Global| Jun 03 2014

Global| Jun 03 2014U.S. Vehicle Sales Surge

by:Tom Moeller

|in:Economy in Brief

Summary

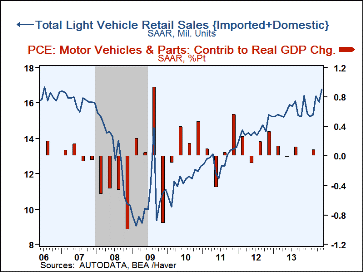

Auto buyers were out in force last month, lifting sales of light vehicles to the highest level since July 2006. According to the Autodata Corporation, unit sales of light vehicle sales during May increased 4.6% (8.3% y/y) to 16.77 [...]

Auto buyers were out in force last month, lifting sales of light vehicles to the highest level since July 2006. According to the Autodata Corporation, unit sales of light vehicle sales during May increased 4.6% (8.3% y/y) to 16.77 million (SAAR). The gain recovered a 2.2% April decline and raised sales by 8.9% since December.

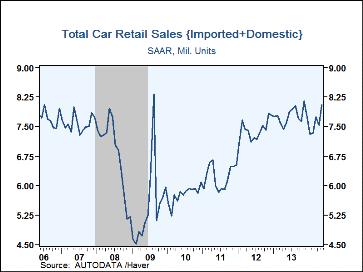

Auto purchases improved 6.6% (5.9% y/y) to 8.04 million and nearly matched November's high of 8.14 million. Sales of domestic autos increased 6.5% (5.7% y/y) to 5.67 million. Sales of imports gained 6.8% (6.2% y/y) to 2.37 million.

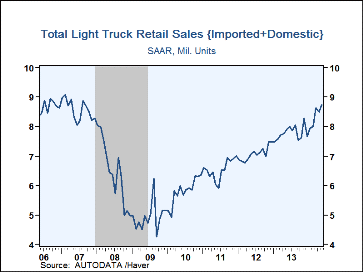

Sales of light trucks recovered 2.8% m/m (10.7% y/y) to 8.73 million, raising them to the highest level since April 2007. Imported light truck sales showed notable strength with a 7.8% increase (-2.1% y/y) to 1.06 million. Sales of domestic light truck sales rose a lesser 2.1% (12.8% y/y) to 7.67 million.

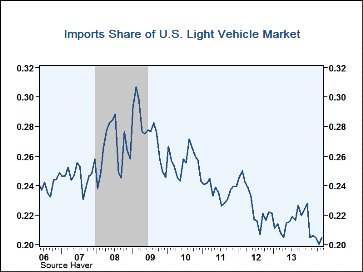

Imports' share of the U.S. light vehicle market improved marginally to 20.5% last month. By vehicle type, imports' share of the U.S. car market ticked up to 29.5%. Imports' share of the light truck market increased to 12.2%.

U.S. vehicle sales figures can be found in Haver's USECON database.

The Economic Recovery and Monetary Policy: The Road Back to Ordinary from the Federal Reserve Bank of San Francisco is available here.

| Light Vehicle Sales (SAAR, Mil. Units) | May | Apr | Mar | Y/Y % | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Total | 16.77 | 16.04 | 16.40 | 8.3 | 15.55 | 14.49 | 12.78 |

| Autos | 8.04 | 7.55 | 7.75 | 5.9 | 7.77 | 7.42 | 6.23 |

| Domestic | 5.67 | 5.33 | 5.48 | 5.7 | 5.47 | 5.10 | 4.21 |

| Imported | 2.37 | 2.22 | 2.27 | 6.2 | 2.29 | 2.32 | 2.02 |

| Light Trucks | 8.73 | 8.49 | 8.65 | 10.7 | 7.79 | 7.08 | 6.55 |

| Domestic | 7.67 | 7.51 | 7.56 | 12.8 | 6.71 | 6.10 | 5.55 |

| Imported | 1.06 | 0.99 | 1.09 | -2.1 | 1.08 | 0.97 | 1.00 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.