Global| Nov 02 2005

Global| Nov 02 2005U.S. Vehicle Sales Lowest Since 1998, Inventories Lower As Well

by:Tom Moeller

|in:Economy in Brief

Summary

According to the Autodata Corporation, US sales of light vehicles in October fell another 10.0% m/m to 14.75M under the weight of higher gasoline prices and lower consumer sentiment. The decline was the third in as many months and [...]

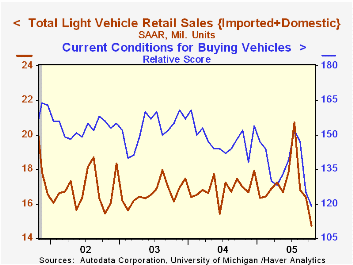

According to the Autodata Corporation, US sales of light vehicles in October fell another 10.0% m/m to 14.75M under the weight of higher gasoline prices and lower consumer sentiment. The decline was the third in as many months and dropped sales to the lowest monthly level since 1998.

Consumer sentiment dropped 3.5% (-19.1% y/y) last month according to the University of Michigan which indicated that current buying conditions for vehicles was especially poor.

In October, US gasoline prices dropped 6.4% versus the September average but prices were up 35.9% versus last year at $2.72 per gallon.

Last month's skid in vehicle sales additionally reflected payback from the earlier success of discount pricing programs. The average of sales during the last six months has been 17.20M, up 2.0% from all of last year.

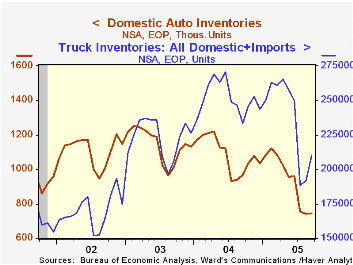

As of September, strong sales had lowered inventories of US autos to the lowest level since late 2001 (-17.9% y/y). At 1.61, the inventory to sales ratio was roughly half the level in January. Inventories of domestic & imported trucks also was down 10.2% y/y though increases in August & September left the level up versus 2002 and 2003.

Sales of US made cars & trucks fell 12.0% (-14.3% y/y). Domestic truck sales dropped 14.0% (-22.8% y/y) and car sales fell 9.3% (-0.9% y/y).

The decline in sales of imported cars & trucks was limited to a moderate 2.7% m/m (-8.6% y/y) as sales of imported trucks rose 4.9% (-12.9% y/y). Sales of imported autos fell 6.1% (-6.2% y/y).

Import's share of the US light vehicle market jumped m/m to 22.5%, the highest monthly level since 1990.

Oil Price Volatility and U.S. Macroeconomic Activity from the Federal Reserve Bank of St. Louis can be found here.

| Light Vehicle Sales (SAAR, Mil. Units) | Oct | Sept | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Total | 14.75 | 16.39 | -13.1% | 16.87 | 16.63 | 16.81 |

| Autos | 7.32 | 7.99 | -2.6% | 7.49 | 7.62 | 8.07 |

| Trucks | 7.42 | 8.40 | -21.4% | 9.37 | 9.01 | 8.74 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.