Global| Jan 17 2003

Global| Jan 17 2003U.S. Trade Deficit Deepened to a New Record

by:Tom Moeller

|in:Economy in Brief

Summary

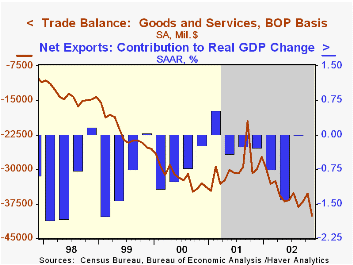

The U.S. foreign trade deficit deepened much more than expected in November. October's deficit was little revised. Consensus expectations had been for a November deficit of $36.1B. The end of the West Coast dock workers strike [...]

The U.S. foreign trade deficit deepened much more than expected in November. October's deficit was little revised. Consensus expectations had been for a November deficit of $36.1B. The end of the West Coast dock workers strike apparently more influenced imports than exports.

Exports rose for the first month in four and the increase recouped all of the prior months' declines. The strong increase was due mostly to a 10.5% surge in exports of food and beverages. Capital goods exports fell for the third month in four (+4.8% AR, YTD). Auto exports fell 4.2%, the most for any month since January 2001. Nonauto consumer goods exports rose 0.6% (2.3% AR, YTD).

Imports surged to the highest level since January 2001. Capital goods imports rose 9.6% (9.2% AR, YTD) following four months of decline. Imports of nonauto consumer goods also surged, up 11.0% (27.5% AR, YTD). Imports of foods and beverages rose 10.0% following three months of decline. Imports of industrial supplies & materials as well as miscellaneous imports fell.

By region, the trade deficit with Japan was stable at $6.5B. The deficit with China widened to $10.5B, a near record, from $9.5B.

| Foreign Trade | Nov | Oct | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Trade Deficit | $40.1B | $35.2B | $29.9B(11/01) | $358.3B | $378.7B | $262.2B |

| Exports - Goods & Services | 1.1% | -0.6% | 6.8% | -6.2% | 11.2% | 2.6% |

| Imports - Goods & Services | 4.9% | -2.0% | 14.4% | -6.0% | 18.3% | 10.9% |

by Tom Moeller January 17, 2003

Industrial production fell unexpectedly last month versus Consensus expectations for a 0.2% gain. It was the third monthly decline in output in four months. November's slight rise was unrevised.

Output in the manufacturing sector fell 0.2% (+1.7% y/y), down for the third month in four.

Lower output of durable goods led the December decline as output of motor vehicles and parts (5.0% y/y) fell 4.7% for the fourth decline in five months. Appliance, furniture & carpeting output rose 0.9% (2.7% y/y) for the fourth consecutive monthly gain. Computer output (-5.7% y/y) also rose following a November surge.

Output of business equipment fell 0.5% (-2.9% y/y), the fifth decline in six months. Output of information processing equipment rose a slight 0.1% following a downwardly revised November drop (-1.7% y/y). Output of transit equipment collapsed 3.6% (-16.6% y/y).

Capacity utilization fell slightly and is down versus its recent high of 76.4% in July. Capacity again rose 0.1%(1.1% y/y) as it has since early last year.

| Production & Capacity | Dec | Nov | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Industrial Production | -0.2% | 0.1% | 2.1% | -0.7% | -3.5% | 4.7% |

| Capacity Utilization | 75.4% | 75.6% | 74.6%(12/01) | 75.6% | 77.3% | 82.7% |

by Tom Moeller January 17, 2003

The Index of Consumer Sentiment from the University of Michigan fell unexpectedly in Mid-January. The Consensus expectation had been for a reading roughly unchanged from December.

The mid-January decline was due to a lower reading of consumer expectations. The reading of current conditions rose slightly.

The University of Michigan survey is not seasonally adjusted. The mid-month reading is based on a survey of 250 households. The final index released at the end of the month is based on a survey of 500 households.

During the last ten years there has been a 50% correlation between the annual change in Consumer Sentiment and the change in payroll employment.

| University of Michigan | Mid-Jan | Dec | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 83.7 | 86.7 | -10.0% | 89.6 | 89.2 | 107.6 |

by Tom Moeller January 17, 2003

The National Association of Home Builders Housing Market Index fell for January. The decline was slight and November levels were revised up so recent home buying conditions remained near the firmest in three years .

Surveys of market conditions for current sales fell as the number rating conditions as good fell significantly. Expected sales in six months fell only slightly.

Traffic of prospective buyers rose back to the highest level of the last three years.

For a description of the housing market index from the National Association of Home Builders, visit the NAHB website.

| Nat'l Association of Home Builders | Jan | Dec | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Composite Housing Market Index | 64 | 65 | 60 | 61 | 56 | 62 |

by Tom Moeller January 17, 2003

Prices for West Texas Intermediate crude oil surged roughly 10% since mid-December. The labor strike in Venezuela which shut down the country's oil output continued, Mideast concerns escalated and inventory conditions appeared lean.

Wholesale gasoline prices remained relatively stable during the last month as the driving season wound down. Wholesale fuel oil prices, on the other hand, surged 15% from mid-December.

Wholesale natural gas prices rose above $5.00/mmbtu, up 13% during the last month.

| Daily Crude Oil Prices | 1/16/03 | 12/19/02 | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| West Texas Intermediate Crude Oil | $33.68 | $30.53 | 87.3% | $26.17 | $25.97 | $30.34 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates