Global| Nov 02 2005

Global| Nov 02 2005U.S. Vehicle Sales Lowest Since 1998, Inventories Lower As Well

by:Tom Moeller

|in:Economy in Brief

Summary

According to the Autodata Corporation, US sales of light vehicles in October fell another 10.0% m/m to 14.75M under the weight of higher gasoline prices and lower consumer sentiment. The decline was the third in as many months and [...]

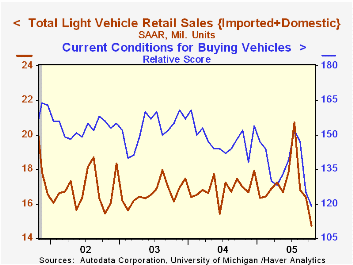

According to the Autodata Corporation, US sales of light vehicles in October fell another 10.0% m/m to 14.75M under the weight of higher gasoline prices and lower consumer sentiment. The decline was the third in as many months and dropped sales to the lowest monthly level since 1998.

Consumer sentiment dropped 3.5% (-19.1% y/y) last month according to the University of Michigan which indicated that current buying conditions for vehicles was especially poor.

In October, US gasoline prices dropped 6.4% versus the September average but prices were up 35.9% versus last year at $2.72 per gallon.

Last month's skid in vehicle sales additionally reflected payback from the earlier success of discount pricing programs. The average of sales during the last six months has been 17.20M, up 2.0% from all of last year.

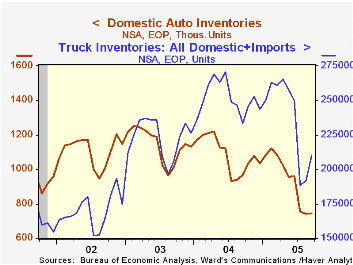

As of September, strong sales had lowered inventories of US autos to the lowest level since late 2001 (-17.9% y/y). At 1.61, the inventory to sales ratio was roughly half the level in January. Inventories of domestic & imported trucks also was down 10.2% y/y though increases in August & September left the level up versus 2002 and 2003.

Sales of US made cars & trucks fell 12.0% (-14.3% y/y). Domestic truck sales dropped 14.0% (-22.8% y/y) and car sales fell 9.3% (-0.9% y/y).

The decline in sales of imported cars & trucks was limited to a moderate 2.7% m/m (-8.6% y/y) as sales of imported trucks rose 4.9% (-12.9% y/y). Sales of imported autos fell 6.1% (-6.2% y/y).

Import's share of the US light vehicle market jumped m/m to 22.5%, the highest monthly level since 1990.

Oil Price Volatility and U.S. Macroeconomic Activity from the Federal Reserve Bank of St. Louis can be found here.

| Light Vehicle Sales (SAAR, Mil. Units) | Oct | Sept | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Total | 14.75 | 16.39 | -13.1% | 16.87 | 16.63 | 16.81 |

| Autos | 7.32 | 7.99 | -2.6% | 7.49 | 7.62 | 8.07 |

| Trucks | 7.42 | 8.40 | -21.4% | 9.37 | 9.01 | 8.74 |

by Tom Moeller November 2, 2005

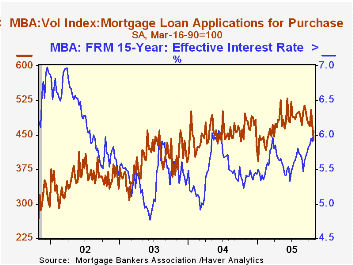

The total number of mortgage applications fell a sharp 4.8% last week on the heels of a 7.9% decline the prior period according to the Mortgage Bankers Association. The decline pulled the average level of applications in October 7.8% below September.

Purchase applications fell especially hard last week, dropped 6.2% following a 7.4% decline the week earlier and pulled the October average 5.0% below September's. During the last ten years there has been a 49% correlation between the y/y change in purchase applications and the change in new plus existing single family home sales.

Applications to refinance fell another 2.8% following an 8.5% decline the prior week. The October average fell 11.4% from September and the figure was 77.5% below the high during 2003.

The effective interest rate on a conventional 30-year mortgage rose to 6.46% from 6.30% the prior week and the effective rate on a 15-year mortgage rose to 6.06%, the highest since July 2002. The interest rate on 15 and 30 year mortgages are closely correlated (>90%) with the rate on 10 year Treasury securities.

The Mortgage Bankers Association surveys between 20 to 35 of the top lenders in the U.S. housing industry to derive its refinance, purchase and market indexes. The weekly survey accounts for more than 40% of all applications processed each week by mortgage lenders. Visit the Mortgage Bankers Association site here.

| MBA Mortgage Applications (3/16/90=100) | 10/28/05 | 10/21/05 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Total Market Index | 646.7 | 679.1 | -15.1% | 735.1 | 1,067.9 | 799.7 |

| Purchase | 437.6 | 466.4 | -11.9% | 454.5 | 395.1 | 354.7 |

| Refinancing | 1,862.8 | 1,916.8 | -19.1% | 2,366.8 | 4,981.8 | 3,388.0 |

by Carol Stone November 2, 2005

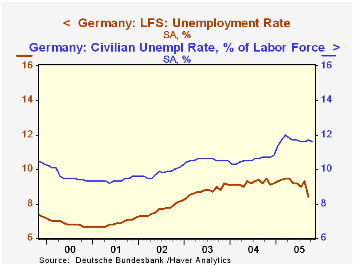

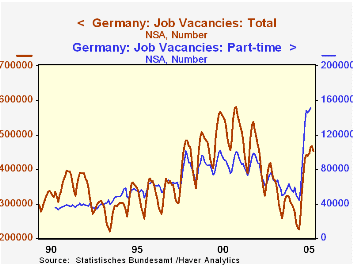

German labor market data was largely favorable in the report issued this morning by the Federal Statistics Office and the Bundesbank. Employment of German residents rose 41,000 in September, following a 29,000 gain in August (seasonally adjusted). The number of workers remains below year-earlier levels but it started to rise, however hesitantly, in May. Another positive development is a marked increase in the number of job vacancies, which numbered 498,000 in October, up 27,000 in the month and 83% greater than a year ago (272,000).

The performance of unemployment depends on which measure is used. The standard German "registered unemployment" remains stubbornly high, at 11.6% in October after 11.7% in September. This is about where the rate has been throughout 2005. The ILO definition, by contrast, has come down sharply. Its latest reading is for September, when it fell to 8.4% from 9.3% in August. This latter, while appearing quite constructive, is not so attractive when labor force developments are considered. The labor force, according to the ILO definition, fell nearly 400,000 in September. Thus, unemployment declined not so much because job market conditions were better, but because people pulled away from it.

Further, the job opportunities that are available have shown most strength in the "part-time" segment. Among total vacancies, those for part-time work have hovered around an 18.6% share for several years. But in 2005, they have jumped dramatically and, accounting for more than half of the year-on-year increase in vacancies, reached 32.5% of the total in August, the latest reported figure.

So there are hesitant signs of improvement in the German labor market: some increase in jobs and at worst a stabilization of unemployment. The growing emphasis on part-time work is a two-edged sword: it can perhaps enhance the number of jobs, but each job would afford smaller wages and benefits than full-time work. Federal Reserve Chairman Alan Greenspan highlights the increased flexibility of US markets as a favorable development, which can help cushion the US economy from shocks. Seen in that light, greater flexibility in German labor markets, a topic of contention in their recent elections, could possibly also limit the harm from such negative forces as high energy costs.

| German Labor Data (Seasonally Adjusted) |

Oct 2005 | Sept 2005 | Aug 2005 | Year Ago | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|

| Employment: German Residents (Mil) | -- | 38.76 | 38.72 | 38.83 | 38.78 | 38.63 | 38.99 |

| Change (Thous or %) | +41 | +29 | -0.17% | 0.38% | -0.92% | -0.56% | |

| Unemployment (ILO, Mil) | -- | 3.56 | 3.98 | 3.95 | 3.94 | 3.71 | 3.24 |

| Total = Labor Force (Mil) | -- | 42.32 | 42.70 | 42.78 | 42.71 | 42.34 | 42.22 |

| Unemployment Rate (ILO, %) | -- | 8.4 | 9.3 | 9.2 | 9.2 | 8.8 | 7.7 |

| Registered Unemployment Rate (%) | 11.6 | 11.7 | 11.6 | 10.7 | 10.5 | 10.5 | 9.8 |

| Job Vacancies (Thous) | 498 | 471 | 445 | 272 | 284 | 351 | 447 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates