Global| Feb 14 2019

Global| Feb 14 2019U.S. Producer Prices Decline; Core PPI Rises

Summary

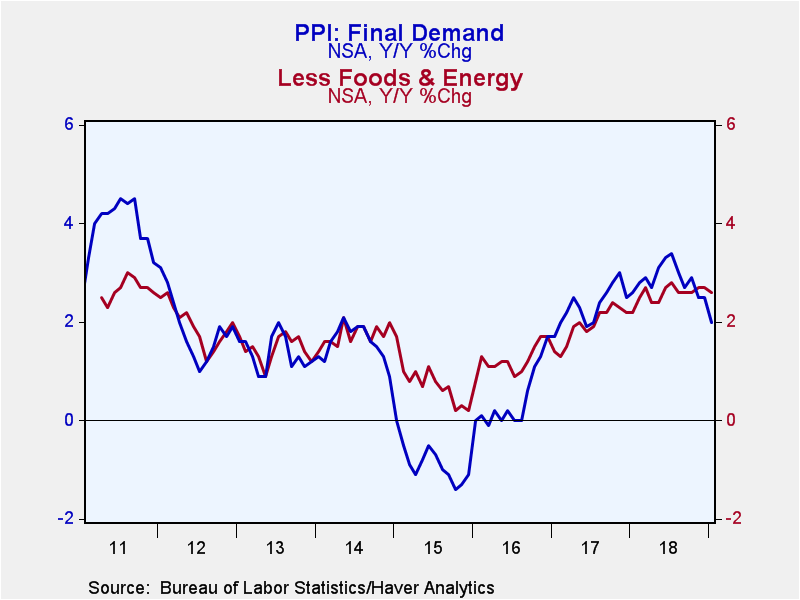

The headline Final Demand Producer Price Index edged down 0.1% for the second consecutive month in January (+2.0% year-on-year). December's reading was revised up from -0.2%. The Action Economics Forecast Survey expected an increase [...]

The headline Final Demand Producer Price Index edged down 0.1% for the second consecutive month in January (+2.0% year-on-year). December's reading was revised up from -0.2%. The Action Economics Forecast Survey expected an increase of 0.1%. Producer prices excluding food & energy increased a great-than-expected 0.3% (2.6% y/y) after an unchanged reading (was -0.1%). A 0.2% gain had been anticipated. The PPI excluding food, beverages and trade services, another measure of underlying price inflation, rose 0.2% (2.5% y/y) following a flat December.

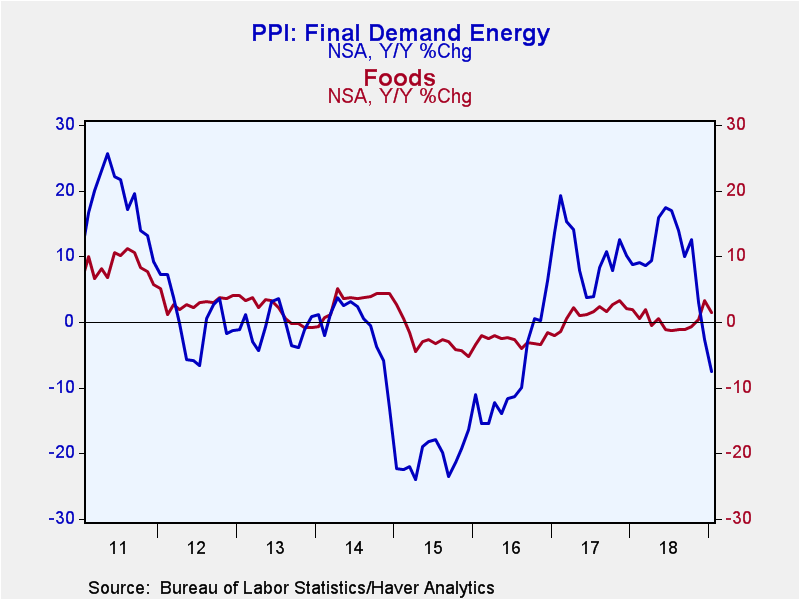

The decline in the PPI reflected a 3.8% drop in energy product prices (-7.5% y/y), the third consecutive monthly decline. Gasoline prices fell 7.3% (-21.0% y/y) while residential natural gas prices edged down 0.9% (+3.6% y/y). Electric power costs increased 0.3% (0.2% y/y). Food prices fell 1.7% in January (+1.4% y/y) after a 2.6% increase. A 22.1% drop in fresh fruits (-4.4% y/y) led the decline, reversing some of December's 45% jump.

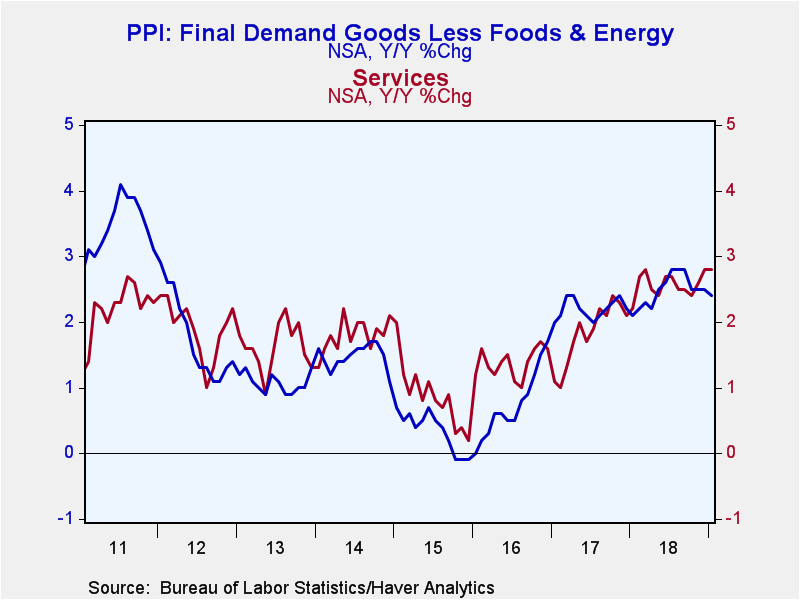

Service prices rose 0.3% (2.8% y/y) after an unchanged reading in December (was -0.1%). The cost of trade services jumped 0.8% (3.2% y/y) while transportation & warehousing costs rose 0.5% (7.0% y/y). Prices for final demand services excluding trade, transportation & warehousing was unchanged for the second consecutive month (2.0% y/y).

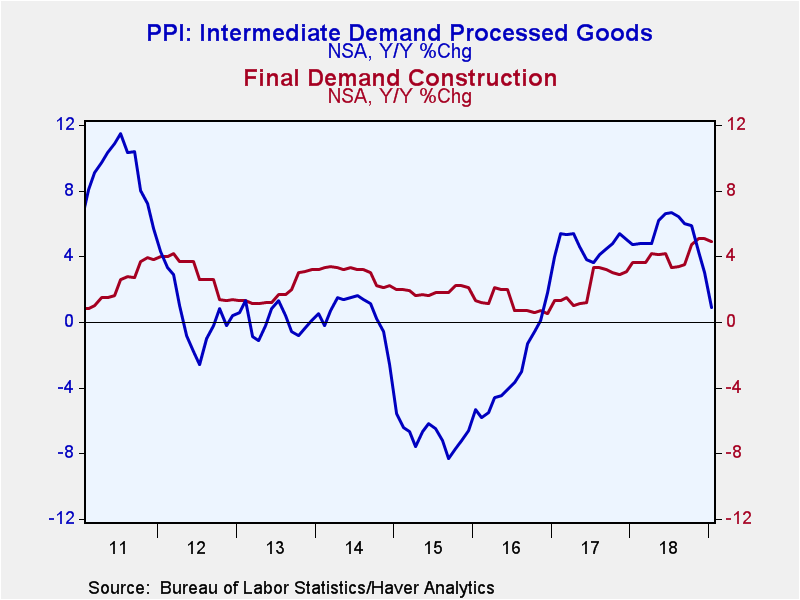

Goods prices fell -0.8% (+0.4% y/y), the third monthly decline. Goods prices excluding food & energy rose 0.3% (2.4% y/y) after a 0.1% reading. Core consumer goods prices increased 0.4% (2.8% y/y), while capital equipment grew 0.6% (2.8% y/y). Government purchased goods prices less food & energy gained 0.4% (2.3% y/y). Construction prices jumped 0.6% (4.9% y/y) following a 0.1% increase.

Prices for intermediate demand processed goods fell 1.4% (+0.9% y/y), the third consecutive monthly decline.

The PPI data using both the current and old methodology are contained in Haver's USECON database. Further detail can be found in PPI and PPIR. The expectations figures are available in the AS1REPNA database.

| Producer Price Index (SA, %) | Jan | Dec | Nov | Jan Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Final Demand | -0.1 | -0.1 | 0.1 | 2.0 | 2.9 | 2.3 | 0.4 |

| Excluding Food & Energy | 0.3 | 0.0 | 0.3 | 2.6 | 2.6 | 1.9 | 1.2 |

| Excluding Food, Energy & Trade Services | 0.2 | 0.0 | 0.3 | 2.5 | 2.8 | 2.1 | 1.2 |

| Goods | -0.8 | -0.3 | -0.5 | 0.5 | 3.4 | 3.3 | -1.4 |

| Foods | -1.7 | 2.6 | 1.3 | 1.4 | 0.2 | 1.2 | -2.8 |

| Energy | -3.8 | -4.3 | -5.1 | -7.5 | 10.2 | 10.4 | -8.4 |

| Goods Excluding Food & Energy | 0.3 | 0.1 | 0.3 | 2.4 | 2.5 | 2.2 | 0.7 |

| Services | 0.3 | 0.0 | 0.3 | 2.8 | 2.6 | 1.8 | 1.4 |

| Trade Services | 0.8 | -0.1 | 0.4 | 3.2 | 1.8 | 1.4 | 1.3 |

| Construction | 0.6 | 0.1 | 0.2 | 4.9 | 4.0 | 2.2 | 1.1 |

| Intermediate Demand - Processed Goods | -1.4 | -0.9 | -0.6 | 0.9 | 5.3 | 4.7 | -3.1 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.