Global| Aug 23 2010

Global| Aug 23 2010U.S. Services Jobs Show Renewed Weakness Following Earlier Moderate Gains

by:Tom Moeller

|in:Economy in Brief

Summary

Earlier improvement in service-sector hiring ran out of gas during the last few months. If it weren't so widespread, the slowdown wouldn't be too noteworthy. But the fact that it's reached into sectors which normally are resistant to [...]

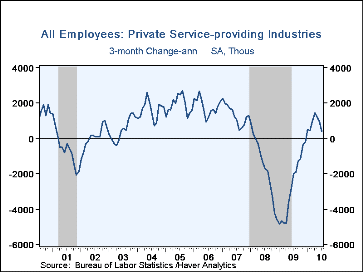

Earlier improvement in service-sector hiring ran out of gas during the last few months. If it weren't so widespread, the slowdown wouldn't be too noteworthy. But the fact that it's reached into sectors which normally are resistant to macro-economic forces is troubling. In the past, employment has been a coincident indicator of economic growth, so maybe future improvement isn't threatened. But what can be said is that there is little if any forward momentum which could potentially aid consumer sentiment, spending and output.

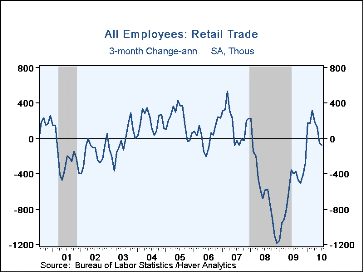

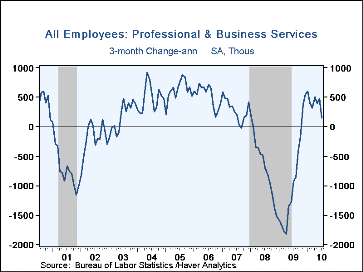

After modest gains earlier, developing weakness is most evident in fewer jobs in the financial, professional and business service sectors. Together these areas account for one-quarter of U.S. payrolls. Slow job growth also is evident in the retail sector which accounts for nearly twenty percent of total jobs. Fortunately, slow growth in these lagging sectors is accompanied by stability in the education and health areas which also make up nearly one-quarter of the workforce.

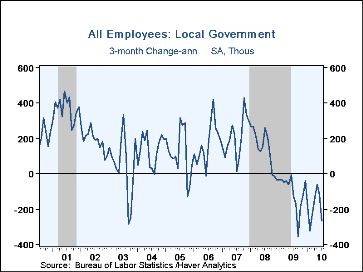

The government sector also shows hiring weakness. This development is a clear outgrowth of weakness in income tax revenues. Aside from the hiring of workers who took the Census, job growth in the Federal government sector never developed forward momentum. Jobs actually have fallen slightly in 2010 following fairly strong growth during 2008 and 2009. Amongst employees in state governments and local municipalities, the recent news has been dismal with the downturn in real estate value and property taxes.

| Payroll Employment (M/M Chg in 000s) |

July | June | May | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Private Services | 38 | 34 | 30 | 0.3% | -3.4% | -0.2% | 1.7% |

| Retail Trade | 7 | -21 | -6 | -0.4 | -4.9 | -1.5 | 1.1 |

| Information Services | 1 | -14 | -2 | -2.6 | -5.9 | -1.6 | -0.2 |

| Financial Activities | -17 | -12 | -9 | -1.9 | -4.7 | -1.9 | -0.3 |

| Professional & Business Services | -13 | 23 | 26 | 1.6 | -6.5 | -1.2 | 2.1 |

| Education & Health | 30 | 26 | 25 | 1.9 | 1.8 | 2.8 | 2.8 |

| Leisure & Hospitality | 6 | 21 | -15 | -0.0 | -2.5 | 0.1 | 2.4 |

| Government | -202 | -252 | 381 | -0.0 | 0.2 | 1.3 | 1.1 |

| Federal | -154 | -225 | 408 | 7.1 | 2.4 | 1.0 | 0.1 |

| Temporary Census Workers (NSA) | -143 | -225 | 410 | -- | -- | -- | -- |

| State | -10 | -13 | -12 | -0.4 | 0.1 | 1.1 | 0.9 |

| Local | -38 | -14 | -15 | -1.3 | -0.1 | 1.4 | 1.4 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates