Global| Apr 10 2018

Global| Apr 10 2018U.S. Small Businesses Optimism Declines; Wages and Selling Prices Continue to Rise

Summary

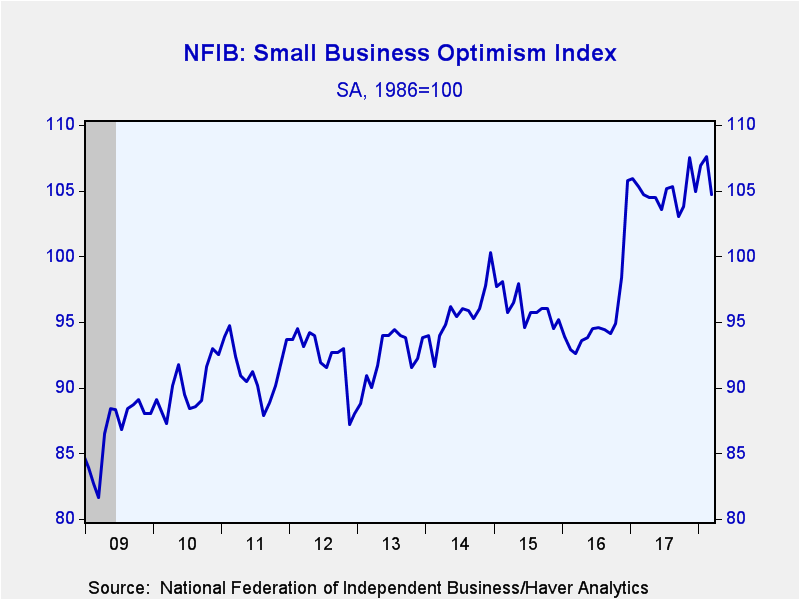

The National Federation of Independent Business (NFIB) indicated that its Small Business Optimism Index for March fell 2.7% to 104.7 (unchanged from a year ago). The level of optimism hit a 35-year high in February and the March [...]

The National Federation of Independent Business (NFIB) indicated that its Small Business Optimism Index for March fell 2.7% to 104.7 (unchanged from a year ago). The level of optimism hit a 35-year high in February and the March reading is in line with levels we saw most of last year.

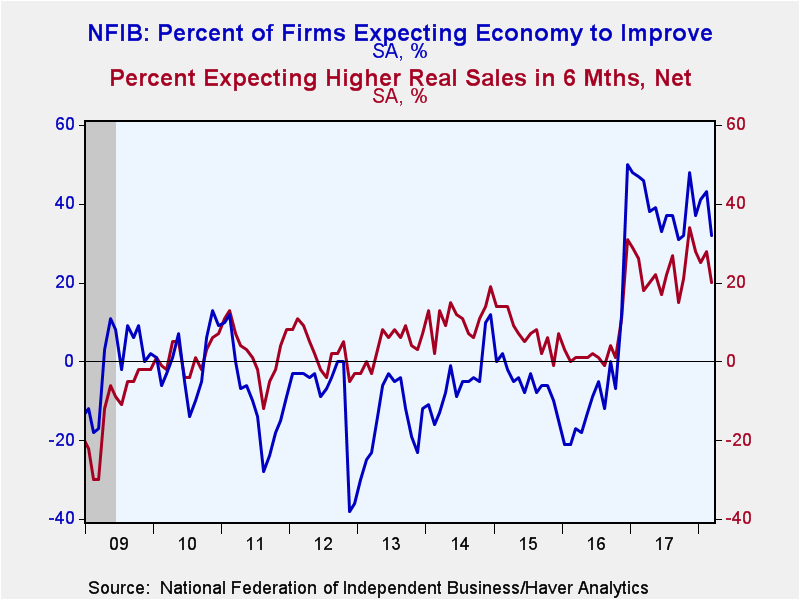

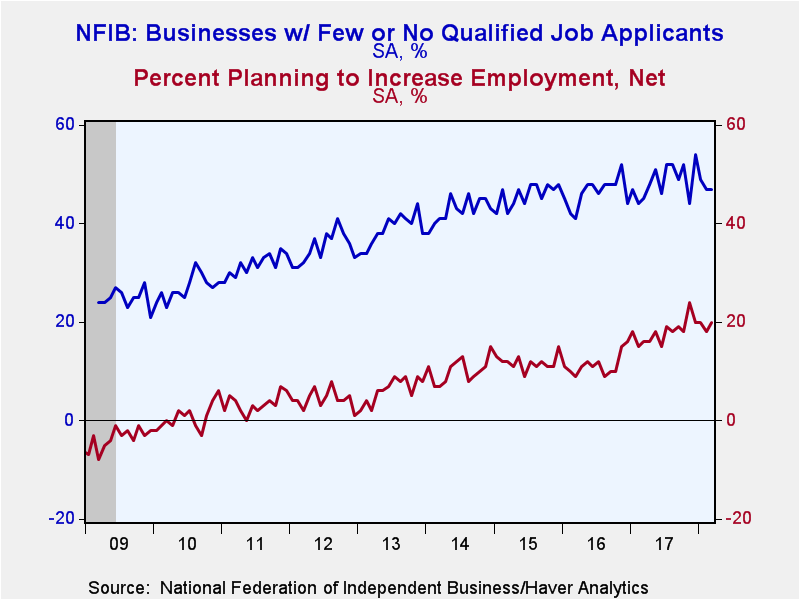

A net 32% of firms expected the economy to improve, down from February's 43% reading and below the 2017 average of 39%. Twenty percent of firms were expecting higher real sales versus 28% last month. Twenty percent of businesses were planning to increase employment, up from February's 18% reading, which was also the 2017 average. Meanwhile, 47% indicated that there were few or no qualified candidates for job openings an unchanged reading from February and somewhat below the 50 level in 2017Q4.

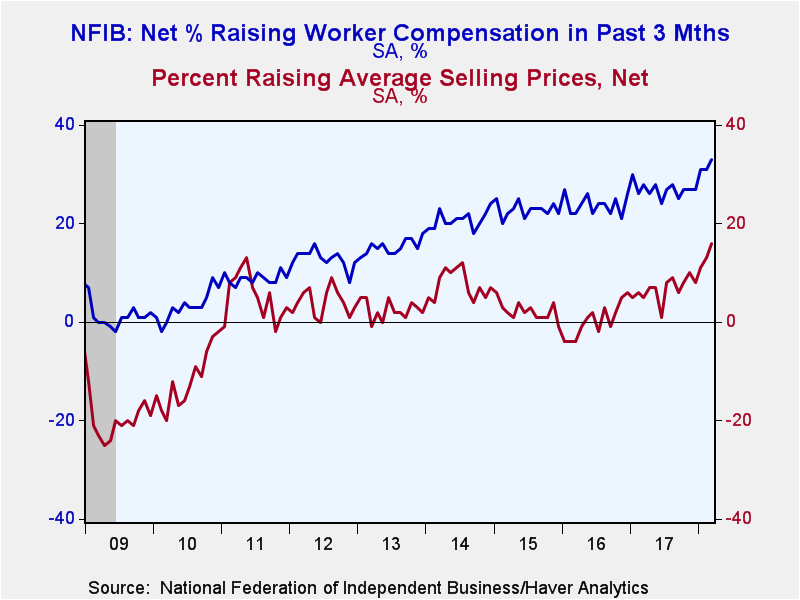

Pricing pressure continues to pick up with a cycle-high net 16% of firms raising average selling prices, up from 13% in February. Twenty-five percent of firms are planning to raise prices also a cycle-high. Last year 21% of small businesses planned on raising prices.

While broader measures of wage growth continue to be tepid, the NFIB survey suggests small businesses continue to raise wages. A net 33% of firms increased worker compensation, the most since 2000 and up from 27% during all of last year. However, the share of businesses planning to raise compensation declined for the second consecutive month to 19%.

Finding the financial resources to expand business remained relatively easy as just a net four percent of businesses reported difficulties in obtaining credit. However, six percent of firms expected credit conditions to tighten, its highest level in 15 months.

This survey inquires about problems facing small business. The most pressing problem in March continues to be labor quality (21% of firms, down from the 20 year high of 22% in February). Despite this, only eight percent of firms reported the cost of labor as the most significant problem. Government requirements became less worrisome at 14%. Taxes continued it precipitous decline with only 13% of firms highlighting this issue, it's lowest reading since 1982. Poor sales remained unchanged at 11%, while competition from large businesses edged up to 11% from 10%. Insurance costs/availability, financial & interest rates, and inflation were all below 10%. Interestingly the 'other' category, which captures issues not described above, doubled to 10% its highest reading in over a year.

Roughly 24 million small businesses exist in the U.S. and they create 80% of all new jobs. The index is based 1986=100. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year.

The NFIB figures can be found in Haver's SURVEYS database.

| National Federation of Independent Business (SA, Net % of Firms) | Mar | Feb | Jan | Mar'17 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Small Business Optimism Index (1986=100) | 104.7 | 107.6 | 106.9 | 104.7 | 104.9 | 95.3 | 96.1 |

| Firms Expecting Economy to Improve | 32 | 43 | 41 | 46 | 39 | -5 | -5 |

| Firms Expecting Higher Real Sales | 20 | 28 | 25 | 18 | 23 | 5 | 8 |

| Firms Reporting Now Is a Good Time to Expand the Business | 28 | 32 | 32 | 22 | 23 | 10 | 12 |

| Firms Planning to Increase Employment | 20 | 18 | 20 | 16 | 18 | 11 | 12 |

| Firms With Few or No Qualified Applicants for Job Openings (%) | 47 | 47 | 49 | 45 | 49 | 46 | 46 |

| Firms Reporting That Credit Was Harder to Get | 4 | 3 | 3 | 3 | 4 | 5 | 4 |

| Firms Raising Average Selling Prices | 16 | 13 | 11 | 5 | 7 | 0 | 2 |

| Firms Raising Worker Compensation | 33 | 31 | 31 | 28 | 27 | 24 | 23 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.