Global| Jun 01 2009

Global| Jun 01 2009U.S. Savings Rate Still Rising As Consumers Remain Cautious

by:Tom Moeller

|in:Economy in Brief

Summary

The personal savings rate jumped last month to the highest level since early-1995. That rise may help explain earlier reports that confidence and sentiment are improving. Consumers are rebuilding their personal balance sheets, mending [...]

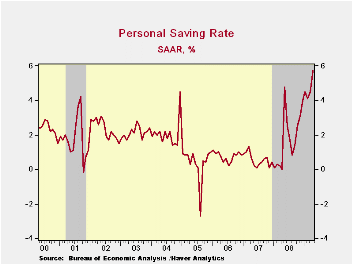

The personal savings rate jumped last month to the highest level since early-1995. That rise may help explain earlier reports that confidence and sentiment are improving. Consumers are rebuilding their personal balance sheets, mending their old ways of easy spending. That is the message from the latest Commerce Department report showing that the personal savings rate jumped during April to 5.7% which was its highest level in over thirteen years.

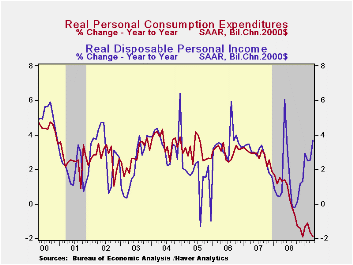

Spending restraint was evidenced in a slight 0.1% decline in personal expenditures during April. It followed a revised 0.3% March decline which was slightly deeper than initially reported. Adjusted for inflation, April spending also fell a slight 0.1% producing a level of real spending that has been unchanged since January.

As might be expected, spending on the largest durable good, motor vehicles, took a large hit and fell 1.3% (-16.9% y/y). Real spending on furniture & appliances also was cut back a slight 0.4% last month (-4.4% y/y) after the sharp 2.8% March drop. Real spending on apparel slipped just 0.1% (-6.5% y/y) after a 1.7% decline. The weakness extends to spending on services which rose all of 0.2% (1.1% y/y).

The sense of consumers' caution stems from weaker income which remains under extreme pressure from the soft job market. Despite a 0.5% rise during April, personal income has been flat this year though the latest rise beat expectations for a 0.2% decline. Wages and salaries reflected higher unemployment and were unchanged (-0.8% y/y) following seven consecutive months of decline. In addition, the recent decline in interest rates took its toll on interest income which in April was off 5.5% y/y.

In light of weak income growth, what additional factor has kicked up the savings rate other than spending restraint? Lower taxes. They are off by nearly one-quarter during the last twelve months. Disposable personal income jumped 1.1% during April and over the last year has risen 4.1%, well in excess of the gain in total personal income. Adjusted for inflation, real disposable income also rose 1.1% last month and over the last year is up 3.7%. So far this year, real disposable income is up at a 6.3% annual rate.

Finally, the PCE chain price index benefited from a 2.6% seasonally adjusted decline in gasoline prices (-37.4% y/y) and rose just 0.1%. A bit firmer were core prices which posted a 0.3% April rise to lift the YTD rate of increase to 2.5% (AR). The latest gain in the overall price deflator exceeded Consensus expectations for a 0.2% rise.

The personal income & consumption figures are available in Haver's USECON and USNA databases.

| Disposition of Personal Income (%) | April | March | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Personal Income | 0.5 | -0.2 | 0.7 | 3.8 | 6.1 | 7.1 |

| Disposable Personal Income | 1.1 | 0.1 | 3.7 | 4.6 | 5.5 | 6.4 |

| Personal Consumption Expenditures | -0.1 | -0.3 | -1.5 | 3.6 | 5.5 | 5.9 |

| Saving Rate | 5.7 | 4.5 | 0.0 (April '08) | 1.8 | 0.5 | 0.7 |

| PCE Chain Price Index | 0.1 | 0.0 | 0.4 | 3.3 | 2.6 | 2.8 |

| Less food & energy | 0.3 | 0.2 | 1.9 | 2.2 | 2.2 | 2.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates