Global| Aug 11 2020

Global| Aug 11 2020U.S. Small Businesses Optimism Backtracks in July

Summary

• NFIB Small Business Optimism Index declines to 98.8 in July after two monthly gains. • Expectations economy will improve drops 14 percentage points. • Fourth consecutive month of net price reductions. The National Federation of [...]

• NFIB Small Business Optimism Index declines to 98.8 in July after two monthly gains.

• Expectations economy will improve drops 14 percentage points.

• Fourth consecutive month of net price reductions.

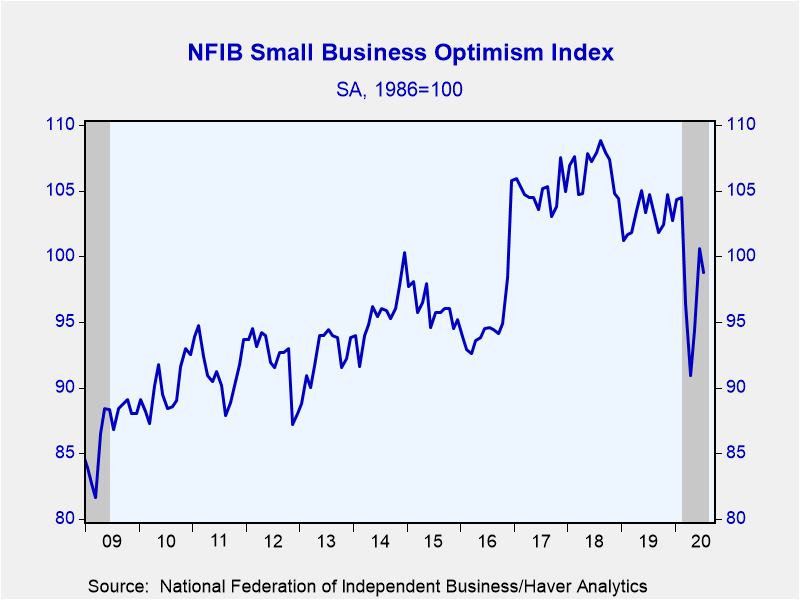

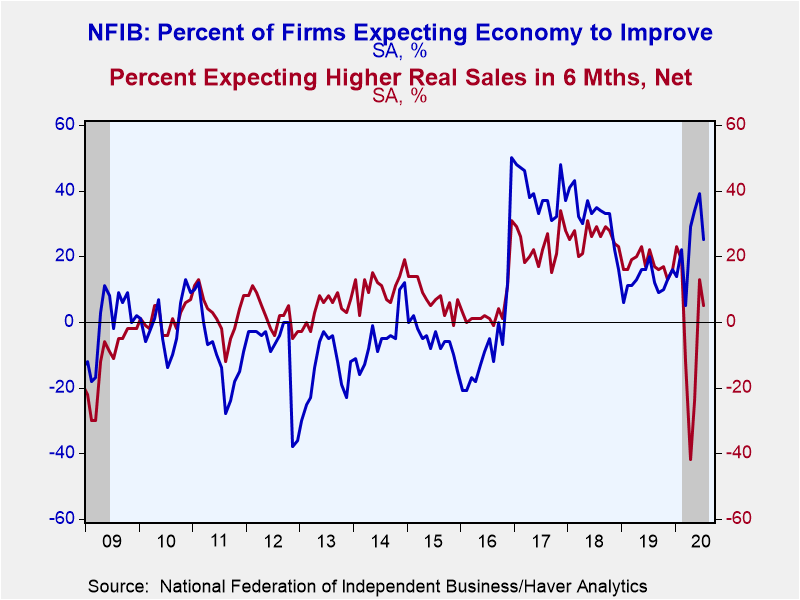

The National Federation of Independent Business (NFIB) Small Business Optimism Index decreased to 98.8 in July after gains in the prior two months. The Small Business Uncertainty Index increased to 88 from 81 -- it was 92 in March -- the record 100 reading occurred in November 2016.Half of the ten components of the Optimism Index fell, led by a 14 percentage point drop in the share of firms expecting the economy to improve to 25%. Expectations for real sales over the next six months decreased to 5% from 13%. And, only a net 11% of firms felt it was a good time to expand their business down from 13%.

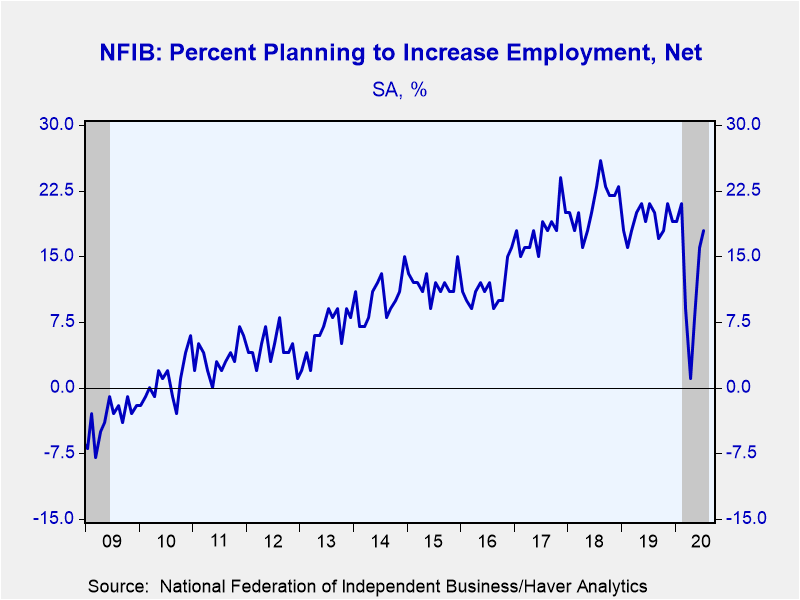

The components that rose showed relatively smaller gains. Capital expenditure plans grew to 26% from 22%. A net 18% of firms planned on increasing employment in July up from 16% in June.

Deflationary pressures continued with a net -2% of firms raising average selling prices in July, the fourth consecutive negative month, though an improvement from the -18% reading in April. Wage pressures ticked up to a net 15% of firms raising wages over the past three months, down from 36% in February. The share of firms expecting to increase compensation showed a similar pattern edging up to 14%, but well below January's 24% reading.

Small businesses continue to indicate they have access to credit with only 2% noting that credit was harder to get, down from 3% in June. The NFIB noted "overall, access to capital is not a serious problem, likely due to the popularity of the Paycheck Protection Program that most small employers have accessed."

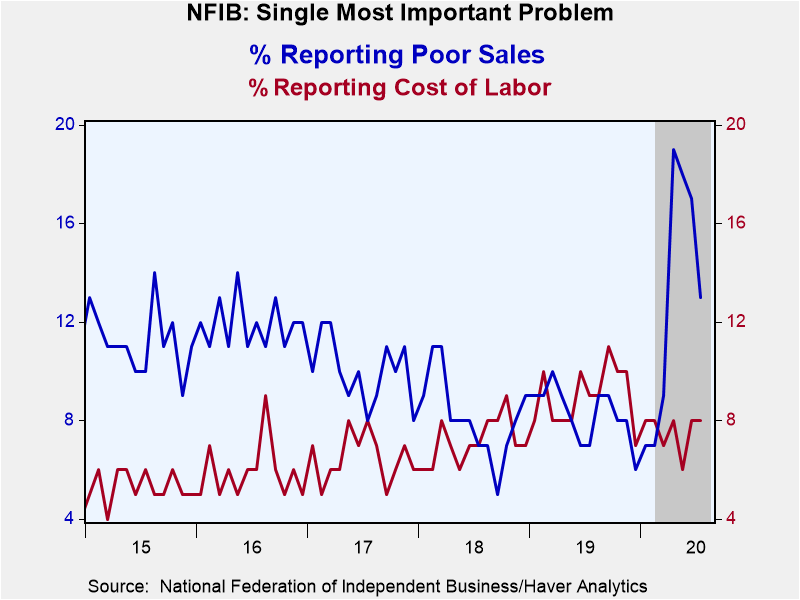

This survey inquires about problems facing small business. While poor sales was no longer the most pressing problem in July, down to a still elevated 13% of respondents from 19%. It is now topped by government requirements, (14%), taxes (18%), and quality of labor (21%). Despite issues finding quality labor, labor cost concerns remain low at only 8% of respondents.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Jul | Jun | May | Jul'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 98.8 | 100.6 | 94.4 | 104.7 | 103.0 | 106.7 | 104.9 |

| Firms Expecting Economy to Improve | 25 | 39 | 34 | 20 | 13 | 32 | 39 |

| Firms Expecting Higher Real Sales | 5 | 13 | -24 | 22 | 18 | 26 | 23 |

| Firms Reporting Now Is a Good Time to Expand the Business | 11 | 13 | 5 | 26 | 25 | 30 | 23 |

| Firms Planning to Increase Employment | 18 | 16 | 8 | 21 | 19 | 21 | 18 |

| Firms With Few or No Qualified Applicants for Job Openings (%) | 44 | 43 | 37 | 56 | 52 | 51 | 49 |

| Firms Reporting that Credit Was Harder to Get | 2 | 3 | 2 | 3 | 4 | 4 | 4 |

| Firms Raising Average Selling Prices | -2 | -5 | -14 | 16 | 13 | 15 | 7 |

| Firms Raising Worker Compensation | 15 | 14 | 14 | 32 | 31 | 33 | 27 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates