Global| Nov 15 2005

Global| Nov 15 2005U.S. Retail Sales Dip

by:Tom Moeller

|in:Economy in Brief

Summary

US retail sales dipped 0.1% last month as consumers shifted away from autos and spent elsewhere. The decline followed a little revised 0.3% September gain but compared favorably to Consensus expectations for a 0.6% decline because [...]

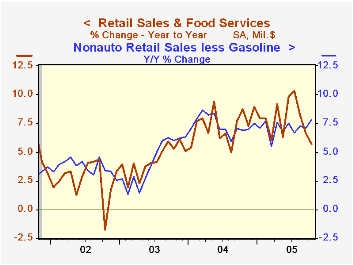

US retail sales dipped 0.1% last month as consumers shifted away from autos and spent elsewhere. The decline followed a little revised 0.3% September gain but compared favorably to Consensus expectations for a 0.6% decline because less autos, retail sales surged 0.9%. That increase was three times the Consensus expectation and the 1.4% September increase was upwardly revised.

Sales at gasoline service stations fell 0.8% after a 5.1% pop in September which was driven by a 16.8% rise in the retail price of gasoline. Gas prices reversed about half of that gain in October and have fallen another 14% so far in November.

Less gasoline, nonauto retail sales rose 1.1% (7.8% y/y) following an upwardly revised 0.8% gain in September. The increase was boosted again by strength in building material sales which jumped 2.1% (13.1% Y/Y) for the third consecutive month of strong gain.

Discretionary spending continued strong as evidenced by a 0.6% (8.2% y/y) rise in furniture & electronics store sales which followed an upwardly revised 1.4% September surge. Sales of nonstore retailers (internet & catalogue) jumped 1.2% (12.2% y/y) and general merchandise store sales rose 1.2% (7.1% y/y). Apparel store sales in October made up for the prior month's dip and ballooned 3.1% (6.5% y/y) even though apparel prices recently have been under pressure (-0.7% y/y thru September).

Today's U.S. Senate Testimony of Ben S. Bernanke is available here.

Oil Prices and Consumer Spending from the Federal Reserve Bank of Richmond is available here.

| Oct | Sept | Y/Y | 2004 | 2003 | 2002 | |

|---|---|---|---|---|---|---|

| Retail Sales & Food Services | -0.1% | 0.3% | 5.7% | 7.3% | 4.3% | 2.5% |

| Excluding Autos | 0.9% | 1.4% | 9.9% | 8.3% | 4.7% | 3.3% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates