Global| Mar 04 2016

Global| Mar 04 2016U.S. Trade Deficit Somewhat Wider in January

Summary

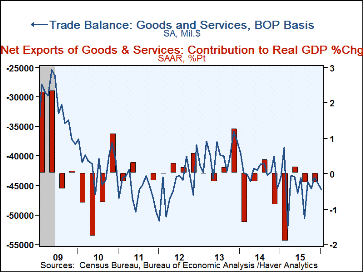

The U.S. foreign trade deficit increased to $45.7 billion in January, following December's $44.7 billion, which was revised from $43.4 billion. The January result was wider than the Action Economics Forecast Survey estimate of $43.2 [...]

The U.S. foreign trade deficit increased to $45.7 billion in January, following December's $44.7 billion, which was revised from $43.4 billion. The January result was wider than the Action Economics Forecast Survey estimate of $43.2 billion. The trade account for all of 2015 was revised to a larger deficit of $539.8 billion from $531.5 billion reported last month, following $508.3 billion in 2014. The deficit in goods widened in January to $63.7 billion from $60.0 billion in December. The surplus in services increased to $18.0 billion from $17.9 billion. The wider goods and services deficit in January resulted from a decline in exports larger than that in imports, 2.1% down in exports (-6.6% y/y) and 1.3% down in imports (-4.5% y/y).

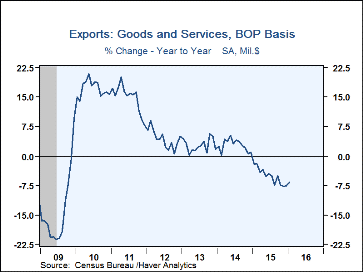

The U.S. foreign trade deficit increased to $45.7 billion in January, following December's $44.7 billion, which was revised from $43.4 billion. The January result was wider than the Action Economics Forecast Survey estimate of $43.2 billion. The trade account for all of 2015 was revised to a larger deficit of $539.8 billion from $531.5 billion reported last month, following $508.3 billion in 2014. The deficit in goods widened in January to $63.7 billion from $60.0 billion in December. The surplus in services increased to $18.0 billion from $17.9 billion. The wider goods and services deficit in January resulted from a decline in exports larger than that in imports, 2.1% down in exports (-6.6% y/y) and 1.3% down in imports (-4.5% y/y).

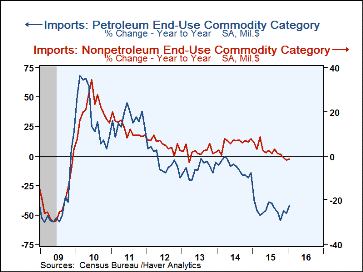

Among exports of goods, all end-use categories fell in January except for a marginal 0.2% rise in autos and parts. Consumer goods, which had had the largest increase in December, had a large decrease in January, 5.0%. "Other" goods exports fell 9.1%, and foods, feeds & beverages were off 4.8%. Industrial materials & supplies were down 2.9% and capital goods, 2.8%. Imports of goods fell with the drop in oil prices as industrial materials and supplies, which include petroleum, declined 5.7% in January. But other end-use groups were also off: capital goods by 2.4%, "other" goods by 1.9% and consumer goods 0.2%. Autos and parts imports, with the firmness in that market in the U.S., rose 1.7% and foods, feeds & beverages were up 1.5%.

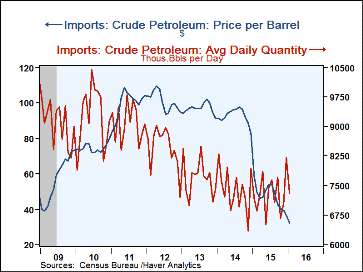

The significance of petroleum prices is seen in the behavior of the petroleum line items. Exports in current prices fell 7.0% in January, but in real terms they rose 3.7%. Imports of petroleum fell 13.5% in current terms, but barely declined, by 0.5%, in real terms.

The real trade deficit in goods (in chained 2009 dollars) widened in January to $62.0 billion from December's $60.1 billion. As with total trade, both exports and imports fell, exports by 2.2% (-3.8% y/y) and imports by 0.4% (+1.8% y/y).

Among services, exports rose 0.3% in January (-0.3% y/y), while imports edged up 0.1 (+2.9% y/y). Transportation services provided to foreign customers had the largest gain among services exports, 1.7%, government services rose 1.6% and travel 1.1%; a few items declined, especially maintenance and repair services exports fell 6.5%. Imports of services were quite mixed, with maintenance and repair increasing 1.7% in January while financial services provided to Americans fell 2.1% and transportation services fell 1.2%.

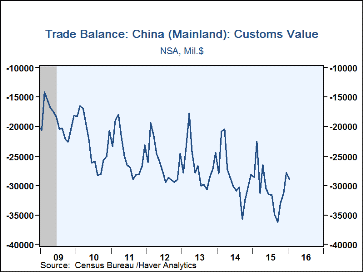

By country, the trade deficit in goods with China increased somewhat in January, to $28.9 billion from $27.9 billion in December. Exports to China fell 14.0% from a year ago, while imports were down 2.7%. The deficit with Japan narrowed in January to $4.9 billion from $6.6 billion the month before; exports there were down 8.1% from a year ago and imports were down 11.9%. The deficit in goods trade with the European Union narrowed more noticeably, to $8.8 billion in January from $13.7 billion in December. Exports to the EU were off 8.1% from a year ago, and imports were down 7.3%.

The international trade data can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in the AS1REPNA.

| Foreign Trade in Goods & Services (Current Dollars) | Jan | Dec | Nov | Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit | $45.7 bil. | $44.7 bil. | $43.6 bil. | $43.6 bil. (1/15) |

$539.8 bil. | $508.3 | $478.4 bil. |

| Exports of Goods & Services (% Chg) | -2.1 | -0.3 | -1.2 | -6.6 | -5.1 | 2.8 | 2.8 |

| Imports of Goods & Services (% Chg) | -1.3 | 0.2 | -1.8 | -4.5 | -3.1 | 3.4 | 0.1 |

| Petroleum | -13.5 | 1.7 | 5.6 | -41.8 | -45.5 | -9.7 | -11.0 |

| Nonpetroleum | -0.6 | 0.1 | -2.6 | -1.6 | 2.2 | 6.1 | 2.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates