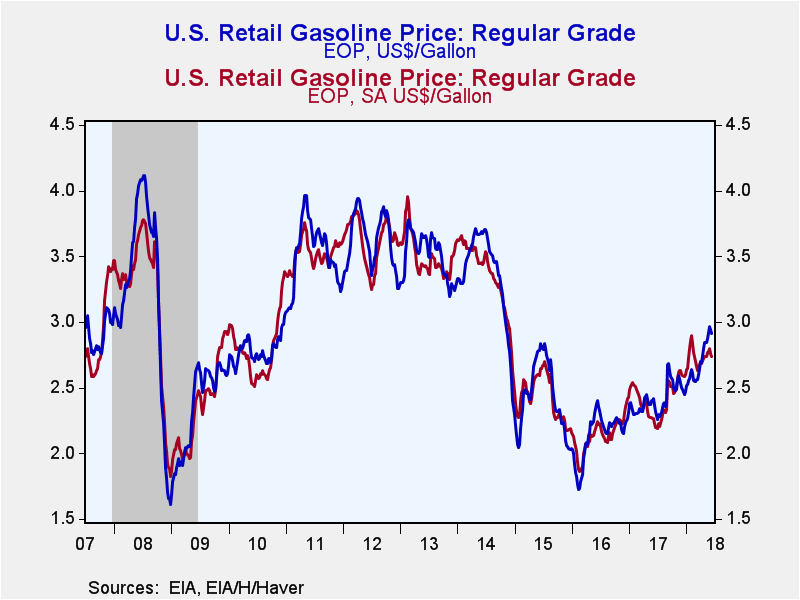

Retail gasoline prices eased to $2.91 per gallon last week (+23.0% y/y) from $2.94 per gallon during the prior week. This was the second consecutive weekly decline, which probably signals the end of the traditional price increase in [...]

Retail gasoline prices eased to $2.91 per gallon last week (+23.0% y/y) from $2.94 per gallon during the prior week. This was the second consecutive weekly decline, which probably signals the end of the traditional price increase in anticipation of the summer driving season. Haver Analytics constructs factors adjusting for the seasonal variation in gasoline pump prices. The seasonally-adjusted price fell slightly to $2.74 per gallon.

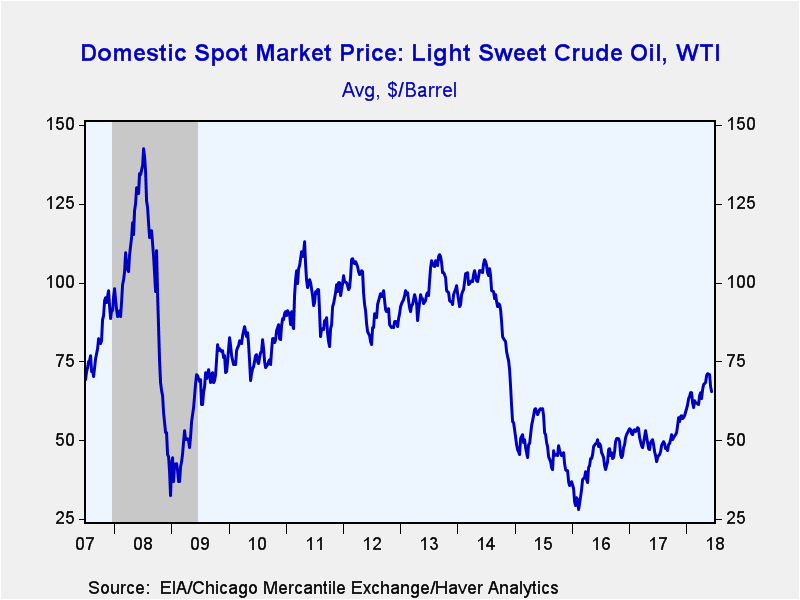

West Texas Intermediate crude oil prices declined to an average of $65.34 (+40.4% y/y) per barrel last week, which was down from $66.97 per barrel in the week prior and from the recent high of $71.31 per barrel three weeks ago. Brent crude oil prices eased to an average of $75.92 per barrel last week and were $76.43 yesterday.

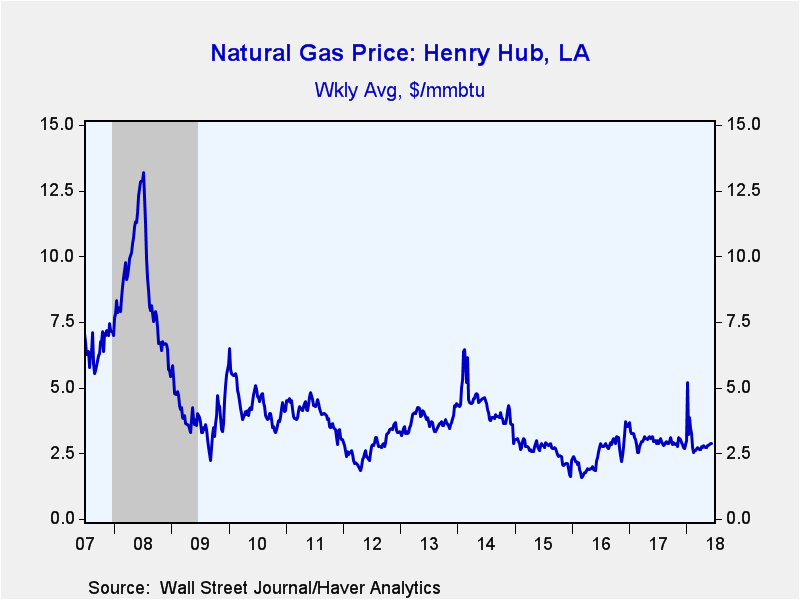

Natural gas prices increased to an average of $2.88/mmbtu last week (-2.4% y/y) from $2.86/mmbtu and were $2.95 yesterday.

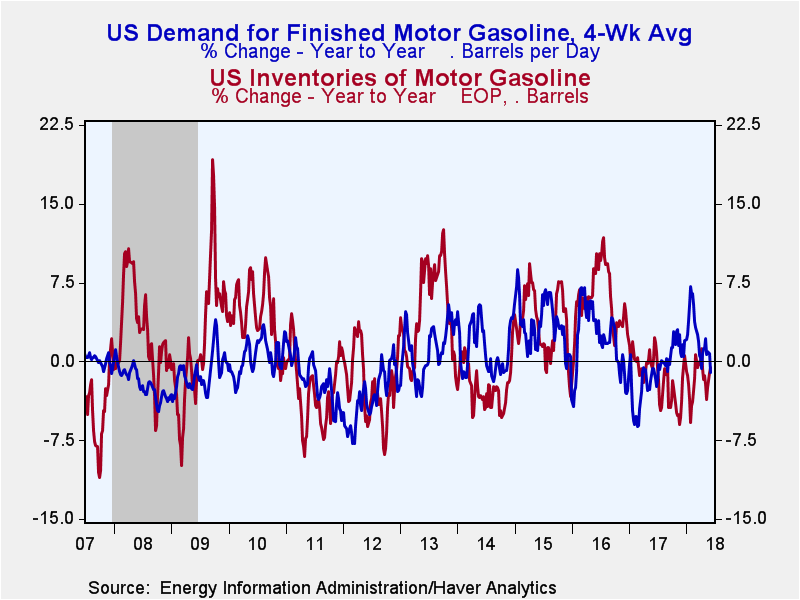

In the four-weeks ending June 1, gasoline demand declined 1.1% y/y, while total petroleum product demand edged up 0.2% y/y. Gasoline inventories declined 0.6% y/y, while inventories of all petroleum products dropped 8.0% y/y. Crude oil input to refineries declined 2.0% y/y in the last four weeks.

These data are reported by the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data, along with regional breakdowns, are in OILWKLY.

| Weekly Energy Prices | 06/11/18 | 06/04/18 | 05/28/18 | Y/Y % | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Retail Gasoline ($ per Gallon Regular, Monday Price) | 2.91 | 2.94 | 2.96 | 23.03 | 2.47 | 2.31 | 2.03 |

| Light Sweet Crude Oil, WTI ($ per bbl, Previous Week's Average) | 65.34 | 66.97 | 70.97 | 40.40 | 50.87 | 43.22 | 48.90 |

| Natural Gas ($/mmbtu, LA, Previous Week's Average) | 2.88 | 2.86 | 2.83 | -2.44 | 2.96 | 2.49 | 2.62 |

Peter D'Antonio

AuthorMore in Author Profile »Peter started working for Haver Analytics in 2016. He worked for nearly 30 years as an Economist on Wall Street, most recently as the Head of US Economic Forecasting at Citigroup, where he advised the trading and sales businesses in the Capital Markets. He built an extensive Excel system, which he used to forecast all major high-frequency statistics and a longer-term macroeconomic outlook. Peter also advised key clients, including hedge funds, pension funds, asset managers, Fortune 500 corporations, governments, and central banks, on US economic developments and markets. He wrote over 1,000 articles for Citigroup publications. In recent years, Peter shifted his career focus to teaching. He teaches Economics and Business at the Molloy College School of Business in Rockville Centre, NY. He developed Molloy’s Economics Major and Minor and created many of the courses. Peter has written numerous peer-reviewed journal articles that focus on the accuracy and interpretation of economic data. He has also taught at the NYU Stern School of Business. Peter was awarded the New York Forecasters Club Forecast Prize for most accurate economic forecast in 2007, 2018, and 2020. Peter D’Antonio earned his BA in Economics from Princeton University and his MA and PhD from the University of Pennsylvania, where he specialized in Macroeconomics and Finance.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates