Global| Dec 05 2014

Global| Dec 05 2014U.S. Trade Deficit Steadies as Exports and Imports Both Rise

Summary

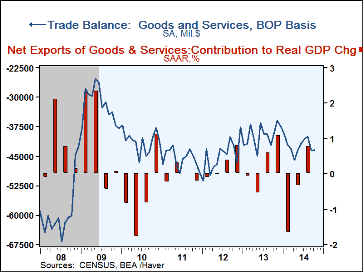

The U.S. foreign trade deficit in goods and services narrowed slightly to $43.4 billion in October from a modestly revised $43.6 billion in September. Expectations in the Action Economics Forecast Survey were for $41.6 billion. [...]

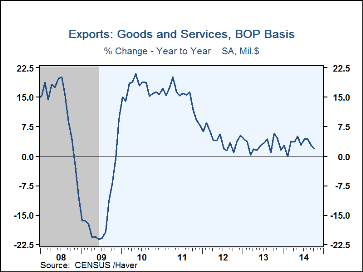

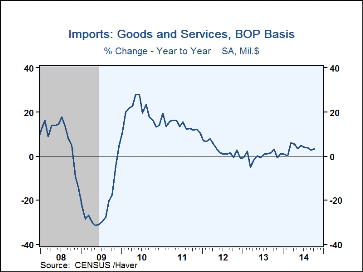

The U.S. foreign trade deficit in goods and services narrowed slightly to $43.4 billion in October from a modestly revised $43.6 billion in September. Expectations in the Action Economics Forecast Survey were for $41.6 billion. Exports rebounded 1.2% (+1.8% y/y), after September's 1.8% fall, revised from 1.5% initially tabulated. Imports rose 0.9% (+3.4% y/y), following September's flat performance. Nonpetroleum imports advanced 1.3% in October while petroleum imports were off 0.6%. This decline reflected the continuing downtrend in the per barrel price of crude oil, as it fell to $88.47 versus $99.96 twelve months earlier. The value of energy-related petroleum imports declined 18.9% y/y and the quantity fell 8.8% y/y.

Exports in October were mixed by type of goods; the total was up 1.4% (1.5% y/y). Foods, feeds & beverages decreased 1.2% (-7.1% y/y) following their huge increase the month before. Industrial supplies & materials edged down 0.2% (-3.0% y/y) and "other" goods exports declined 3.1% (+6.3% y/y). Other broad categories rose in October: capital goods excluding autos gained 3.8% (5.8% y/y), consumer goods excluding autos, 2.6% (4.0% y/y) and auto vehicles, parts and engines, 1.2% (4.9% y/y). Exports of services increased 0.5% (2.9% y/y) with travel up just 0.2% (2.1% y/y).

Imports of goods rose 1.0% (3.6% y/y), led by the auto category, up 4.8% in October and 7.8% year-on-year. Capital goods imports rose 2.2% in the month (8.9% y/y) and food, feed and beverages were up 2.1% (11.5% y/y). Industrial supplies & materials had a more modest 0.5% increase and were down 4.1% year-on-year. There were declines in consumer goods imports of 1.6% in October (+4.2% y/y) and in "other" goods of 2.0% (+1.4% y/y). Services imports rose 0.4% (2.8% y/y) even as travel imports declined 0.2% (+5.3% y/y).

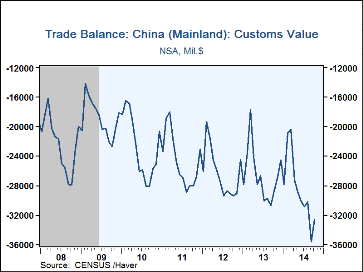

By country, the deficit in goods with China edged back somewhat to $32.6 billion after the record $35.6 billion in September. Imports from China were up 8.1% y/y and exports to China fell again year-on-year, this time by 3.2%. The trade deficit with Japan increased again, to $6.4 billion from September's $5.3 billion. Exports to Japan did show a gain of 2.2% y/y and imports were up 1.3% y/y, the first year-on-year increase since September 2013. The trade deficit with the European Union widened a bit further to $12.7 billion in October from $11.8 billion the month before. Exports rose 2.9% y/y and imports decreased 0.9% y/y.

The international trade data can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figures are from the Action Economics Forecast Survey, which is carried in the AS1REPNA.

| Foreign Trade (Current Dollars) | Oct | Sep | Aug | Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| U.S. Trade Deficit | $43.4 bil. | $43.6 bil | $40.0 bil. | $39.1 bil. (9/13) |

$476.4 bil. | $537.6 bil. | $548.6 bil. |

| Exports (%) | 1.2 | -1.8 | 0.3 | 1.8 | 2.9 | 4.2 | 14.8 |

| Imports | 0.9 | 0.0 | 0.1 | 3.4 | 0.1 | 2.9 | 13.9 |

| Petroleum | -0.6 | -3.3 | -3.7 | -16.2 | -11.0 | -5.5 | 30.7 |

| Nonpetroleum goods | 1.3 | 0.4 | 0.8 | 7.5 | 2.0 | 5.2 | 12.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.