Global| Nov 23 2007

Global| Nov 23 2007UK Banks Sharply Restrain Mortgage Lending in October

Summary

The British Bankers' Association (BBA) this morning reported significant declines in mortgage lending activity for October. These data cover the nine members of the "Major British Banking Groups", which account for some two-thirds of [...]

The British Bankers' Association (BBA) this morning reported significant declines in mortgage lending activity for October. These data cover the nine members of the "Major British Banking Groups", which account for some two-thirds of all UK mortgage loans outstanding.

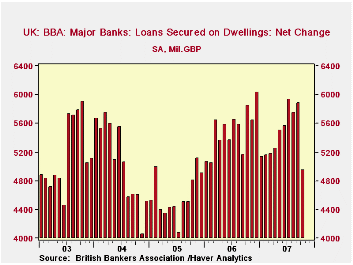

The net change in loans outstanding at these big banks was £4.95 billion in October, markedly less than September's £5.88 billion and the smallest monthly amount since December 2005, £4.90 billion. The peak month was December 2006 at £6.04 billion.

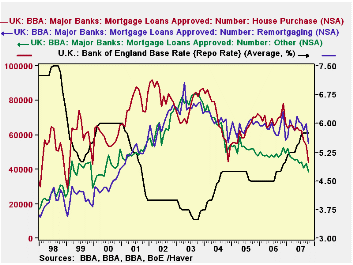

The accompanying loan approval information is valuable, of

course, as a leading indicator of the actual loans made. This showed

distinct weakness in October, with the number of loans approved for

home purchase at just 44,100 (absolute figure, not rounded or

annualized), compared with almost 54,000 in September. The year-ago

number was 70,458 and the recent peak was 78,301 in November 2006. Loan

approvals for remortgaging and for "other" purposes -- this last

importantly including equity withdrawal -- also decreased

significantly. As seen in the second graph here, the last "other"

category has been drifting downward since a peak in late 2003. But

straight refinancing loans have more or less paralleled home purchase

loans since early 2003. Both of these loan groups retrenched somewhat

with the Bank of England tightening during 2004, but held up well

during more interest rate hikes from mid-2006. Finally, both purchase

and remortgaging loan approvals began to come down more decisively in

May this year and have continued to decrease since then despite the

BoE's steady rate policy beginning in August.

These lending data for October reflect the first full month following the international credit crunch of late August and September. In the UK, this directly involved Northern Rock, one of the nine "Major British Bank Groups" and a "Top 5" mortgage lender, which experienced massive deposit runs in September. The October figures thus illustrate clearly the impact of reversals in the global mortgage security market. Additionally, press reports today also indicate that Northern Rock's own delinquency experience has been worsening. Broader data on mortgage possession actions from the UK's Council of Mortgage Lenders show a sharp uptrend in such proceedings beginning in 2006. So while we may be disturbed by loan performance in the US, it is certainly not the only country where borrowers are faltering, contributing to an eventual slowdown in the entire home financing system.

| UK BBA | Oct 2007 | Sept 2007 | Aug 2007 | Year Ago | Monthly Averages | ||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Mortgage Loans, Net Change, Bil.£ | 4.95 | 5.88 | 5.75 | 5.84 | 5.50 | 4.59 | 5.05 |

| Number of Loan Approvals | |||||||

| Home Purchase | 44,100 | 53,997 | 56,811 | 70,458 | 68,961 | 62,754 | 68,888 |

| Remortgaging | 54,881 | 66,519 | 62,559 | 66,238 | 64,149 | 65,014 | 67,989 |

| Other (incl "Equity Withdrawal") | 38,471 | 43,143 | 40,744 | 48,298 | 48,557 | 52,127 | 64,924 |

| Average Value, Loans Approved for Home Purchase*, £ | 153,500 | 152,300 | 153,800 | 144,600 | 139,167 | 128,250 | 112,100 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates